I No Longer Use Ledger

In This Issue

- Rebecca shares her thoughts on Ledger’s mid-life crisis, Lido launching V2 for staked ETH withdrawals, Tether DCAing into Bitcoin, the UK both crushing and promoting crypto & Australia makes its first FX CBDC transaction.

- Altcoin Alpha by David

- This week’s Airdrop by Jesse

- Sam has an NFT report on DeGods.

Premium Subscription highlights this week:

- Jesse’s Altcoin Report: Find out if dYdX is a good investment to add to your portfolio.

- Rekt Capitals Weekly TA: Every week Rekt shares TA on trending altcoins so that you can be prepared for what’s to come!

The News Now

Ledger’s Mid-Life Crisis—It Wants Your Keys! 🔓

“I no longer use Ledger.” You’ve most likely heard this exact line several times this week. Ledger’s new online seed phrase recovery feature has the crypto community asking this crucial question: “Is my seed phrase really safe?”

Here are the details you need to know about Ledger Recover:

- It’s a subscription-based service that lets users store their seed phrase online so it’s easy to recover if you lose it—costing $9/month.

- It’s not a mandatory purchase or the default mode, but rather a service you can choose to opt into.

- If enabled, the backup is split into 3 pieces and stored at 3 different companies: Ledger, Coincover, and EscrowTech.

- The service requires Know Your Customer (KYC) identification checks consisting of a document and selfie recording.

- OG Ledger owners are good for now, as the feature isn’t available on the older S wallets—it’s coming to newer wallets in firmware update 2.2.1.

“Not your keys, not your coins” is the mantra crypto enthusiasts live and die by. But let’s play devil’s advocate for a moment. It’s estimated around $545M worth of Bitcoin was lost in 2022 due to lost passwords or incorrect seed phrases. The data proves that cold storage isn’t for everyone. Leaving your crypto on an exchange is easy and convenient for some users. So, there is a need to address and resolve this issue. For users that struggle with the concept of cold storage, Ledger Recover is an easy-to-use and affordable solution which could give them peace of mind. Bottom line: If we’re going to onboard billions of people into crypto, self-custody needs to be more user-friendly. It can’t happen without it.

Whilst this has a lot of the crypto community concerned, many of the smart people in crypto remain silent. Why? This has always been possible with Ledger as it uses a closed-source system. Just like Apple must sign off on every app before it goes live in the app store, Ledger must sign off on every Ledger app too. Ledger-approved code (in theory) keeps the bad actors away.

There is no need to panic, nothing has changed yet. It does however open up the conversation about what Ledger may do or could do in the future. Is this just to boost profits? Or a way to let the regulators spy and seize? In the short term, you can keep calm and carry on. But if you don’t trust Ledger at all, it’s probably best you look for an alternative.

Lido Launches V2 For Staked ETH Withdrawals 💰

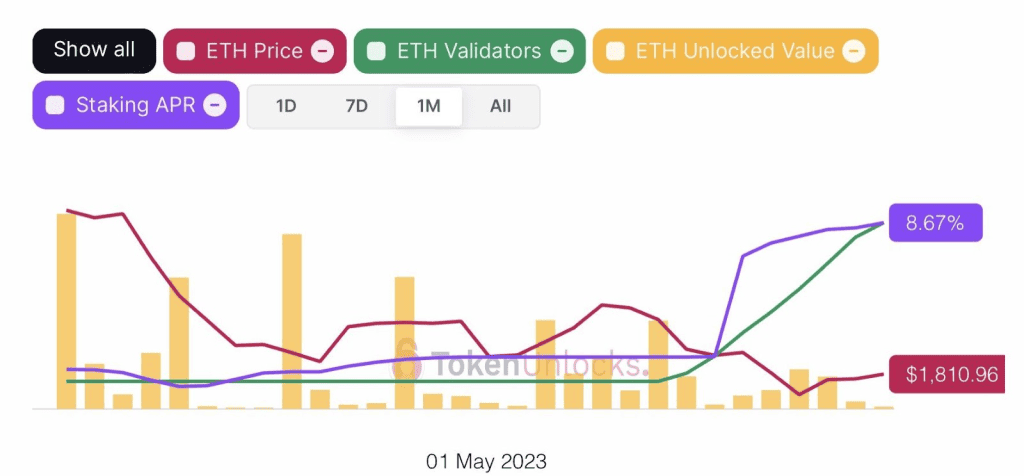

Lido has finally joined the Shapella party. Lido Finance successfully upgraded to V2 this week, allowing users to withdraw their stETH. Lido Finance takes almost 80% market share of liquid staking derivatives on the Ethereum network, so this upgrade is a big freaking deal.

Since the Shapella upgrade, the exit queue for ETH withdrawals has been backed up—by up to 2 weeks. So just how long will Lido Finance withdrawals take? When the exit queue on Ethereum’s Beacon chain is empty, it can take around a day. But the maximum time it may take to exit and withdraw from the staking queue is currently 5.5 days.

Even still, users who request to withdraw their stETH won’t have to wait long for that dopamine hit. Users will receive a Lido-issued NFT immediately to represent the withdrawal request. Then they must use the NFT to claim their rewards and after that, the NFT is burned. Lido has become the fourth largest withdrawal entity, with over 278K ETH withdrawn already.

But the good news is:

- The current annualized rate of return for ETH staking is currently at a historic level of 8.6%.

- More ETH is being deposited than withdrawn—3.4M deposits and 2.67M withdrawals.

- The stETH APR has hit an all-time high of 8%.

Tether Bets Big on Bitcoin With DCA Strategy 🛍

The halving countdown is on! With less than 365 days until the next Bitcoin halving, Tether is going all in on BTC. HODL’ing $1.5B in Bitcoin on its balance sheet just isn’t enough for ‘em. Tether is going to DCA into Bitcoin starting this month, using as much as 15% of its net monthly profits. Tether’s CTO is oozing with orange soda levels of Bitcoin conviction saying “Bitcoin is the epitome of a sound and secure monetary system. It defied expectations, shattered boundaries, and provides access to the global financial system to anyone with an internet connection.”

The UK Crushes Crypto But Ends Up Promoting It 🎰

It seems the UK is flip-flopping on crypto more than price action itself. The UK wanted to become a global crypto hub. Now, the UK sees crypto as merely a gambler’s paradise. The UK’s Treasury Committee released a new report recommending crypto be regulated as gambling. Crypto was described as “unbacked assets” with “no intrinsic value” that “serve no useful social purpose.”

But in the next breath said there’s promise in the underlying technology as its “most convincing use case” is to “improve the efficiency and reduce the cost of making [international] payments.” Let’s not forget that the worthless currency is their fiat money. The British £1 coin just celebrated its 40th birthday and has lost 70% of its value during that time. They know the problem and understand the solution. They just want their own solution, not the people’s.

Australia Makes First FX CBDC Transaction 🇦🇺

The floodgates are open on CBDCs, and it’s no secret that Australia is an eager beaver. Already well into its CBDC pilot, Australia just celebrated a new first. The country has made its first foreign exchange transaction using its Australian dollar CBDC—eAUD.

The transaction consisted of eAUD being traded for USDC and was carried out by crypto fund managers DigitalX and TAF Capital. The transaction was settled using a decentralized app on Canvas, an Ethereum L2 network. Canvas is a privacy-focused L2 that uses StarkWare’s zk roll-up technology. The aim of the CBDC pilot is to test different use cases with this test exploring tokenized FX payments. We all know what the underlying technology can do, but we don’t need a CBDC for that.

Altcoin Alpha by David

Existing Projects / Tokens

- Gains Network [GNS] just introduced gTrade v6.3.2, which mainly focuses on a major overhaul of the protocol’s fee structure. Gains Network is a small DeFi protocol that’s live on Arbitrum and Polygon.

- GMX’s V2 testnet is now live. GMX, a decentralized spot and perpetual exchange, is currently the largest dApp on Arbitrum and 3rd largest on Avalanche.

- Radiant Capital’s [RDNT] proposal for a particular strategic allocation of 3.3M ARB granted to it is now live and open for discussion on its DAO. Radiant Capital is a multi-chain lending and borrowing protocol.

- Ronin [RON] just launched the Mavis NFT marketplace. Ronin is calling Mavis their “first generalized NFT marketplace.” Ronin, a smaller EVM-based blockchain, has carved out a nice NFT and play-to-earn gaming niche for itself as the blockchain currently ranks 2nd in all-time NFT sales volume.

- SUI’s SUI-USD trading pair is set to launch on Coinbase May 18th, pending sufficient liquidity conditions. Sui is the new L1 protocol that launched mainnet on May 3rd.

- Uniswap [UNI] will soon be available on Polkadot. Specifically, Uniswap will be launching on Polkadot’s Moonbeam parachain, by leveraging a cross-chain communications protocol. UNI token holders voted for the expansion on May 17th. Also, some Uniswap stakeholders are discussing the possibility of launching Uniswap on Coinbase’s L2 network, Base.

New Projects / Tokens

- SEI keeps teasing Crypto Twitter with their upcoming mainnet release. Sei is being touted as an L1 blockchain specifically built for traders. Sei claims transaction finality at 300 milli per second and a highly optimized network and environment for trading.

Airdrop of the Week by Jesse

Cheelee

Cheelee is a new GameFi short video platform built for the future of Web3. Anyone can use the platform to earn money from creating and watching content. Unlike TikTok, Cheelee lets users monetize their time spent on the platform no matter how many subscribers or views they get. Cheelee’s goal is to become a premier contender in the attention economy by making its users partners instead of products.

To get things started, Cheelee is giving away up to $100 in free CHEEL tokens to new users who join the platform and complete simple tasks. To get started and earn your free tokens download the Cheelee App on Android or iOS and create an account.

Once that’s done you can head over to the Cheelee Airdrop Page and complete the provided tasks. This will include completing a few simple follow tasks and providing Cheelee with your BSC wallet address.

Once all tasks are completed hit the “send” button on the page to complete this airdrop.

What Are DeGods by Sam

When it comes to PFPs, the DeGods collection has shown impressive resilience, calculated risk-taking, and built connections across three blockchains: Solana, Ethereum and Bitcoin.

Related to DeGods, there’s also y00ts, another highly regarded set of PFPs, but this time associated with Solana and Polygon. Both collections fall under the roof of a platform called Dust Labs, but there’s also a DAO, called DeDAO, and just to confuse matters, there’s another entity behind it all called DeLabs. However, the entire creative enterprise is primarily run by two web3 forward-thinkers.

Frank DeGods and Kevin Henrikson

The person most closely associated with DeGods is Frank DeGods, real name Rohun Vora, a co-founder of Dust Labs. Pseudonymous when DeGods launched, he doxxed himself shortly after and it was revealed that he had dropped out of UCLA, been through a fellowship at the Y Combinator startup incubator, and… was a fan of Frank Ocean (hence the alias).

Assuming a less high profile but also pivotal role in the building process, there was Kevin DeGods, the CEO of Dust Labs, who, at the same time as Frank DeGods, also revealed his own true identity: web2 (and now web3) tech entrepreneur and angel investor Kevin Henrikson.

The DeGods Collection

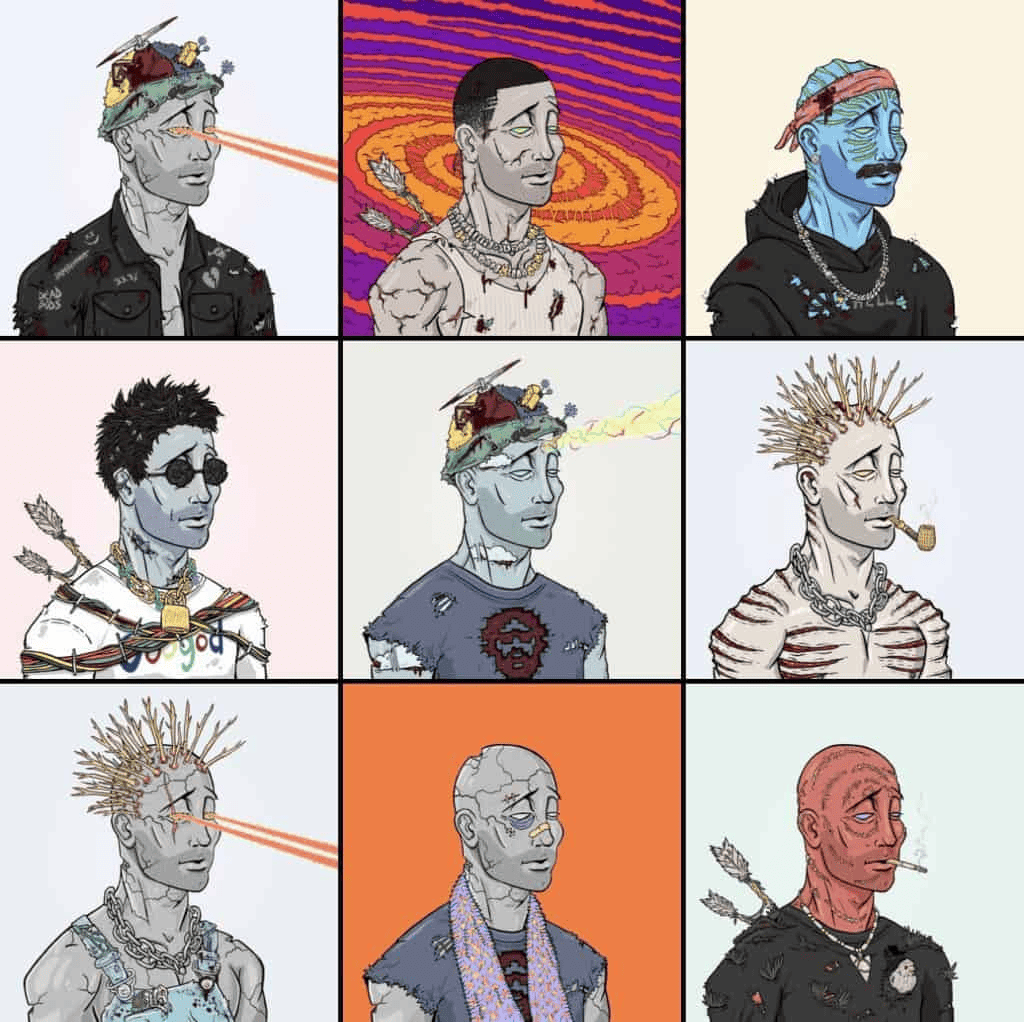

Image credit: DeGods

First minted on Solana in October 2021 for 3 SOL, DeGods is a collection of 9,465 PFPs depicting–in true PFP form–surface variations on a sideways-facing character template, this time all styled around deities.

There were originally 10,000 PFPs, but 535 were burned and have subsequently come back to life on a new blockchain (actually, on the oldest blockchain, more on this below). DeGods can be staked in a non-custodial way to earn DePoints (which remain within the ecosystem) and the project’s native token, DUST (which trades on DEXes Orca, Jupiter and Raydium, and on the CoinEx platform).

DeadGods

Image credit: DeGods

There are DeGods, and there are DeadGods, which were introduced in March 2022. The idea here is that you can “transcend your DeGod”, which means you take a DeGod, pay some DUST (currently around 1,765 DUST, which is over $3,000 at the time of writing), and your DeGod becomes a DeadGod, meaning the metadata is altered but the underlying token remains the same, so there’s no change in the DeGods total supply.

DeadGods have an altered appearance, are rarer and more valuable (although you’re paying for that rare value), and come with added benefits, including staking reward boosts, and greater sway in the DeDAO.

The Transition to Ethereum

In December 2022, it was announced that DeGods would be leaving Solana and moving to Ethereum. This risked alienating the Solana NFT community and came when Solana was dealing with reliability issues, but DeGods itself looked strong, and Frank DeGods stated that the project had “capped out on Solana”. It wasn’t until the start of April this year that DeGods finally migrated, and it’s subsequently traded impressively on Ethereum.

An Ordinals Early Mover

Image credit: DeGods

In March, just before the Ethereum move, DeGods made a splash in the nascent Bitcoin Ordinals ecosystem. It did this by inscribing 535 DeGods onto the Bitcoin blockchain, the items in question being PFPs from the original collection that had, much earlier, been burned.

“What is dead may never die”, tweeted Frank DeGods, and those reanimated DeGods have subsequently gone on to become one of the most popular Ordinals collections, currently sitting at a floor price just under 1 BTC.

By the way, if you’re wondering why 535 DeGods were burned in the first place, it was due to an idea called, memorably, the Paper Hands Bitch Tax. This system was retired at the start of 2022, but when working it meant anyone who sold a DeGod for less than their own buy price was taxed 33.3%. The tax raised was then used by the project to buy and burn the cheapest DeGods on the market.

Blur and Blend

Leading up to the Ethereum move, DeGods also announced a partnership with NFT trading platform Blur, which was busily disrupting the NFT space with its token farming incentives, and creating division as to whether it was a force for good or for market chaos. Either way, a tie-up with DeGods was good publicity.

Following on from that, Blur this month initiated its Blend protocol, which offers NFT-collateralized loans and a buy now, pay later facility. At first Blend only included CryptoPunks, Azuki, and Milady Maker, but DeGods was soon announced as the fourth collection to be integrated.

y00ts

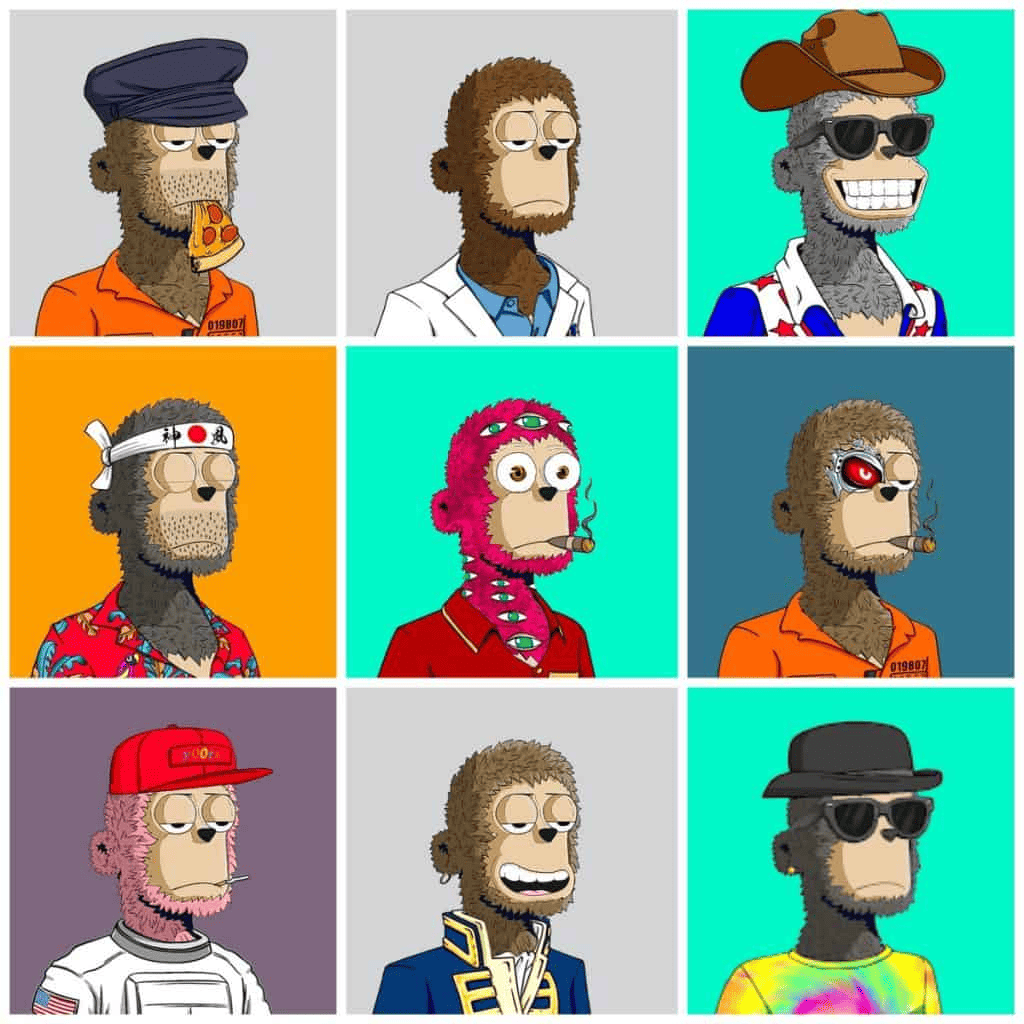

Image credit: y00ts

If you’re interested in DeGods, you also need to be aware of a collection called y00ts, which was created by Frank DeGods and is part of Dust Labs and DeLabs. It minted in September 2022 through an exclusive process called y00tlisting, with DeadGods holders also given mint access.

The collection is made up of 15,000 PFPs, this time showing cartoonish monkey characters, and y00ts functions as a dynamic meeting point for web3 builders and participants, incorporating multiple members’ clubs (all listed on the y00ts website) formed around specific niches.

Focusing on decentralized approaches to IP, y00ts utilizes staking and PFP customization, and seems like an experimental venture to test out novel Web3 approaches.

The Transition to Polygon

When it was made public that DeGods would relocate to Ethereum, it was also announced that y00ts would move to Ethereum sidechain Polygon. The bridge across opened at the end of March and it looks now like a positive move for all parties.

We can say for sure that Polygon welcomed the change as, in fact, they paid for it, having given a $3 million grant to DeLabs in return for y00ts making the network transition.

Dust Labs

Image credit: Dust Labs

As mentioned, both DeGods and y00ts are part of Dust Labs, which markets itself as building web3 tools and software solutions, and is especially focused on NFTs.

In September 2022, Dust Labs raised $7 million in a seed funding round that included investors such as Solana Ventures, Magic Eden, and Foundation Capital (and also FTX Ventures, but that of course was before the FTX mega-implosion).

Why Are DeGods So Valuable?

Image credit: DeGods

NFTs are unpredictable and it’s sometimes a challenge to pinpoint exactly why a collection becomes sought after. With DeGods, there appear to be various factors at play.

- Frank DeGods has become influential and well-respected in the NFT space. Anything he is associated with now has cachet.

- Having made it to the top on Solana, DeGods was not content to stand still, and made a bold play, which paid off, by bridging to Ethereum.

- The idea of strong communities is over-egged in NFTs, but DeGods actually has a loyal and engaged community.

- When Bitcoin Ordinals started taking off, DeGods quickly got involved and made imaginative use of the PFPs removed from the original Solana collection.

- The Blur partnership was another example of reacting quickly to market shifts, and means DeGods is now included in Blend.

All in all, DeGods, with y00ts alongside, has taken a unique path navigating multiple blockchains, and come out the other side of booms and crashes looking more dynamic than ever. Where it goes from here remains to be seen, but I wouldn’t bet against it testing out more new ideas, as in Frank DeGods’ own words, “the biggest risk is not taking one”.

Go Premium To See This Weeks Top 3 NFT Mints

Subscribe to the Wealth Mastery Premium Investor Report to get this weeks top 3 NFT mints AND gain full access to the premium archives.

Final Notes

Watch my video below on how to make money investing in Bitcoin & crypto. 👇

Thank you so much for your support, and I truly hope that today’s issue will give you insights needed to help you master your wealth.

If you are reading this it means you are on the free version of the Wealth Mastery Investor Report, which is great for news and tips on the crypto markets.

If you really want to take advantage of fastest growing asset class EVER, I highly recommend you to check out my new Altcoin course: Mastering Altcoin Investing

In this course we’ll teach you all about how to spot, choose and acquire the winning altcoins of the next bull market.

Learn how to build your portfolio so that growth is ensured and risk is mitigated. Let me help you build a strategy that’ll change your life forever in the upcoming bull run.

Are you ready to make it?

See you next time!

Lark and the Wealth Mastery Team

Recommended Services

💰 BINANCE: BEST EXCHANGE FOR BUYING CRYPTO IN THE WORLD 👉 10% OFF FEES & $600 BONUS

🚀 BYBIT: #1 EXCHANGE FOR TRADING 👉 GET EXCLUSIVE FEE DISCOUNTS & BONUSES

🔒 BEST CRYPTO WALLET TO KEEP YOUR ASSETS SAFE 👉 BUY LEDGER WALLET HERE

Legal Disclaimer

Wealth Mastery (Lark Davis, and the Wealth Mastery writing team) are not providing you individually tailored investment advice. Nor is Wealth Mastery registered to provide investment advice, is not a financial adviser, and is not a broker-dealer. The material provided is for educational purposes only. Wealth Mastery is not responsible for any gains or losses that result from your cryptocurrency investments. Investing in cryptocurrency involves a high degree of risk and should be considered only by persons who can afford to sustain a loss of their entire investment. Investors should consult their financial adviser before investing in cryptocurrency.

You can find a full disclosure of all my crypto & venture investments here.