Where Does the Contempt for Crypto Stem from?

TL;DR

Why do so many ‘normies’ have a contempt for crypto? I have explored some motivations, ranging from conflicting interests to a distaste for the casino aspect of crypto. The undercurrent beneath many objections seems to be a disagreement about how much the traditional financial system can be trusted. Critics of crypto have more trust in the current system and think that crypto could undermine it, which they don’t like.

Renowned economist Nouriel Roubini called Bitcoin the ‘mother of all bubbles.’

Jamie Dimon, CEO of JP Morgan, agreed and called it it worse than the tulip bulbs, referring to the 17th-century Dutch tulip mania.

Jack Bogle, the late founder of Vanguard advised investors to ‘avoid Bitcoin like the plague’.

Of course, we reserve a special mention for the colorful derogatory term Warren Buffett’ used, his infamous ‘Rat poison squared’.

The Spectrum from Mild Contempt to Vitriol

Of course, the vitriol is loudest in the depths of a bear market. ‘The apparent stabilisation of bitcoin’s value is likely to be an artificially induced last gasp before the crypto-asset embarks on a road to irrelevance.’ As could be read in a column by European Central Bank employees. To which Dutch Financial Times journalist Joost van Kuppeveld added: ‘and we won’t give it a proper burial but will let it rot’.

While such a comment may be an outlier, you might recognize it as a more extreme version of the kind of response you would have experienced with friends, family or your hairdresser. They no doubt have expressed it in a less vitriolic way, in a mumbled ‘Oh dear’ maybe, or a smirk. In the depths of the bear market, it might have taken the form of a gentle ‘I told you so – but you can still be redeemed. Just sell the orange coin and return to our circle of normies.’

No, thank you. But this all still leaves us wondering, where does this contempt spring from? Let’s try to come up with a few reasons.

1. Conflicting Interests

In the early 20th century, automobiles were ridiculed and even actively opposed by the incumbent horse industry. This ad shows scaremongering by a horse carriage company.

It’s no big surprise that a central banker won’t be first in line to support a newcomer who disrupts the industry’s raison d’etre. Maybe this explains why a person such as Alex de Vries, employed by the Dutch National Bank, is such a fervent anti-crypto publicist, going as far as quoting dubious research about Bitcoin’s environmental impact.

True, but still. There are plenty of Bitcoin and crypto critics who aren’t employed by incumbents and still are violently opposed to it.

So, let’s dig a bit more for other explanations.

2. Obnoxious Behavior by Bitcoin Maxis

Not every Bitcoiner is as mild as Satoshi who once sighed on Bitcoin Talk email forum in 2010: ‘If you don’t believe me or don’t get it, I don’t have time to try to convince you, sorry.’

Unlike gentle soul Satoshi, a certain brand of Bitcoin Maximalists can be very annoying with their lines such as ‘Have fun being poor’, and ‘Cry harder’. A subset of Bitcoiners subscribes to an extreme version of libertarianism, where the role of the government is minimal or even non-existent. While defendable, it’s an extreme view that won’t garner support among large swaths of the population.

Seeing other people getting richer while being mocked hardly wins over crypto skeptics. It doesn’t require a degree in psychology to suspect that people will dig in their heels and shout back harder, crying salty tears when the price moons, and rubbing salt in the wounds after the BTC price tanks. It’s just quite childish behavior from both sides, to be honest.

Of course, if you’re in crypto longer than a few days, you know that this animosity and tribalism doesn’t only exist between crypto land and fiat land. It also exists between different projects within crypto. The tribalism, the insults, the jabs, they can be quite nasty. Bitcoin maxi’s think their ‘immaculately conceived’ chain issues the only real money and the other chains only deal in shitcoins. Sad.

3. Guilty by Association with the ‘Casino’ and Pumps and Dumps

From the outside, it could appear as if all crypto owners are Lambo flashing man-childs. After all, the people who not only made money but flaunt it, dominate the timelines. You don’t see the modest ones.

Then there are the scams and semi-scams of new projects being launched with promotors cashing out. A lot of people might have a negative view of Bitcoin because they see these practices. Not knowing, of course, that Bitcoin was founded in a different way – and a lot of its successors had noble ambitions as well, even if they weren’t as ‘pure’ in their intentions.

This unfortunate heightened visibility of the Lambo’s ties in with Chris Dixon’s view, in his book Read Write Own. He argues that blockchain technology should be viewed as a new type of computer that allows for the construction of a type of internet that is fairer to users and creators. The profits not just flow to the big social media companies, but to creators as well. Tokens are the tool that mediates this. But, sadly, tokens are mostly associated with the rags and riches, the easy price gains and disastrous crashes, the Lambo’s and the jail time.

But, argues Dixon, just as with previous new technologies that went to market, such as the internet in the late 1990s, in crypto you have speculators but there are also builders.

“One group, which I call the casino, is often the much louder of the two, and it is primarily interested in trading and speculation. […] The other group, which I call the computer, is the far more serious of the two, and it is motivated by a long-term vision […]”

Fortunately, skeptics who take a bit of time to do the research will notice this. Finance blogger Quoth the Raven had a recent coming out where he explained why he is a new convert: Why I Bitcoin. He started looking into Bitcoin in earnest after years witnessing colleagues such as Lyn Alden talk highly about it. He realizes it’s not just a software application but more like a new internet, the internet of money.

Quoth the Raven:

“I think there are a lot of people out there, like me, that are just looking to diversify their way out of a broken fiat system. […] It’s a really big idea — and my brain is really small — which is why it has taken me this long to wrap my head around it. But, as they say, “once you see it, you can’t unsee it”.

Crypto is indeed a ‘really big idea’ and wrapping your head around this is hard. It doesn’t suit everyone’s temperament to be pulled into a new paradigm. And the first major roadblock obscuring that new paradigm and distracting from it, are the pumps and dumps and Lambo’s. It’s as if the truth is hidden from view by a huge circus (in this sense it’s not unlike a lot of religions, where you will find a lot of symbolism and seemingly nonsensical behavior covering the religious dogmas).

Trust in the Current System

I believe a central but often unspoken attitude underlies many sorts of resistance against Bitcoin/crypto. And that is the belief by many that the current system isn’t so bad. Why would we want to subvert that?

The attitude could be described as follows: ‘We must give the government a major role in organizing our lives, to uplift the poor and to fight crime.’

This trust in Western democracies might often be sort of justified. If you’re a middle-class homeowner in let’s say The Netherlands, with a government-subsidized mortgage, why complain? The system has treated you kindly.

I’m reminded of an article by Jesse Myers, Why the yuppie elite dismiss bitcoin. He starts out with a similar question as this article’s.

‘My other friend groups have largely heeded my vociferous and fervent testimony that Bitcoin is the most important asset of the 21st century. Yet my elite MBA friends cling to dismissiveness that borders on outright hostility. Why?’

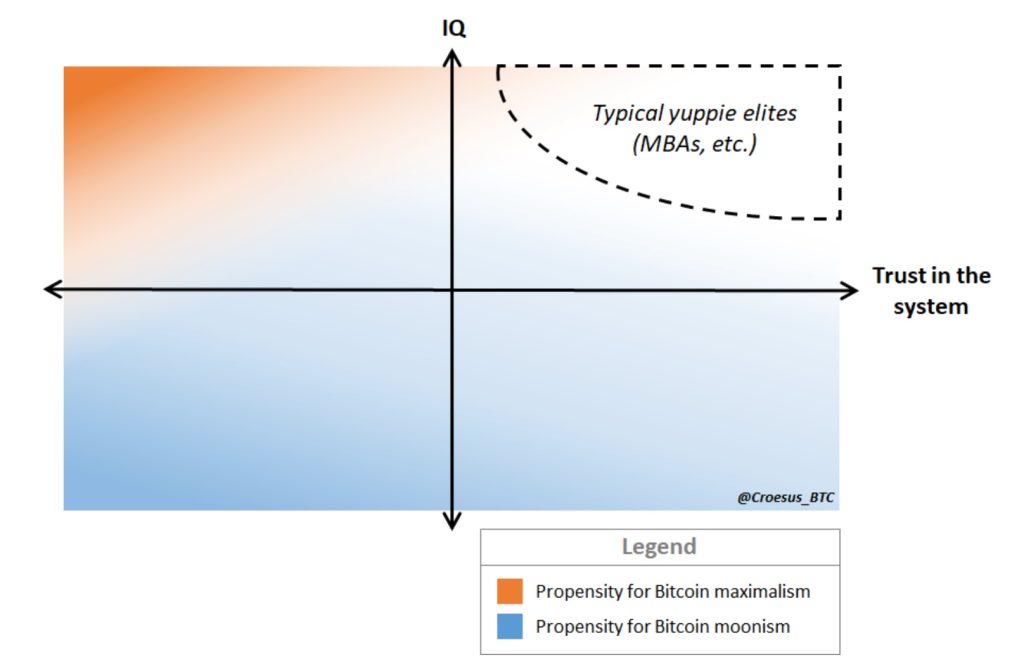

Myers comes to the conclusion that there is a deep divide between Bitcoin maxi’s and yuppies: the degree to which a person has trust in the system.

The MBA graduates, the ‘yuppies’ of today are spoon-fed a ‘shoddy propaganda version of monetary theory as a result of the largely successful ideological extermination of sound monetary theory.’

To sum this central bank-led monetary system up: everyone who has had a position close to the central bank money printer in recent decades, has experienced outsized financial benefits. Their asset prices have gone up, up, up. Why even question a system that has been so good to you?

Below is Myers’ graph in which he wants to sketch that IQ isn’t the determining factor. Very smart people can still oppose Bitcoin, precisely because they trust the system so much. “Whaddayamean ‘Our money is broken?’ Doesn’t the government have our best interests at heart? It sure had my best interest at heart…”

The ‘yuppie elite’ see Bitcoin as anti-social, undermining the collective. Isn’t crypto only known for defrauding consumers with boiler room fraud-type schemes, attacking companies with ransomware, and financing terrorists?

Of course, these arguments aren’t solid (these things happen in crypto, but they happen in every sector of finance since the dawn of time – but it’s for another article to debunk these allegations in detail…)

Myers’ argument is related to the above-mentioned Conflict-of-interests argument. But it runs deeper, according to Myers.

‘The lack of belief in Bitcoin among the yuppie elite combined with the significant interest in Bitcoin among non-yuppies triggers a clear pattern-recognition response: Bitcoin is for people not in the know.’ To put it a bit less polite: the yuppies are too full of themselves to realize they might be wrong. Maybe the same could be said about Bitcoin maxi’s – but they at least put in the research. They don’t just trust the system, as they have verified for themselves how monetary history has spawned different systems.

Conclusion

We haven’t even touched on some anti-Bitcoin arguments, such as that it is bad for the environment. But the most important source of the distrust of crypto seems to stem from a trust in the financial system that crypto wants to be an alternative to. People don’t want the status quo to be undermined. Even though the status quo isn’t perfect, many people prefer it to the uncertainty that the change introduced by a groundbreaking technology will bring. The gut reaction is: ‘We are doing quite well with our (financial) institutions. And while the existing system may not be perfect, we are anxious for the technological change that is coming through AI and crypto. So, let’s keep it the same, it’s safe. Let’s get rid of crypto.’