Portfolio Tip, Art Blocks, Cardano vs Solana & Trending Coins

In This Issue

- For this weeks portfolio tip, I’ll be talking about being too early.

- Sam has a report for you on Art Blocks.

- David breaks down the differences between Cardano and Solana.

- Rebecca has this week’s top trending coins.

Premium Subscription highlights this week:

- My portfolio: I have some new buy and sell orders set.

- Token Launches: A notable token launch this week and directions on how to learn more.

- NFT mints: 3 upcoming NFT mints to keep an eye on.

Lark’s Portfolio Tips

Too Early

I read an interesting article by Coindesk the other day that Decentraland and Sandbox, the biggest crypto metaverses, both have less than 1,000 daily active users. And yet, these coins have market caps of over a billion dollars. That is about $1,000,000 in market cap per daily user. Sandbox has said these numbers are wrong and that they have 210,000 monthly active users and Decentraland said that they have 56,000.

Still though, it got me thinking.

Valuations in crypto are notoriously hard to “get right” due to this all being such new technology. The fact is that we are still so crazily early on most sectors in crypto.

There are a few break away apps like SWEAT that have millions of users. Yes, the major blockchains maintain good daily user bases, but most dapps are not doing awesome as far as gaining traction with users is concerned.

Here are a few sectors with big potential, but which are largely still too early:

Metaverse – There was a moment in time when EVERYONE was talking about the metaverse. It was the next big thing. Only problem is that the metaverse of promise is many years away. We are still wildly early in this sector. And while early movers like Decentraland, Sandbox, and Wilder World have made big moves there is no guarantee they will prove to be the winners especially when industry heavyweights like Facebook are going all in on metaverse.

Gaming – Crypto and gaming go together like peanut butter and jelly. The value proposition for game developers and users is massive. However crypto gaming has not truly had a break away moment yet. Games like Axie Infinity did attract users, but also those just looking to farm tokens by playing and breeding. However major gaming studios are investing in the space, and the quality of game releases continues to be increasing in quality. And, yes, users are noticing with games on cheaper chains like Polygon and Solana starting to get real user bases. BUT, even then many games will simply fade away into irrelevance, but some will make huge gains. The trick is finding the winners… and remembering to take profits!

Insurance – In the real world insurance is a massive industry. In crypto it remains a very niche product. Nexus Mutual is the only insurance protocol with any real traction, and it does not see any real value accrue to token holders. Others like Bridge Mutual have basically failed to navigate the narrow path of incentives for liquidity providers and token inflation. Insurance WILL be big, but it is still too early.

Defi – It’s still early, but we are not as early here as many sectors in crypto. Big protocols like Aave and Curve Finance have billions of user funds sitting on their smart contracts, although much of it is from whales. Defi has seen incredible amounts of innovation with lots of experiments that failed. We have also seen huge amounts of money lost due to hacks. Many tokens have cratered in value because they create no value except vague promises of “governance”. The long term picture for defi is bright, and traditional finance money is entering the space, but defi is still early and there are a lot of growing pains we are working through.

While we are no longer super early for Bitcoin and Ethereum, considering their current market caps, we are still early for many sectors in crypto. And while we will see many coins rise and fall, the ideas birthed in the furnace of chaos in crypto will go on to change everything. And yes, massive gains will be had in the above sectors, but the failure rate will be high. 90% of the coins in the markets will trend to complete irrelevance. Always remember that!

Start your Wealth Mastery Premium Subscription today!

What is Art Blocks by Sam

NFTs may have a huge range of potential future applications, but they’re currently most strongly associated with PFPs and art. In that second category, art, you can find all kinds of creations, but–probably because NFTs are part of the tech industry–there’s been a renaissance of generative art, and Art Blocks is the leading platform for generative art NFTs.

What is Generative Art?

Generative art from 1967 by Frieder Nake

We should start by figuring out what exactly is meant by that term, generative art. Actually, it’s pretty straightforward. Generative art means art that is created through a programmed algorithm, according to set parameters.

You might have one person creating everything to set the process in motion, in which case they would be a kind of coder-artist, and you might come across the term creative coding. Alternatively, you could have a collaborative project involving an artist and a coder working together.

For some early generative art that predates blockchain technology by decades, start with artists such as Frieder Nake, Georg Nees, and Paul Brown, and you’ll immediately see the similarities with current NFT-based generative art like that curated by Art Blocks.

How does Art Blocks Fit In?

A Chromie Squiggle by Snowfro

Art Blocks was launched in November 2020 by Erick Calderon, also known as Snowfro, who had profited from being an early CryptoPunks collector. The purpose of Art Blocks was to act as a platform for generative art coded on the Ethereum blockchain, which could be traded in NFT format. The first Art Blocks collection was Chromie Squiggles, by Snowfro himself.

In a sense, Art Blocks provides art on-demand. The process works through creators–artists/programers–assembling unique, artwork-making code, and when a buyer clicks mint, a new piece within a limited collection is automatically produced, appearing as an NFT in the buyer’s wallet.

The NFT space is a creative culture clash. At one end we have cartoonish illustrations of apes, aliens and zombies, and a fixation on pixelated gaming nostalgia. Then, at the other end of the spectrum–where Art Blocks resides–we find outsider artists and abstract compositions, and a crossover with top-end auction houses and exclusive gallery spaces.

The End of Curated Collections?

Fontana #27 by Harvey Rayner

Changes are in the pipeline, but Art Blocks has up to now had three different types of collection, Curated, Playground and Factory, of which Curated are the most prestigious.

As the name suggests, Curated collections are carefully selected, and they have been divided into eight series. However, Art Blocks recently announced that Series 8 will be the last of the Curated groupings, drawing a close to a colorful, fast-moving couple of years that have left a permanent impression on the worlds of both art and crypto.

Of the other two collection types, Playground projects are created by artists from the Curated section, but they don’t require approval in the way that Curated projects do. Factory collections are by other artists, and have a more relaxed admission process. However, Art Blocks is now gearing up for a series of alterations and upgrades.

What is Art Blocks 2.0?

Image credit: Art Blocks

In addition to wrapping up the Curated series, Art Blocks is overhauling its wider operations in preparation for what’s being called Art Blocks 2.0, with changes scheduled to be fully implemented at the beginning of November.

A major improvement from a practical point of view is that Art Blocks will utilize a new smart contract, lowering transaction costs for both artists and buyers by about 65%.

There will also be changes to the collection types. The Playground and Factory collections will join to become a new category called Art Blocks Presents. To distinguish original-era collections from new entrants, pre-upgrade work will be tagged with Heritage status.

Also, there will be a new category called Art Blocks Explorations, which houses specially commissioned projects produced in collaboration with the Art Blocks team.

Finally, there will be a revamped website. Expect the possibility of a surge of interest in both new and old collections around that time, keeping in mind that NFT markets are driven by attention.

Which Collections are the Most Highly Rated?

Fidenza by Tyler Hobbs

Art appreciation is, of course, totally subjective, but in terms of which collections have become the most famous, and have registered the highest-priced sales (this is where art meets crypto, after all), the top collections are Fidenza by Tyler Hobbs, Ringers by Dmitri Cherniak, and Chromie Squiggle by Snowfro.

Relatedly, take a look at the new QQL generative art platform, co-created by Tyler Hobbs and Dandelion Mane. The QQL application allows anyone to create generative art, but in order to mint an artwork into an official QQL NFT, users need a QQL Mint Pass.

The platform’s 900 Mint Passes were sold at the end of September for 14 ETH each (with the price found through a Dutch auction process), and they currently hold a floor price of 18.8 ETH on OpenSea.

QQL is separate from Art Blocks, but Tyler Hobbs achieved lasting fame through his Art Blocks-curated Fidenza collection, and QQL traces back directly to the impact of Art Blocks and its artistic/tech launchpad.

Go Premium To See This Weeks Top 3 NFT Mints

Subscribe to the Wealth Mastery Premium Investor Report to get this weeks top 3 NFT mints AND gain full access to the premium archives.

Here’s what the investment community says about the Wealth Mastery Premium Investor Report

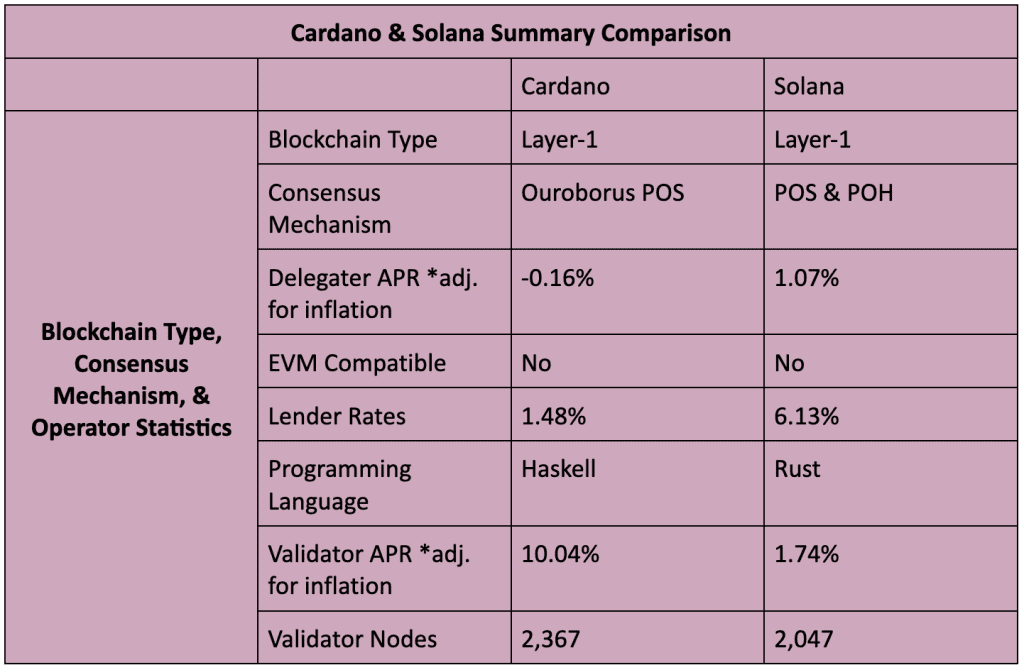

Cardano vs Solana by David

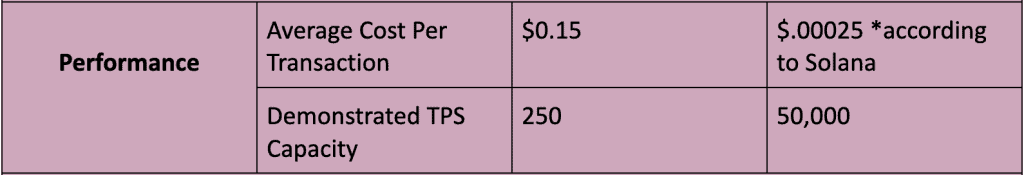

Ethereum broke new ground with the concept of smart contracts. But as a proof of work (formerly) chain performing 30 transactions per second (TPS), the market foresaw a need for more energy-efficient, faster networks.

Cardano and Solana – known as version 3.0 blockchains – represent the next developmental iteration after Ethereum. If the future is multichain, then investors are wise to examine both, as each has made a name for itself and pushed blockchain technology forward in innovative ways.

The following analysis compares Cardano and Solana from conceptual, technical, product, and tokenomic perspectives. High-level positives and criticisms are provided in the conclusion. So LFG.

What Are Cardano and Solana

Cardano and Solana are decentralized, smart contract, proof of stake (POS), L1 blockchain networks. Both support diverse economic ecosystems and provide users with fast transactions and low fees. Both networks are in the top 10 crypto projects by market cap. Their native tokens are ADA and SOL, respectively.

How Do Cardano and Solana Work

While they seem similar, under the hood inspections reveal key conceptual and technical differences between the two networks. Here are the differences:

Cardano Concepts and Technicals

- Development, Research, and Philosophy: Cardano’s development has been slow and purposeful as the network is subject to extensive peer-reviewed research and testing. But, project developers have extremely ambitious hopes that the network will one day transform the global economy into a more financially inclusive system.

- Epochs and Slots: The Cardano blockchain is divided into epochs (approx. 4 days) and slots (approx. 20 seconds). The latter occurs inside the former. Ouroboros POS randomly selects nodes (odds in proportion to stake) to validate new blocks for each slot. Given an epoch can contain 432,000 slots, Cardano is able to process approximately 250 TPS.

- Ouroboros POS: “Ouroboros” is the ancient symbol of the snake that eats itself. Ouroboros POS implements a Global Random Oracle (GRO) which is essentially a randomly changing randomness algorithm. GRO leverages previous block data to help it change – hence the parallel to the symbol. GRO selects Cardano’s validators and is believed to provide enhanced network security due to the extreme difficulty in anyone correctly predicting how the algorithm will change.

- Sidechains: Cardano’s next stage (Stage Four: Basho) will usher in the development of sidechains – newly created blockchains that communicate and run in parallel with Cardano’s mainchain. The purpose of sidechains is to help the network scale. Thus, Cardano is becoming conceptually similar to Polkadot, which is a network of blockchain networks.

Solana Concepts and Technicals

- Hybrid POS and proof of history (POH): Solana implements a novel consensus mechanism that uses both POS and POH. Thus, the network is considered as one of the most technically advanced due to this hybrid nature.

- POS: Solana’s 2,047 validators are randomly selected to propose the next block. Selection odds are in proportion to stake. Other validators must either accept or reject the newly proposed block. If verified, the chosen validator receives a reward. Delegators are free to stake with any validator they like.

- POH: Solana produces extremely fast transactions because validators can efficiently verify the proper ordering of transactions with each other. Every validator runs a “cryptographic clock” that works in unison with every other cryptographic clock on the network. These clocks are synchronized because every validator can only commit one CPU to run the SHA-256 algorithm – the beating heart of each clock.

- Single Global State: Solana’s hybrid approach creates a blockchain so fast and efficient that there will be no future need for any sharding, scaling, or sidechain solutions. Thus, it’s intended that Solana will maintain a single global blockchain state. One blockchain – simple and seamless.

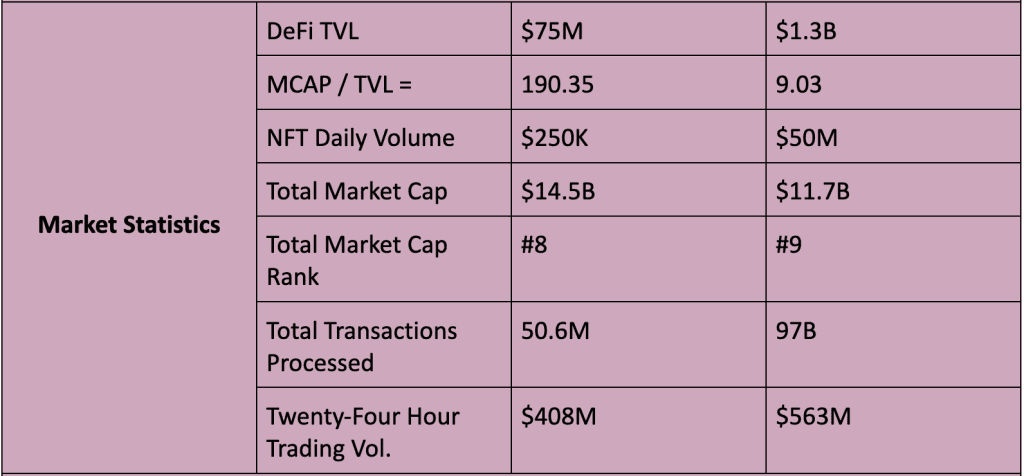

Cardano vs. Solana: Product Statistics

Cardano and Solana both support NFTs, DeFi marketplaces, decentralized exchanges, gaming, metaverse, and payment dApps.

However, data indicates that Solana’s ecosystem is much more developed than that of Cardano. MCAP / TVL is a useful formula to determine practical use of an ecosystem. The lower the number, the better. Cardano’s is 190 and Solana’s is 9. Thus, Solana’s economic utilization is roughly 21X that of Cardano.

Cardano Product Statistics

- NFT Marketplaces: Current daily USD volume averaging $250K.

- DeFi, Lending, and DEXs: Market cap of $75M locked across 12 projects.

- Web3 Gaming: Cardano’s gaming ecosystem is in its infancy. User numbers are very low.

Solana Product Statistics

- NFT Marketplaces: Current daily USD volume averaging $50M.

- DeFi, Lending, and DEXs: Market cap of $1.3B locked across 83 projects.

- Web3 Gaming: Solana’s gaming ecosystem is better developed with more users.

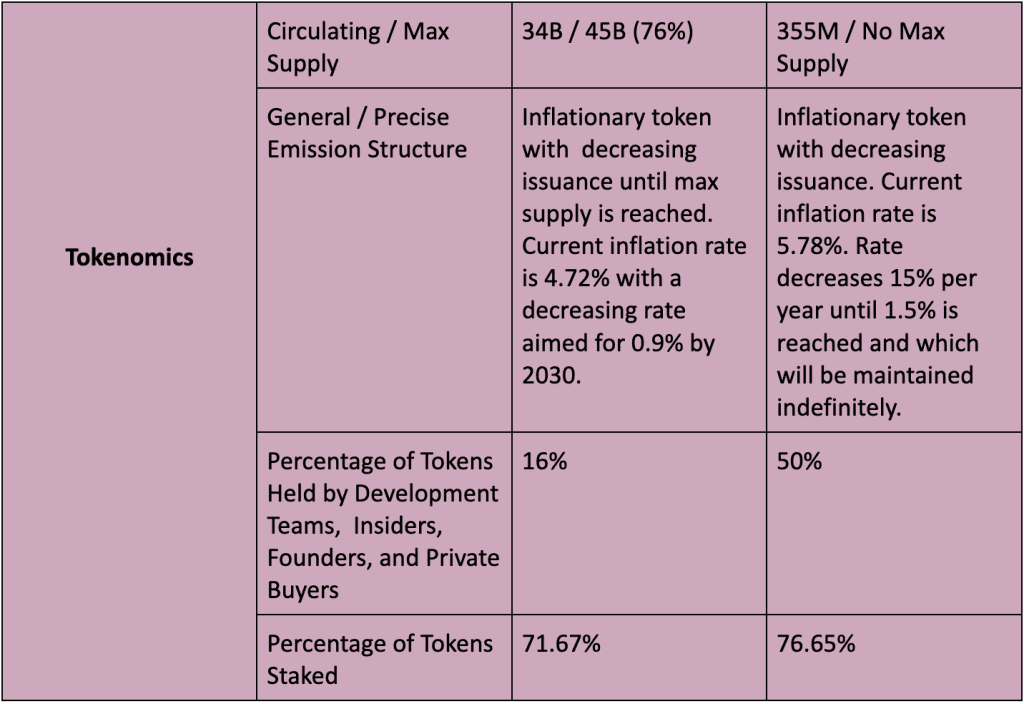

ADA and SOL: Tokenomics

ADA and SOL are the native tokens for Cardano and Solana, respectively. Both are used for transactions, network fees, staking, and governance. However, both differ significantly in terms of tokenomics, and initial and current token distributions. Data indicates that Cardano’s ADA has a more favorable tokenomic and distribution setup for retail investors.

ADA Tokenomics

- Max supply of 45B tokens. 34B (76%) are in circulation.

- ADA is an inflationary token with decreasing issuance over time. The current inflation rate is approximately 4.72%. The rate is estimated to be 0.9% by 2030.

- Approximately 71% of ADA tokens are staked.

- Initial coin distribution occurred from 2015 to 2017. The vast majority of coins (25.9B out of 31.1B) were sold through a public token sale.

- 79.7% of ADA is held by investors. 16% is held by Cardano’s founders and development teams.

SOL Tokenomics

- Current circulating supply of 352M. No fixed max supply.

- Inflationary token with decreasing issuance on a fixed schedule. Inflation rate is currently 5.78%. This rate decreases 15% per year until 1.5% is reached, which will then be maintained for the long-term.

- Approximately 76.65% of SOL are staked.

- Initial coin distribution occurred between 2019 and 2020. Four of the five sale rounds dealt exclusively with non-public buyers. An estimated 50% – 60% of the initial token distribution went to the development team, founders, insiders, and non-public purchasers.

- Currently, 50% of SOL is held by public buyers and the community reserve, while the other 50% is held by Solana’s founders, the development team, and private buyers.

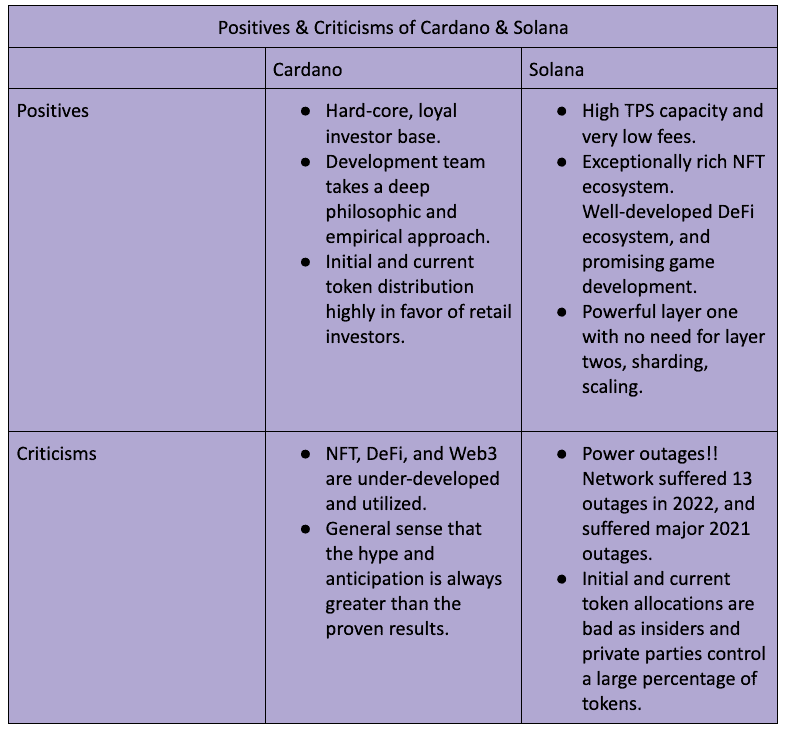

Cardano & Solana: Concluding Thoughts, Positives & Criticisms

Cardano and Solana are conceptual and developmental upgrades from Ethereum. Each introduced innovative technologies to the blockchain industry. Both chains have significant market share and many positives, but investors will want to know of the existing negatives with both projects.

Cardano’s achilles heel is its inability to garner significant practical use, despite its large market cap. This contradiction (extremely high MCAP / TVL) is a double-edged sword. Clearly, Cardano has a loyal fan-base, shown by its high market cap. But its low TVL shows that the chain has been unable to achieve wide-scale practical use. Only time will tell if Cardano will be able to facilitate more wide-scale practical use-cases.

Solana’s major problem is its system-wide power outages. The system has suffered 13 outages in 2022. The latest occurred October 1st, when the network went offline for six hours due to one single misconfigured node. While the network prides itself on being a powerful single global state, one cannot help but wonder if this architecture is exposed to certain technical vulnerabilities, given the prevalence of outages over the past two years.

Trending Coins This Week by Rebecca

Here are my key takeaways from the trends this week, and there’s been a bit of everything – hacks, acquisitions, launches, updates, and development.

1 – Battle Infinity is a play-to-earn (P2E) gaming ecosystem that launched staking in September and already has $4M in total value locked (TVL). With up to 25% APY available, investors are jumping in.

2 – Quant Network aims to be the first OS built for blockchains. QNT is up 20% this past week due to the upcoming Sibos conference, bringing together global financial services. There have already been talks that Quant can help with the development of CBDCs.

3 – Crypto Legions is a P2E NFT game that’s launched Version 3 of its gameplay a day after releasing its token.

4 – Terra Luna Classic (LUNC) is the original version of the Terra blockchain that’s trying to get listed on Coinbase. There have been over 200,000 tweets supporting a LUNC listing on Coinbase, and the Luna team has got billboards in Times Square to help with the mission.

5 – Reserve Rights is a dual token stablecoin platform on Ethereum that’s launched its full protocol. At the launch party, the team announced it’s also partnered with privacy-focused crypto payments firm MobileCoin, and launched a new stablecoin dubbed, eUSD.

6 – Huobi is a crypto exchange that’s set to be acquired by Hong Kong-based investment company About Capital Management. There are rumors that the real investors behind the deal are Tron founder, Justin Sun, and FTX CEO, Sam Bankman-Fried.

7 – Evmos is an EVM on the Cosmos network that’s launched support for multi-sig accounts and DIA’s multi-randomness, allowing developers to test DeFI, NFT, and GameFi use cases. The team is also currently judging its hackathon entries.

8 – GMX is a derivatives exchange on Arbitrum that’s announced its listing on Binance, allowing users to trade it against BTC, BUSD, and USDT. Binance has also added GMX to Binance Convert so it can be traded against over 350 tokens. GO PREMIUM to read our DeFi tutorial on how to earn 31% ARP on GMX with stablecoins.

9 – Optimism is an L2 Ethereum scaling solution that’s seen Lido Finance roll out support to Ethereum Layer 2’s. Optimism has also fully decommissioned its Kovan testnet to mark Goerli as its sole testnet post-Ethereum Merge.

10 – Ethereum has received support from Coinbase on an upcoming improvement to the network called EIP 4844, to reduce the fees on Layer 2 rollups.

11 – BNB is the native coin for the Binance exchange. The BNB Smart Chain has resumed its operations after a $566M bridge exploit that saw the hacker get away with $110M. Binance, just like FTX, reportedly still has $1B to spend on acquisitions this year.

12 – NEAR Protocol is an L1 network that’s announced a new partnership with Google Cloud, to provide infrastructure for its Web3 start-up platform, Pagoda.

13 – Gala is a play-to-earn (P2E) gaming ecosystem that’s announced a collaboration with Universal Games to bring the Dreamworks Trolls franchise into its Voxverse metaverse. The partnership will include an NFT collection of 8,888 Trolls.

14 – Bitcoin mining difficulty hits a new all-time high after its latest adjustment and is up by 13%. Mt. Gox has released its timeline for Bitcoin repayment and now has plans to release 137,000 BTC on January 10, 2023.

15 – Unizen is an operating system for cross-chain-enabled exchange applications. Unizen’s Trade aggregator V1 is now live supporting 60 DEXs across 7 blockchains, as well as supporting trade splitting across liquidity pools.Follow Rebecca on Twitter and Instagram.

Final Notes

Thank you so much for your support, and I truly hope that today’s issue will give you insights needed to help you master your wealth.

If you are reading this it means you are on the free version of the Wealth Mastery Investor Report, which is great for news and tips on the crypto markets.

If you really want to take advantage of fastest growing asset class EVER, I highly recommend you join us in the Premium Investor Report.

You’ll immediately get access to:

- Deep dive Altcoin report & The Trending Coin Report

- Technical Analysis on the crypto large caps and overall market

- Token sales, Airdrops and DeFi Tutorials

- Updates on the NFT Ecosystem and new mints

- My Investment Portfolio Updates

See you next time!

Lark and the Wealth Mastery Team

Legal Disclaimer

TCL Publishing ltd (director Lark Davis, owner of Wealth Mastery) is not providing you individually tailored investment advice. Nor is TCL Publishing registered to provide investment advice, is not a financial adviser, and is not a broker-dealer. The material provided is for educational purposes only. TCL Publishing is not responsible for any gains or losses that result from your cryptocurrency investments. Investing in cryptocurrency involves a high degree of risk and should be considered only by persons who can afford to sustain a loss of their entire investment. Investors should consult their financial adviser before investing in cryptocurrency.