Solana vs Elrond (eGLD)

Solana vs Elrond! Two popular cryptocurrency blockchains competing to become the primary Web3 blockchain commerce ecosystem of the future. This article will give a comparison overview of each, offer helpful data for potential investors, stakers, and validators, and propose high-level positives and criticisms of each project. Let’s go!

What are Elrond and Solana

Elrond and Solana are both decentralized, proof of stake (POS), layer one blockchain protocols. Both support DeFi, NFT marketplaces, decentralized exchanges (DEXs), gaming, metaverse and payment dApps. Both are competing to become the primary Web3 blockchain commerce ecosystem of the future with high scaling, fast transactions, and low fees.

- Elrond hopes to be “the Internet Scale Blockchain”. The technological centerpieces are a “secure proof of stake” consensus mechanism (SPOS) and scaling via adaptive state sharding. Elrond’s native token is EGLD. Elrond was created in 2017 by Beniamin and Lucian Mincu. The protocol was publicly launched in 2019. The Elrond Network is a private company that supports the network’s development and is staffed by the founders along with another 23 technology and business professionals.

- The Solana protocol is considered one of the most technically advanced in the industry due to its hybrid POS and proof of history (POH) consensus mechanism. Solana was created in 2017 by Anatoly Yakavenko. Its official Mainnet launch occurred in early 2020. Currently, the Solana Foundation supports the protocol’s open-sourced infrastructure and development. This foundation is composed of multiple Silicon Valley technology leaders and experts.

How do Elrond and Solana Work

Both Elrond and Solana utilize a mix of technologies to achieve relatively high scaling, fast transactions, and low fees. However, they each deploy different types of technologies to achieve their intended effects. Let’s look at the details.

Elrond

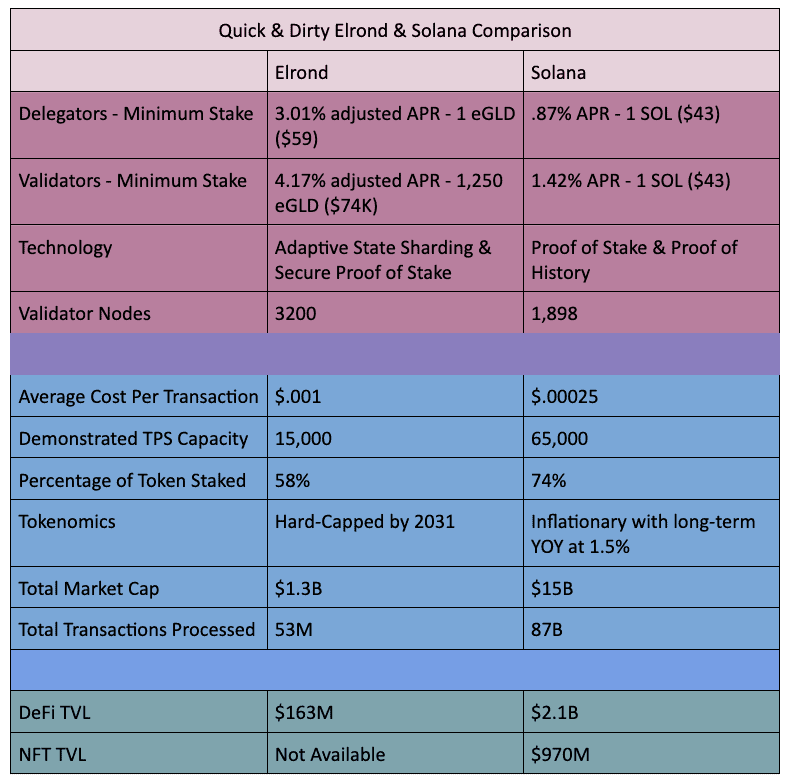

- Elrond utilizes adaptive state sharding for increased scaling and a SPOS consensus for speed and security. These two technologies work in tandem and have resulted in Elrond currently achieving a 15,000 transactions per second (TPS) capacity with an average cost of $.001 per transaction.

- Adaptive State Sharding: Allows Elrond to scale because the blockchain silos key processes (accounts, smart contracts, etc.) into separate “shards”. Separating the workload reduces latency, which allows the blockchain to take on more work.

- The SPOS consensus mechanism works like a traditional POS mechanism (e.g. they both select staked validators to propose new blocks to the blockchain), but with a few differences. First, the SPOS system assigns validators to work specific shards. Second, the system uses a special algorithm that randomly selects validators in each shard to propose that shard’s block. And third, SPOS then securely merges these separate shard blocks back together into one common blockchain ledger. Elrond currently hosts 3200 active validators.

Solana

- Solana utilizes a hybrid POS and POH consensus mechanism. Please see here for an in-depth analysis concerning consensus mechanisms, POS, and POH. This hybrid system seems to be producing its intended effect because Solana currently has a 50,000 TPS capacity with an average $.00025 transaction cost.

- Proof of Stake: Solana implements a fairly standard POS. Solana’s 1,895 validators are randomly selected to propose the next block. A validator’s chances of being selected are proportional to the amount of SOL staked. The other validators either accept or reject the proposed block; and if verified, the chosen validator receives a reward. Delegators (anyone who holds SOL) are free to stake with any validator they like. Read about how to stake Solana here.

- Proof of History: Solana produces fast transactions because POH allows validators to efficiently and quickly verify the proper ordering of transactions with each other. Every validator runs a “cryptographic clock” that runs in unison with every other cryptographic clock on the network. These clocks are synchronized because every validator must commit only one CPU to run the SHA-256 algorithm continually to keep time.

- Single Global State: Solana’s hybrid approach creates a blockchain with no need for additional layer two or sharding solutions. Solana states that this single global state creates efficient and seamless communication across the blockchain with no fragmentation.

Other ways of using Solana: How To Use Solana – The Full Guide

Solana vs Elrond – Products

Both Elrond and Solana support NFT and DeFi marketplaces, decentralized exchanges, gaming, metaverse, and payment dApps. However, the development rates between the two are drastically different.

Elrond

- NFT Marketplaces: Total of 223K NFTs minted and available for trading across 7 marketplaces.

- DeFi and Lending: Market cap of $163M locked on 1 DeFi project, the Maiar Exchange.

- Decentralized Exchanges: Maiar Exchange is the major DEX in the ecosystem. Although there may be more.

- Metaverse dApps: Collaboration with Netvrk to develop Elrond’s metaverse ecosystem. High anticipation for release of Metaverse game Cantina Royal.

Solana

- NFT Marketplaces: Market cap of $970M, 5.7M NFTs, with a $1.5 average mint cost.

- DeFi and Lending: Market cap of $2.1B locked across 73 DeFi projects, with an $.18 average transaction fee.

- Decentralized Exchanges: Solana currently hosts multiple decentralized exchanges including Solanium, ALF Protocol, and Enrex.

- Web3 Gaming: Solana has a growing Web3 gaming portfolio that currently includes Star Atlas, Aurory, and Panzerdogs.

eGLD and SOL Tokens and Tokenomics

eGLD and SOL are the native tokens for Elrond and Solana, respectively. Both are used for transactions, paying for network fees, staking, validator and staking rewards, and governance. However, there are some differences with concerns to adoption and tokenomics.

eGLD

- Ranked #44 in market cap at $1.3B.

- Intended as more of an electronic store of value. Hence the name. So, the token is designed to have a relatively tight max supply with a current circulating supply of 22.9M eGLD, and a total max supply capped at 31.4M. That max supply will be reached in 2031. The newly minted coins are released into the ecosystem via validator and staker rewards.

SOL

- Ranked #9 in market cap at $15B.

- Inflationary token with no fixed max supply. Current circulating supply of 345M. Although no max supply, SOL’s inflation rate operates on a fixed schedule. As of late 2020, SOL’s inflation rate is 8% annually, decreasing by 15% every year, until SOL hits a 1.5% inflation per year, which it will maintain for the long term. The newly minted SOL are dispersed into the ecosystem via staking rewards to validators, delegators, and general stakers.

Final Thoughts

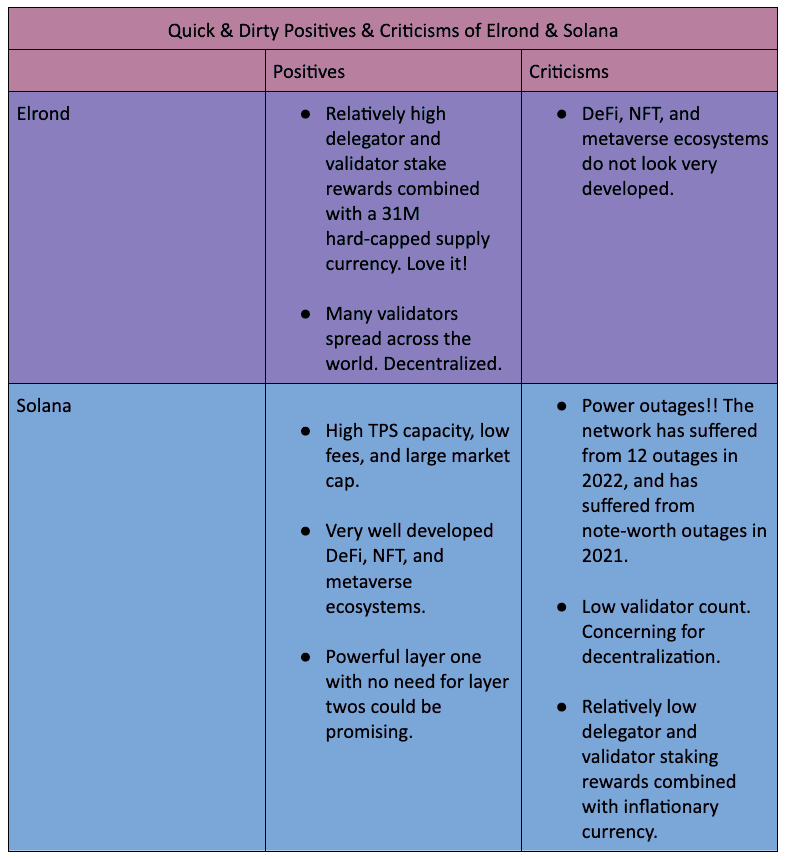

Both Elrond and Solana are vying to become the premier blockchain commerce ecosystem of the internet. Both prioritize scaling, fast transactions, and low fees. However, each utilizes different technologies, has relatively different performance statistics, and has different positives and criticisms.

Elrond has an excellent development team and great tokenomics. But so far, its ecosystem seems to be underdeveloped. Solana’s performance statistics are through the roof, and it boasts a very rich metaverse ecosystem. However, system-wide outages over the past two years have cast genuine doubt over the soundness of its technology and ability to scale.

Solana is currently in the lead, but only time will tell which one might achieve global dominance.

This might interest you too

Are you comparing Solana with other blockchains? Check out our review on Polygon vs Solana!

Responses