Is the Bull Run Over???

GM friends.

If you’re sweating this current price dip, then you’re definitely Class of 2024, and we need to have a serious pep-talk.

So pour up a coffee and have a seat. Here’s your mid-week crypto update. ☕️📰

Here’s what’s in today’s issue:

- David shares his thoughts on whether or not the bull run is over, the world’s largest pension fund eying Bitcoin, MicroStrategy holding over 1% of BTC’s max supply & BlackRock launching a $100M tokenized asset fund.

- Rekt Capital has the latest technical analysis for you on the market.

- Erik has an article on how high the Bitcoin price can go this cycle.

- In case you missed it by Rebecca.

Step 1: Sign up using this link

Step 2: Fund your account with $100 or more

Step 3: Claim your bonus and free trade

Is the Bull Run Over???

The swinging price action, and corresponding mood on Crypto Twitter, sometimes feels like an unmedicated bipolar patient.

Last week, investors were browsing Zillow and counting the days until wen lambo. Now, the sky is falling, and fast food applications are being assembled.

But is this bull run really over? Let’s break down exactly what’s happening, why, and where I think we’re going from here.

BTC Falls 17%, ETH Loses 25%

Exactly one week ago, bitcoin hit an all-time high at $73,800. Since then, it’s fallen 17%, with prices now at 63K.

Likewise, ETH peaked just over $4K, then plunged 25%, and is now trading at $3,200. And crypto’s entire market cap has dropped from $2.77 to $2.38 trillion.

Why is this Happening?

According to Alex Kruger (Columbia MBA, crypto and macro investor), here’s the reasons for this latest price action:

We’ve discussed the perils of leverage before. Leverage long BTC traders piled in near all-time highs. Once they started getting liquidated, it created a cascading effect that applied downwards pressure on the spot price.

Financial analysts and the overall market have soured on the idea that the SEC will approve the spot ETH ETFs in May. So some traders and investors are jumping ship, believing ETH prices are overvalued compared to the probabilities of an approval.

And the spot bitcoin ETFs experienced negative outflows on Monday and Tuesday of this week. Monday’s outflows totaled $154M, and Tuesday’s were $326M. Tuesday’s outflows were the largest since the ETFs launched.

Where We Going From Here?

Before we talk about the medium term, let’s put this current dip into perspective. Just in case you’re new around here.

To be frank, this is a dip for ants. It’s a complete joke. If you’ve been worried, then I encourage you to go back and look at the frequent 30% price dips during the 2017 and 2021 bull runs.

This pullback is very normal, and actually very healthy for the crypto markets.

With regards to the medium term, I’ve got two points for you. First, remember that THE. HALVING. IS. IN. 30. DAYS. And you know exactly what that means.

And second, keep in mind what the analysts are projecting for the next 18 months. Case in point would be Standard Chartered Bank, who on Monday raised their bitcoin price target to $150K by the end of 2024, and $250K near the end of 2025.

This bull run has just begun, and we haven’t seen anything yet.

World’s Largest Pension Fund Eyeing Bitcoin

Can you guess what’s the world’s largest pension fund?

It’s Japan’s Government Pension Investment Fund (GPIF). This fund has $1.54 trillion in assets under management, and it’s tasked with providing retirement income and benefits to Japan’s government employees.

Now, can you guess what asset GPIF is considering for an investment? That’s right. It’s the corn.

Announced on Tuesday, GPIF stated that they’re launching a five year research plan to explore the placement of non-traditional assets into their fund, for the purposes of diversification. And bitcoin will be one of the assets considered.

GPIF’s announcement noted that the search for diversification via non-traditional assets is due to “major changes in the economy, society, and rapid technological progress.” Currently, GPIF invests in stocks, bonds, real estate, and core infrastructure projects.

However, it’s well known that Japan is staring down the barrel of a looming pension crisis, given the country’s declining birth rate, shrinking labor force, and aging population.

So, it makes sense that bitcoin might be considered, given the GPIF will one day soon be in need of some asymmetric returns.

MicroStrategy Holds > 1% of BTC’s Max Supply

On March 5th, MicroStrategy announced a private offering of $600 million in convertible bonds. The company ended up raising $800M, and completed a 12K BTC purchase by March 10th.

On March 14th, the company announced another convertible bond offering, to the tune of $500M. MicroStrategy again shot past its goal, raising $603.75M. With this new cash, the company completed the purchase of another 9,245 BTC this past Tuesday.

So MicroStrategy’s total BTC holdings is now 214,246. This means this one company holds more than 1% of bitcoin’s max supply. Insanity.

BlackRock Launches $100M Tokenized Asset Fund

Here’s some interesting news.

On Tuesday, BlackRock submitted a filing with the SEC for a new tokenized asset fund. But the details are pretty sparse. Here’s what we know.

It’s called the BlackRock USD Institutional Digital Liquidity Fund. It’s registered in the British Virgin Islands, and BlackRock has partnered with Securitize for the fund’s development. Securitize is a San Francisco-based asset tokenization company. Finally, the fund has already been seeded with $100 million in USDC on the Ethereum blockchain.

And that’s about all we really know as neither company has yet to disclose more details. But that won’t stop us from speculating.

The leading theory at this point is that this is BlackRock’s opening move into the tokenization of, and investment in, real world assets (RWAs). And if this turns out to be the case, we will have to wait and see what RWAs BlackRock tokenizes and offers to investors first.

We will keep you updated on this as more news comes out.

In today’s edition of the Wealth Mastery Newsletter, the following cryptocurrencies will be analysed & discussed:

- UniSwap (UNI)

- Theta Token (THETA)

- Coti (COTI)

- Chiliz (CHZ)

- Crypto Com (CRO)

UniSwap — UNI/USDT

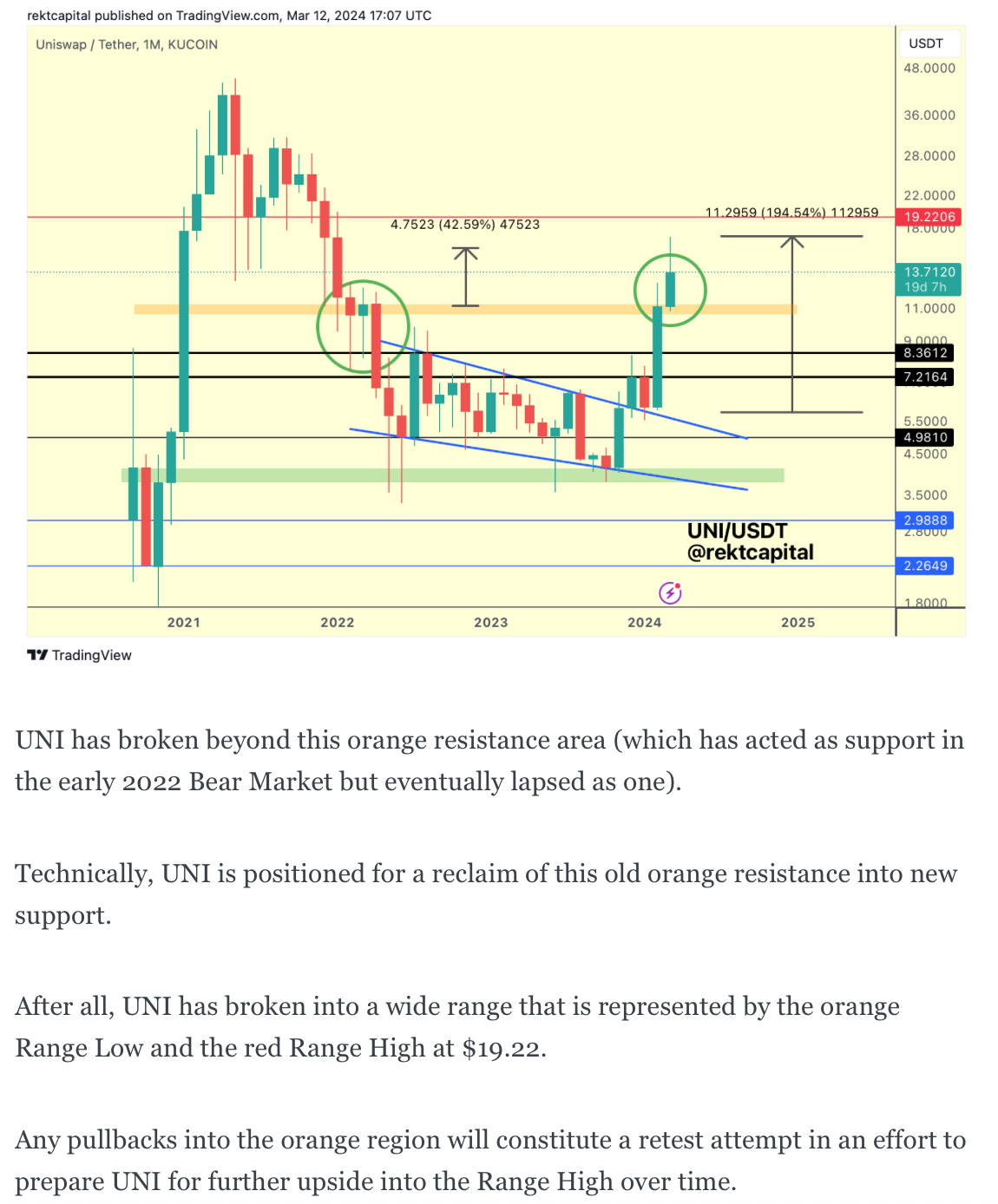

Last week, we spoke about how UNI was positioning itself for a retest of the orange region that it had broke in previous weeks:

Here’s today’s update:

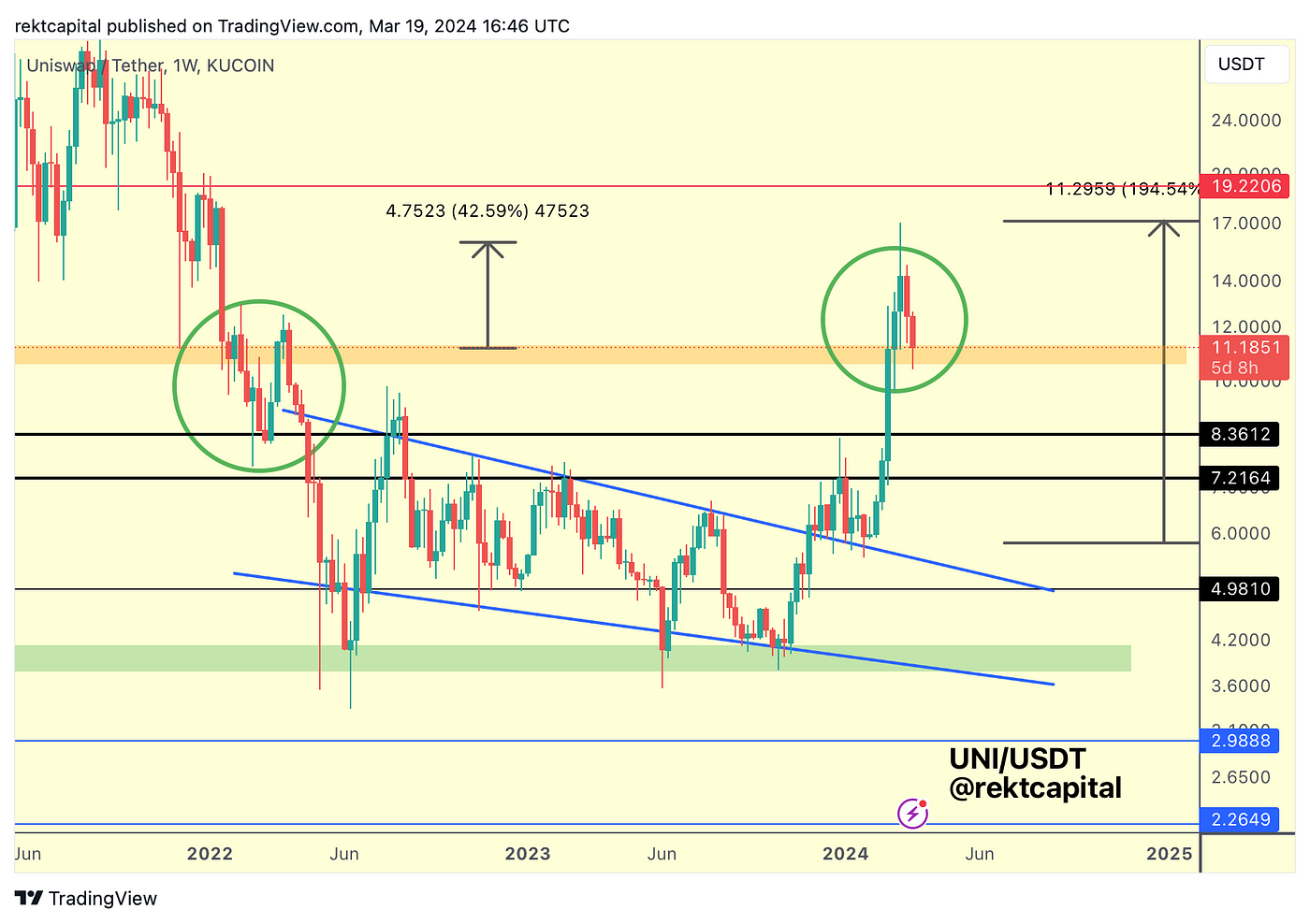

UNI is now in the process of a retest of this old orange area of resistance into a new source of support.

In early 2022, the green circle showcases how this region figured as a point of rejection whereas this current green circle is to demonstrate how this same price area can flip into a base from which UNI could be able to springboard from in the future.

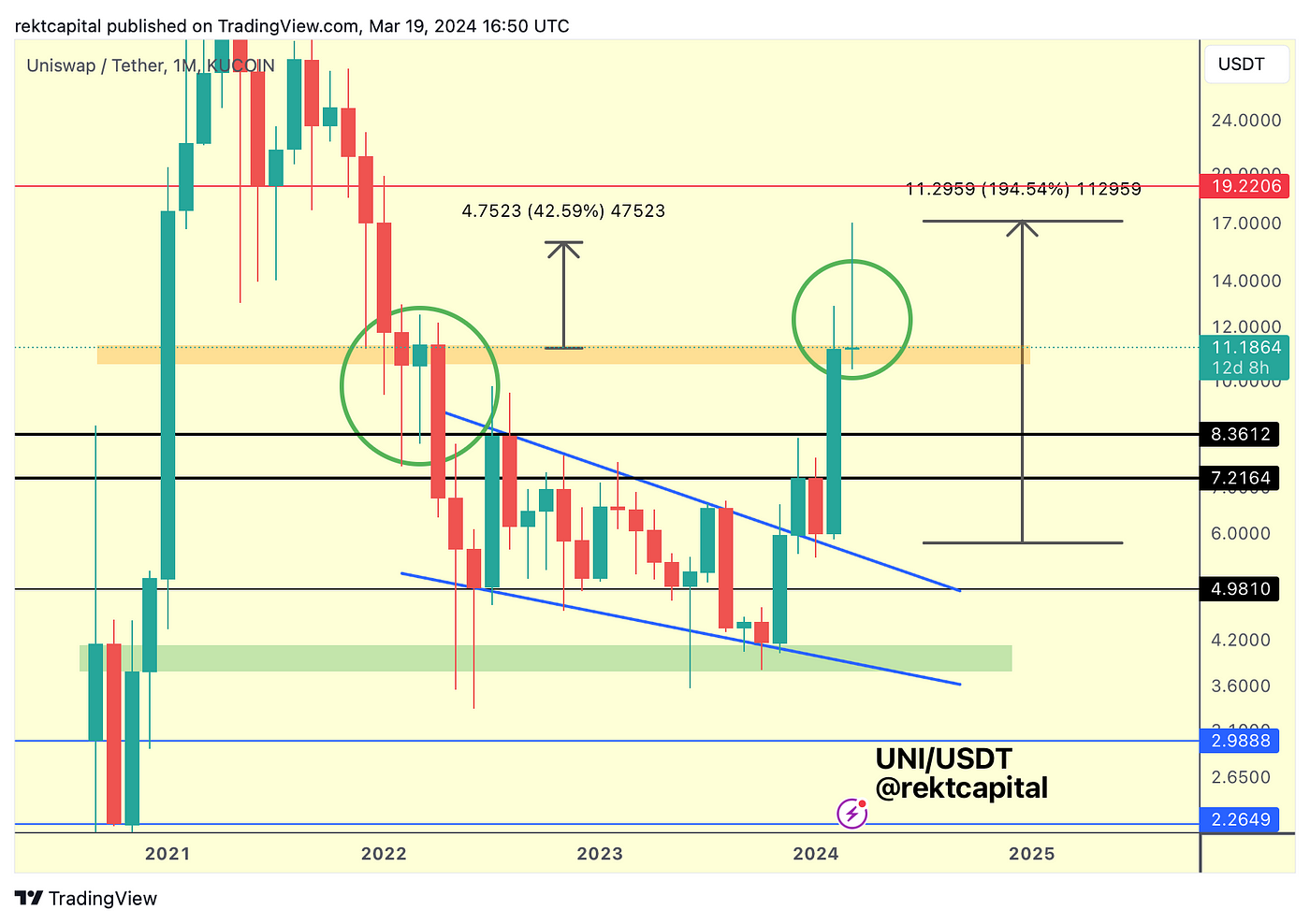

The Monthly timeframe highlights how this current retest could become a more volatile one:

In early 2022, a retest was in progress back then as well but it failed; nonetheless, that support area showed that price could downside wick quite considerably during the retest.

If UNI is going to perform a volatile retest this time around as well, the black $8.36 would be a region to tag, with scope for even wicking below that, right into the black-black range of $7.21-$8.36.

If the Bitcoin Pre-Halving Retrace continues, then this is a scenario worth keeping in mind.

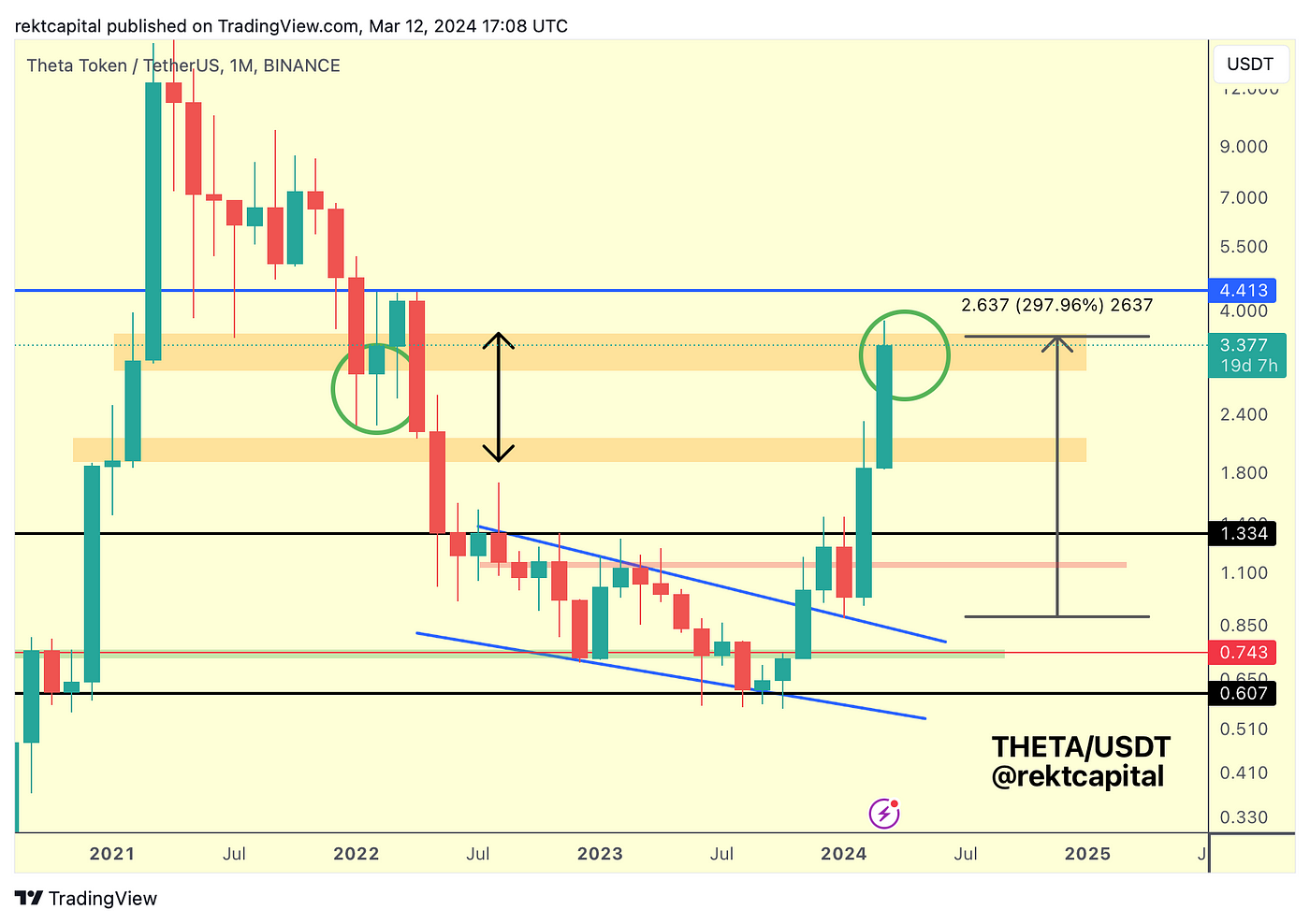

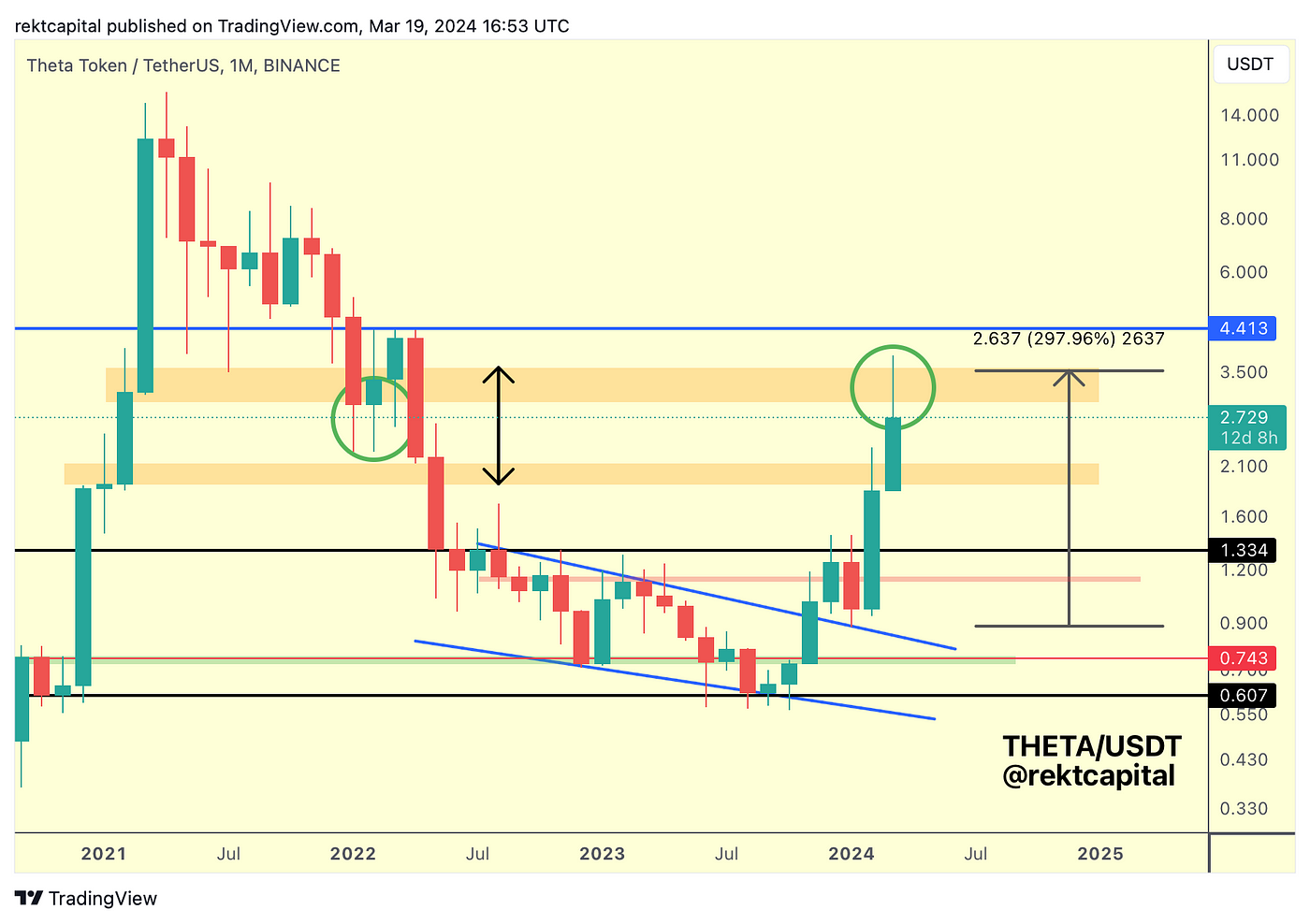

Theta Token — THETA/USDT

Last week, we spoke about how THETA could dip into the orange box for a retest, akin to early 2022 (green circle):

A dip did occur, however THETA lost this orange area as support and pulled back more:

As a result, THETA is in no man’s land, within the orange-orange macro range.

Still, with many days left in the month, THETA could still try to reclaim the orange box above as support, however because of how it’s currently positioned right now, THETA could also dip into the orange Range Low to re-affirm itself inside this range and confirm a bout of consolidation within it.

What’s clear is that THETA may not be ready to breakout from this orange-orange macro range just yet so some consolidation may be needed to set the stage for that to happen at some point in the future.

CLICK HERE to go Premium and read the rest of this week’s Market Analysis – Premium subs can read Rekt capital’s full report.

How High Can the Bitcoin Price Go this Cycle?

TL;DR How high can the Bitcoin price go this cycle (2021-2025)? While predicting the exact top is of course impossible, we can make some educated guesses.

Let’s look at the catalysts that drive this bull market, draw some charts comparing this cycle to previous ones, and look at the average prediction of the analyst crowd.

TO READ THE REST OF THIS ARTICLE, CLICK HERE – “How High Can the Bitcoin Price Go this Cycle?”

Crypto Market News

- Japan’s state pension fund, the world’s largest with $1.4 trillion in assets, is considering diversifying into Bitcoin. Source

- Global crypto funds have broken the 2021 inflow record in less than 3 months in 2024. Source

- Coinbase is planning to raise $1 billion from convertible notes that must be repaid by 2030. Source

- Coinbase Wallet quietly integrated Blockaid’s security tool in late 2023 after announcing it saved users over $75 million in 5 months. Source

- Ark Invest has sold another $27M in Coinbase stock over the past week. Source

- Nigeria has ordered Binance to hand over information about its top users including transaction history from the past 6 months. Source

- Starbucks is shutting down its Odyssey NFT rewards program on March 31. Source

- Ledger is set to launch its new Stax wallet in May this year after first announcing it back in 2022. Source

- El Salvador has moved some of its Bitcoin reserves into cold storage and published the wallet address on X. Source

Coins and Projects

- MicroStrategy now owns over 1% of Bitcoin’s total supply after buying another 9,245 BTC for the $623M it just raised in convertible notes. Source

- Standard Chartered has raised its Bitcoin price prediction to $150K by the end of 2024 and $250K by the end of 2025. Source

- Bitcoin’s spot ETFs hit a record of $1 billion in daily inflows on March 12. Source

- Spot Bitcoin ETFs could see $220 billion in inflows over the next 3 years according to JMP Securities. Source

- Spot Bitcoin ETFs saw negative money flows after GBTC saw $642M in outflows on March 18. Source

- Bitcoin’s price is unlikely to fall below $50,000 unless “something dramatic happens’ according to Galaxy Digital CEO Mike Novogratz. Source

- Jan3 CEO Samson Mow has said Bitcoin could reach $1 million per coin in 2024 or 2025. Source

- First Trust and SkyBridge have been ordered to abandon their Bitcoin ETF application by the US Securities and Exchange Commission (SEC). Source

- Jack Dorsey’s Block has started shipping its Bitkey Bitcoin wallets. Source

- Ethereum’s Dencun upgrade has successfully gone live on the mainnet and is designed to reduce Layer-2 fees. Source

- Blast network stopped producing blocks after experiencing issues related to Ethereum’s Dencun upgrade. Source

- Ethereum Layer-2 transaction fees are already showing significant drops after the Dencun upgrade. Source

- Ethereum staking protocol Swell has launched a Layer-2 restaking rollup with $1 billion in total value locked (TVL). Source

- Fidelity has changed its spot Ethereum ETF application to include staking. Source

- MakerDAO has announced it will be launching two new tokens as part of its first phase of Endgame in Summer 2024. Source

- Aavegotchi is set to launch a Layer 3 rollup in Q2 that will use Coinbase’s Base network for settlement. Source

- PancakeSwap has unveiled its V4 which will be released later this year with 4 key features. Source

- OKX exchange has reportedly delisted USDT pairs in Europe with speculation this is due to the stablecoin rules included in the MiCA regulations. Source

- Toncoin has gained 61% in two days as Telegram is considering a potential stock market IPO. Source

Macro News

- The US SEC has requested an extra $158M from the federal budget to police the crypto market. Source

- The EU is planning to roll out its digital Euro CBDC in November 2025. Source

- EU regulators have published a set of draft rules for stablecoins under its MiCA regulations. Source

- India is going to settle stock market trades faster in a bid to compete with crypto. Source

- El Salvador’s President has removed income tax on money coming into the country from abroad—it was previously taxed at 30%. Source

- The IMF wants Pakistan to impose capital gains on crypto to qualify for a $3 billion bailout. Source

Thank you so much for your support, and I truly hope that today’s issue will give you insights needed to help you master your wealth.

If you are reading this it means you are on the free version of the Wealth Mastery Investor Report, which is great for news and tips on the crypto markets.

If you really want to take advantage of fastest growing asset class EVER, I highly recommend that you check out my new altcoin course: Mastering Altcoin Investing

In this course we’ll teach you all about how to spot, choose and acquire the winning altcoins of the next bull market.

Learn how to build your portfolio so that growth is ensured and risk is mitigated. Let me help you build a strategy that’ll change your life forever in the upcoming bull run.

See you next time!

Lark and the Wealth Mastery Team

💰 BINANCE: BEST EXCHANGE FOR BUYING CRYPTO IN THE WORLD 👉 10% OFF FEES & $600 BONUS

🚀 BYBIT: #1 EXCHANGE FOR TRADING 👉 GET EXCLUSIVE FEE DISCOUNTS & BONUSES

🔒 BEST CRYPTO WALLET TO KEEP YOUR ASSETS SAFE 👉 BUY LEDGER WALLET HERE

📈 TRADING VIEW: BEST CHARTING SOFTWARE ON THE INTERNET 👉 JOIN NOW

1️⃣ COINLEDGER: #1 CRYPTO TAX SOFTWARE 👉 IF YOU OWN OR TRADE CRYPTO YOU NEED THIS

Wealth Mastery (Lark Davis, and the Wealth Mastery writing team) are not providing you individually tailored investment advice. Nor is Wealth Mastery registered to provide investment advice, is not a financial adviser, and is not a broker-dealer. The material provided is for educational purposes only. Wealth Mastery is not responsible for any gains or losses that result from your cryptocurrency investments. Investing in cryptocurrency involves a high degree of risk and should be considered only by persons who can afford to sustain a loss of their entire investment. Investors should consult their financial adviser before investing in cryptocurrency.

You can find a full disclosure of all my crypto & venture investments here.