Polygon vs Solana: Economic Blockchains of Tomorrow (2022 Review)

Bitcoin is the gold 2.0 digital store of value, but it’s the other Layer-1 protocols (and Layer-2s built on top) that will facilitate the vast majority of tomorrow’s digital economic transactions.

And concerning these L1s and L2s, the future is likely multi-chain. Various use-cases and economies will develop within a select basket of protocols. Savvy investors will benefit by performing due-diligence on the protocols best positioned to become the powerhouse economic chains of tomorrow.

This article will be exploring two such contenders: Polygon vs Solana. Below, investors, stakers, and validators will find helpful comparison perspectives, data, and high-level positives and criticisms of both projects. So LFG!

What Are Polygon and Solana

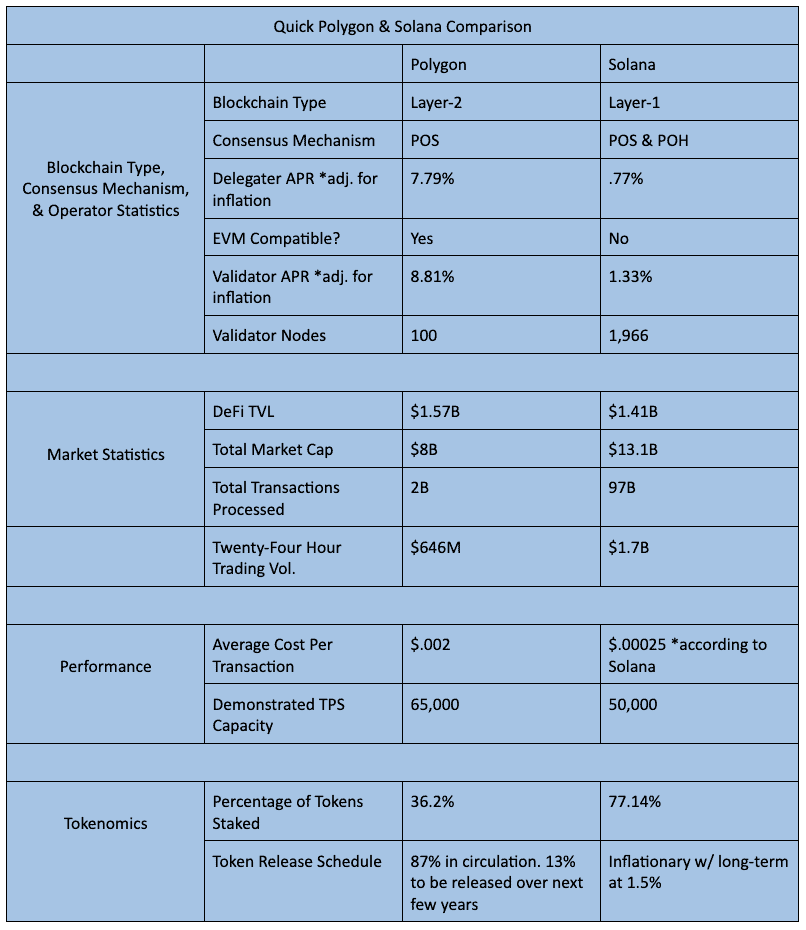

Polygon and Solana are both decentralized, proof-of-stake (POS) blockchain networks. Both support diverse economic ecosystems. Both are in the top 12 crypto projects by market cap and provide users with fast transactions and low fees. However, there are major conceptual and technical differences between the two.

- Polygon is a decentralized, POS, L2 multi-blockchain network for Ethereum. Polygon has a POS main-chain, but it also has a software framework that allows third-party developers to create new L2 chains that work with its main-chain and Ethereum chain. Polygon’s core mission is to bolster Ethereum by reducing the latter’s gas fees and increasing its transaction output. Polygon is EVM compatible, and its native token is MATIC.

- Solana is a decentralized, hybrid POS and proof of history (POH), L1 blockchain protocol. Solana is considered one of the most technically advanced in the industry due to this hybrid nature. Solana has a single global state – meaning there is only one working blockchain – with no need for additional scaling solutions or sharding. Solana was engineered to dramatically improve transaction output and fees over other POS competitors. Solana’s native token is SOL.

How Do Polygon and Solana Work

Polygon and Solana use differing macro-schemes and technologies to achieve diverse economic ecosystems, high scaling, low fees, and fast transactions. Let’s examine the details.

Polygon Technicals

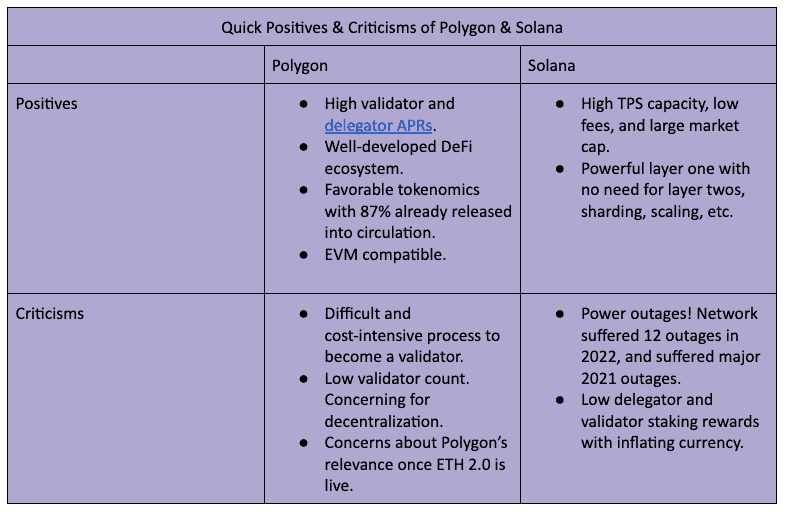

- As a POS, L2 multi-blockchain network, Polygon was built for the purpose of supporting Ethereum. With its high TPS and fees at a fraction of a penny, the system is clearly fulfilling its mission for Ethereum.

- Proof of Stake: Polygon’s main-chain uses a decentralized network of 100 permissionless POS validators to secure the network. With a set of staking management contracts deployed on Ethereum, anyone can stake MATIC on these contracts and join as a validator. However, one must currently stake approximately $20K of MATIC in order to become a top 100 validator. So entry is difficult. Validators are subject to rewards and slashing.

- Layer-2: L2s are built “on top” of the underlying L1 for the purpose of improving the latter’s scalability and efficiency. Polygon achieves lower gas fees and increased TPS for Ethereum by processing transactions on the Polygon chain, and then batching over in bulk the synthesized transaction data onto the Ethereum chain.

- Multi-Blockchain Network: The core of Polygon is the Polygon software development kit (SDK). The SDK allows third-party developers to create Ethereum-compatible side-chains and dApps that connect to Polygon’s main-chain and the larger Ethereum chain behind it. The amount of innovation happening with Polygon side chains is staggering. Polygon Edge (a particular software development kit iteration) is live. And multiple zk-rollups, optimistic rollups, and other scaling solutions are under development.

Solana Technicals

- Solana’s hybrid POS and POH consensus mechanism is what enables the protocol to achieve a 50,000 TPS capacity with average fees at $.00025 per transaction. See here for an in-depth technical analysis of this innovative consensus mechanism.

- Proof of Stake: Solana implements a fairly standard POS. Solana’s 1,966 validators are randomly selected to propose the next block. A validator’s chances of being selected are proportional to the amount of SOL staked. The other validators either accept or reject the proposed block; and if verified, the chosen validator receives a reward. Delegators (anyone who holds SOL) are free to stake with any validator they like.

- Proof of History: Solana produces fast transactions because POH allows validators to efficiently and quickly verify the proper ordering of transactions with each other. Every validator runs a “cryptographic clock” that runs in unison with every other cryptographic clock on the network. These clocks are synchronized because every validator must commit only one CPU to run the SHA-256 algorithm continually to keep time.

Interesting read: How To Use Solana | The Full Guide

- Single Global State: Solana’s hybrid approach creates a blockchain with no need for additional layer two or sharding solutions. Solana states that this single global state creates efficient and seamless communication across the blockchain with no fragmentation.

Polygon vs. Solana: Product Statistics

Polygon and Solana both support NFT and DeFi marketplaces, decentralized exchanges, gaming, metaverse, and payment dApps.

Polygon Product Statistics

- NFT Marketplaces: $287M in USD transactions since the beginning of 2022. Current daily USD transactions averaging at $200K. Polygon NFTs hosted on OpenSea.

- DeFi and Lending: Market cap of $1.57B locked across 302 DeFi projects, with fees ranging between $0.01 to $0.1. Polygon hosts the DeFi heavy-weights AAVE, Curve, and Uniswap.

- Decentralized Exchanges: $3.86B in USD volume over the past 30 days. Large selection of DEXs including Quickswap, Sushiswap, Firebird Finance, Polycat Finance, and Polydex.

- Web3 Gaming: Top three games with the highest user volume within the past 30 days are Benji Bananas (165K users), Sunflower Land (72K users), and Arc8 (68K users).

- EVM Compatibility: From a user experience perspective, Polygon benefits by being compatible with Ethereum, and thus having access (realized or potential) to Ethereum’s rich dApp ecosystem.

Solana Product Statistics

- NFT Marketplaces: Current daily USD transactions averaging between $50K to $150K. Solana NFTs hosted on OpenSea.

- DeFi and Lending: Market cap of $1.41B locked across 81 DeFi projects, with an $.18 average transaction fee.

- Decentralized Exchanges: Hosts multiple decentralized exchanges including Solanium, ALF Protocol, and Enrex.

- Web3 Gaming: Top three games with the highest user volume within the past 30 days are Gameta (164K users), Tap Fantasy (2K users), and Defi Land (585 users).

MATIC and SOL: Tokenomics

MATIC and SOL are the native tokens for Polygon and Solana, respectively. Both are used for transactions, network fees, staking, and governance.

MATIC Tokenomics

- Max supply of 10B tokens, all of which have technically been issued. 8.7B are currently in circulation, while the remaining 1.3B will be unlocked over the next few years via staking rewards.

- 36.2% of MATIC tokens are currently locked up in staking contracts.

SOL Tokenomics

- Inflationary token with no fixed max supply. Current circulating supply of 352M. Although no max supply, SOL’s inflation rate operates on a fixed schedule. As of late 2020, SOL’s inflation rate is 8% annually, decreasing by 15% every year, until SOL hits a 1.5% inflation per year, which it will maintain for the long term. The newly minted SOL are dispersed into the ecosystem via staking rewards to validators, delegators, and general stakers.

- 77.14% of SOL tokens are currently locked up in staking contracts.

Conclusion

Most signs indicate that both Polygon and Solana will have a bright future in the Cryptoverse. But each chain does have fundamentally different use cases: Polygon works to bolster Ethereum while Solana stands as its competitor. Both chains employ innovative (but different) technologies.

Polygon’s strongest positive is its EVM compatibility. This feature significantly opens Polygon’s use-case potential. Conversely, it’s not clear exactly how Polygon fits into the broader picture, assuming all goes well with ETH 2.0.

Solana’s strongest positive might be its single global state. This feature brings a refreshing simplicity to the project. But Solana’s biggest strike is its recurring power-outages. Each one takes a toll on Solana’s credibility and the token’s price. This is a must-fix for the project’s care-takers.

Responses