Synthetix vs UMA: TL;DR – Synthetix Wins (For Now)

This might be a first-ever when it comes to a crypto comparison article, but I’m going for it. When it comes to a heads-up comparison between two Ethereum-based, synthetic asset protocols – Synthetix and Uma – Synthetix is the winner. Things could change quickly, given the nature of crypto. But as of now, Synthetix has the action.

This article compares the Synthetix and UMA protocols, and their native tokens, in order to provide crypto investors an edge as to what technologies and economic opportunities are coming around the corner.

Let’s roll.

What are Synthetix and Uma

Synthetix and UMA are both decentralized protocols that allow users to mint and trade synthetic assets on Ethereum. These synthetic assets are technically ERC-20 tokens that are pegged to the price of real world assets. As the price of the real world assets fluctuate, so too does the value of the ERC-20 tokens. Thus, Synthetix and UMA both provide crypto-native investors an innovative way to trade and get exposure to traditional asset price action, without having to depart from their crypto-based infrastructure, payment rails, and dApps.

Within both protocols, the represented real world assets are never actually bought, held, or sold. Instead, both Synthetix and UMA require their synthetic assets to be sufficiently overcollateralized to ensure that holders can always redeem their synthetic assets for the current value of the represented real world assets.

Even though Synthetix and UMA are at different developmental stages, these protocols have the potential to be revolutionary. With this technology, anyone with an internet connection can get investment exposure to any tradable asset under the sun. If there is sufficient market demand for price exposure to a real world asset, users will gather the funds necessary to make a tradable market for that asset on the blockchain. In that sense, these DeFi protocols are attempting to bash in the doors to a traditionally restrictive and highly-regulated $540 trillion dollar derivatives market.

How do Synthetix and UMA Work

While both Synthetix and UMA are similar in that they both allow users to mint and trade synthetic assets on Ethereum, their foundational and technical aspects are very different. Let’s examine the details.

Protocol Design

- Synthetix: A smart contract protocol with its own developed dApps. Thus, users can easily access these dApps to mint, buy, or trade synthetic assets (called “synths”). The dApp Mintr is for minting. Kwenta is the premier decentralized exchange. Lyra is for options trading. Thales is for Parimutuels trading. Because these assets are ERC-20 tokens, developers can create their own dApps and integrate them on top of Synthetix’ functionality.

- UMA: Technically, UMA (Universal Market Access) is a smart contract builder and innovative oracle. Practically, it appears that UMA is more of an open infrastructure rails system that allows for the creation and price tracking of synthetic assets via smart contracts. At the time of this writing, it does not appear that UMA has its own native marketplace or decentralized exchange. Rather, it seems that UMA is depending on third-party developers to create user-interface dApps, while UMA focuses on building strong underlying synthetic asset infrastructure.

Purchasing Synthetic Assets

- Synthetix: (1) exchange ETH for sUSD on Kwenta; and (2) exchange sUSD for any synth available on any of the Ethereum-based platforms built on the Synthetix protocol. Top platforms include Kwenta (DEX), Lyra (Options), and Thales (Parimutuels).

- UMA: Minters determine the asset required to purchase an applicable synthetic asset. So theoretically, any ERC-20 token could be required to purchase any particular synthetic asset. UMA’s website is a good starting place for finding applicable market-places.

Minting Synthetic Assets

- Synthetix: Users can stake SNX (Synthetix native token) on Mintr (a Synthetix dApp that functions as a synth minting facility) in order to create synths. Users must stake and maintain a 600% collateral ratio for their synths. So into Mintr goes SNX, and out comes a fresh synth ERC-20 token.

- UMA: The resources available state that users should (1) typically supply ETH or DAI as collateral to UMA; (2) specify the contract terms, which typically includes identifying the underlying asset and specifying the contract expiration date; (3) minting the ERC-20 token; and (4) depositing the token to their preferred marketplace. At the time of this writing, it’s still not clear where in UMA one actually does this minting.

How are Synthetic Assets Collateralized

- Synthetix: Uses “pooled counterparty” economics to back their synths. Essentially, this means that Synthetix’ collective minter-base theoretically provides enough over-collateralization to the entire system so that any synth will be able to be redeemed for its current value. Thus, Synthetix provides greater back-stop security for any one synth at the expense of increasing the risk of a network-wide financial contagion.

- UMA: Uses contract-specific collateralization. In English, that means an UMA synthetic asset is only backed by the collateral that the minter staked to create it. Collateral from other synthetic assets cannot be tapped to back-stop the value of any other synthetic asset. Thus, UMA provides less back-stop security for any one synthetic asset in exchange for not exposing the entire network to possible financial contagion.

How are the Prices of Synthetic Assets Tracked

- Synthetix: Utilizes price feeds via Chainlink’s Price Reference Data. Thus, synth prices are completely dependent upon – and centrally exposed to – Chainlink.

- UMA: Removes third-party oracles from the equation entirely. Instead, UMA places responsibility for price accuracy onto its user-base, through a combination of collateralization, economic incentives, game theory, and a final dispute resolution process. UMA calls itself an optimistic oracle because – similar to optimistic rollups – the protocol only springs into action in the rare event that someone disputes a synthetic asset liquidation. UMA claims this process to be a more dependable method for securing correct price feeds as compared to using third-party oracles. UMA further claims that this method allows for the creation of any synthetic asset under the sun, so long as there is available price data for a real asset in the real world.

Governance

- Synthetix: Synthetix has dissolved its non-profit foundation, which was formally in charge of operating the protocol. In its place, three DAOs were established to resume control and operations. The SynthetixDAO manages funding to core contributors. The Grants DAO manages funding to Synthetix ecosystem partners. And the ProtocolDAO handles maintenance and upgrades for the protocol, user-interface, and related dApps.

- UMA: It appears that UMA operates with a core contributing team in conjunction with the UMA DAO and the SuperUMAn DAO. Stakeholders use UMA Improvement Proposals (UMIPs) to propose changes to the protocol, which are then voted on with UMA’s native token (UMA). The SuperUMAn DAO is in charge of UMA’s broader marketing campaign.

Product Offerings and Accessibility

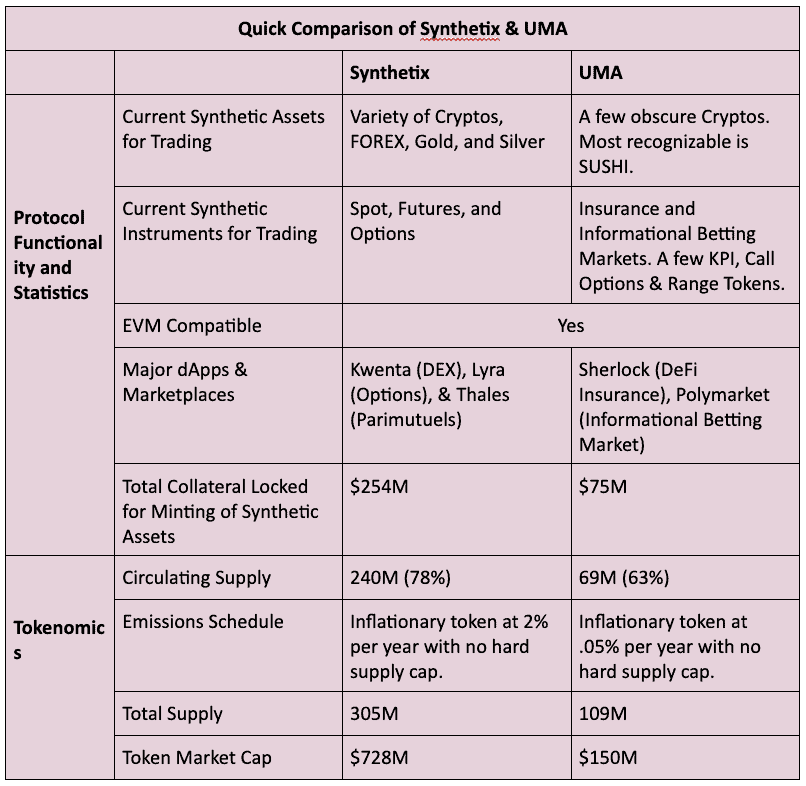

The difference between the two protocols with regards to product offerings and accessibility is striking. Given Synthetix’ total collateral locked is $254M, compared to UMA’s $75M, you can probably infer the difference.

Synthetix’ offerings are as advertised. Current synths for trading include a variety of cryptos, FOREX currencies, gold, and silver. These synths can be traded with spot, options, and futures instruments. All of these trades can occur on Synthetix flagship dApps Kwenta, Lyra, and Thales. Minting is done on Mintr. Easy-peezy.

For as much ink has been spilled writing about UMA, its product offerings and accessibility are disappointing. In terms of product offerings, there isn’t much. UMA’s main products currently are DeFi Insurance (operating on the Sherlock dApp), and an informational betting market (operating on the Polymarket dApp). Other than that, traders can get exposure to just a few very obscure crypto options and range tokens off UMA’s product website. It’s not clear how users mint synthetic assets. So accessibility is weird. The screenshot below appears to summarize all of UMA’s product offerings at this time. Yikes!

Tokenomics

Here’s a look at the tokenomics of each protocols’ native tokens.

Synthetix

SNX is used to provide the necessary collateral in order to mint synthetic assets. SNX holders are economically incentivized to create synths because they receive inflationary rewards and trading fees on their created synths.

There have been multiple changes with concerns to SNX’ supply limit and emissions schedule over the years. But currently, it appears that SNX is an inflationary currency at 2% per year with no hard supply cap. However, the founder of Synthetix, Kain Warwick, published a proposal to the ProtocolDAO in August of 2022, which would cap SNX supply at 300 million tokens. The current status of the proposal is as a “draft” with the release TBD.

The first 100M SNX were released in 2018, with an allocation as follows:

- 60% allocated to public investors

- 20% allocated to core contribution team

- 12% allocated to the foundation

- 5% reserved for partnership incentives

- 3% reserved for bounties and marketing incentives

UMA

UMA is used for two purposes. First, UMA token holders spend UMA as votes whenever contracts are disputed (this is integral to the process of how the prices of UMA synthetic assets are tracked). Those who vote correctly are rewarded more UMA. Second, UMA holders can spend UMA as votes with concerns to issues proposed in UMA’s UMIP process.

UMA’s 1M tokens were released in early 2020. However, the UMA protocol pays inflationary rewards to UMA users who respond to price requests and win disputes. Thus, the inflation rate is estimated to be at .05% per year.

UMA’s initial token distribution was as follows:

- 35M tokens are planned to be distributed to developers and UMA users.

- 33.5M tokens are held by the core development team.

- 15M tokens are allocated to investors.

- 14.5M tokens are reserved for future token sales.

- 2M tokens were deposited into a Uniswap liquidity pool.

Conclusion

Both Synthetix and UMA are Ethereum-based protocols that allow users to mint and trade synthetic assets on the blockchain. Essentially, Synthetix and UMA are creating permissionless, decentralized derivatives markets on the blockchain. Given the traditional derivative market is the world’s largest, it’s hard to overstate how revolutionary protocols like this could be to the global financial system.

UMA is a really interesting project. In a way, it’s analogous to a layer-0 blockchain network. UMA’s focus seems to be on developing high-quality synthetic asset infrastructure rails, so that other third-party developers can build consumer-facing dApps and products. UMA’s user-based price oracle system also seems like an interesting idea.

Having said that, when it comes to Synthetix versus UMA, Synthetix is the current winner. Synthetix has a broad menu of synths that can be traded across multiple types of instruments. Accessibility is easy. UMA and its third-party partners just don’t have the synthetic assets or accessibility …. yet.

The blockchain synthetic asset space has enormous potential. Investors would be wise to keep their eyes on these two protocols moving forward.