EigenLayer: Restaked Ether Allows Anyone to Tap Into Ethereum’s Security

TL;DR

EigenLayer enables any new protocol or application, regardless of whether it’s Ethereum-compatible, to tap into the pooled security of Ethereum’s stakers. This creates an environment that encourages bootstrapping new applications. Also, it allows Ether stakers to gain some juicy yield on the side. But stakers spreading their tentacles outside the Ethereum ecosystem doesn’t come without risks…

Imagine you’re a billionaire and just bought an island. You want to establish a nation on it. The first pressing question you will be faced with is: how to protect that island from invaders? You could either fund and train an army or… become friends with a superpower like the United States.

Now picture trying to build a new decentralized app. Instead of funding your security budget… you could become friends with… Ethereum. That’s what EigenLayer makes possible. A bit like the United States Navy can use the same vessel to protect both its shore and a friendly neighboring island nation, so Ethereum stakers can choose to stake their Ether a second time to a network they want to support. The same stake to secure the Ethereum network can be re-used to secure other networks. EigenLayer is the tech that intermediates.

What is EigenLayer?

EigenLayer is not to be confused with Layer 2 but is more akin to liquid staking. It is a series of smart contracts which interact with staking. You can stake in Ethereum and then also specify to the EigenLayer contracts that you allow your ETH to be staked a second time – and third, and fourth, and… as many times as there are applications that invite you. This allows you to reap some extra staking rewards. You get paid for the opportunity to validate other chains/networks. Of course, this also makes you vulnerable to a second round of slashing. No extra rewards without extra risks.

In practice, it means EigenLayer essentially adds one more step to your staked ETH withdrawal flow. So instead of directly going into your wallet upon withdrawal, your staked ETH is going to a contract that is partly controlled by you and partly has the slashing power given to it by the EigenLayer contracts.

EigenLayer as a New Marketplace for Decentralized Trust

In a similar way to how MEV created a new market (making money from arbitraging the Ethereum mempool) EigenLayer will create a ‘marketplace for decentralized trust’, in the words of Sreeram Kannan, founder of EigenLayer.

Taking a step back to understand what this means, let’s ask ourselves: what is it that Ethereum (or any other blockchain) sells? When you pay gas fees, what do you pay for? To get a transaction through. In other words, you pay to be included in a block. You compete to be included in a block. So, the product shipped by a blockchain is blockspace.

Considering that ‘storage fees’ for Ethereum blocks are orders of magnitude higher than for conventional databases, why do people pay so much for Ethereum storage space? Because they value the decentralized, non-censorable nature of this special type of storage space.

But, argues the founder of EigenLayer, decentralized trust can be supplied in a much more ‘raw’ form. What builders of new apps and protocols might desire, is not necessarily blockspace, but the foundation that secures this blockspace: the trust that their apps are tied to a decentralized system. Imagine a new protocol that provides censorship-resistant identity. Or new bridges, or new data storage protocols. They could all use some of this security. In the same way that these days, conventional apps rely on cloud services for storage. They outsource this aspect of their operation.

By tying its fate to the battle-tested Ethereum consensus, a new app or protocol can bootstrap itself. It can tap into Ethereum’s network effect, its robust decentralization. Quite literally, actually. A new protocol could for example ‘order’ only home stakers to participate, and not the institutional stakers, ordering as it were a decentralized de-luxe product.

So, any chain or organization can tap into this new supply of decentralized trust that isn’t blockspace. In other words, the ‘commodity’, provided by protocols like EigenLayer that make restaking possible is Ethereum’s raw, decentralized trust. Compare it once more to the new island nation. It doesn’t want to buy a plot of land in the US, it wants the protection that secures such a plot of land within or outside of the US. It wants the navy, not the land.

Pandora’s Box?

The idea that security can be applied flexibly outside Ethereum is… kind of wild. But first of all: can it be applied flexibly? Stakers/validators of Ethereum are the army for the Ethereum nation. Their staking secures against certain kinds of attacks like invalid blocks, double spends on their own chain.

Can you secure other things by repurposing the army? An argument pro would be, again taking the US Army analogy – if the US becomes the security supplier for the rest of the world – they are gaining ‘fees’ from all these other countries. This will upgrade U.S security: they can pay for a bigger army. That’s the same thing that’s happening through restaking.

But Vitalik Buterin, in his post Don’t overload Ethereum’s consensus, is concerned that projects outside Ethereum might exert pressure on the Ethereum community to make biased decisions.

Vitalik doesn’t think that all kinds of restaking are bad, though. He first gives a low-risk example of restaking:

“Dogecoin decides to switch to proof of stake, and to increase the size of its security pool it allows Ethereum stakers to “dual-stake” and simultaneously join its validator set. […] Low-risk.”

And then a high-risk example:

In this hypothetical example, Ether gets restaked for the purpose of securing a price oracle for a future Brazilian central bank digital currency. Should a civil war type of conflict break out in Brazil, dividing Brazil into two distinct north/south currencies, this could end up dividing the Ethereum community. Which do Ethereum stakers view as the ‘real’ price of the Brazilian currency?

Vitalik:

“As soon as a blockchain tries to “hook in” to the outside world, the outside world’s conflicts start to impact on the blockchain too. Given a sufficiently extreme political event – in fact, not that extreme a political event, given that the above story was basically a pastiche of events that have actually happened in various major (>25m population) countries all within the past decade – even something as benign as a currency oracle could tear the community apart.”

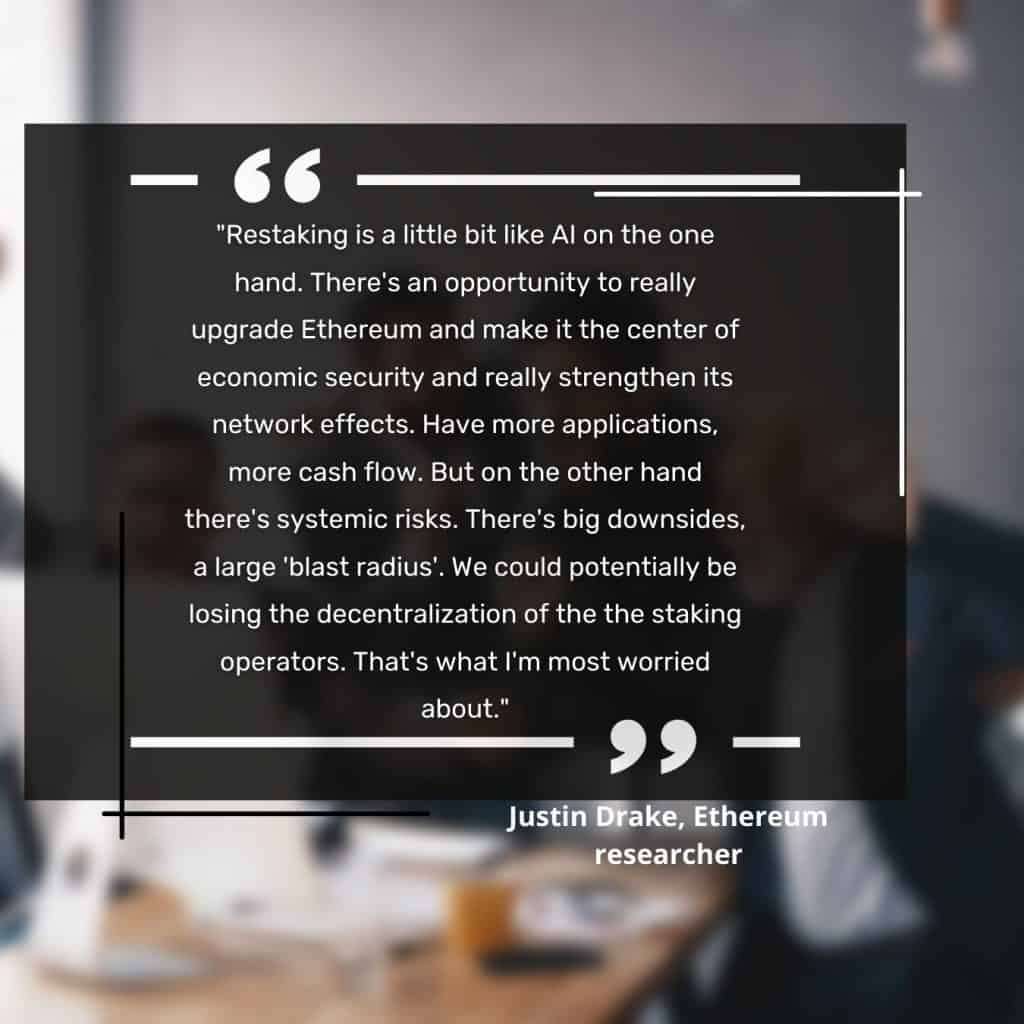

Ethereum developer Justin Drake shares Vitalik’s worries, even though he is excited too:

Conclusion

Restaking is a new ‘primitive’, the first new foundational technology to emerge in the Ethereum ecosystem since MEV showed its ugly interesting head around DeFi summer of 2020. Vitalik warns we should ‘be wary of application-layer projects taking actions that risk increasing the “scope” of blockchain consensus to anything other than verifying the core Ethereum protocol rules.’ i

But the cat seems to be out of the bag. Developers can now launch a network and use restaking security to bootstrap themselves in their infancy. Eventually, such a network can ‘graduate’ from Ethereum and rely on its own security. That’s the healthy restaking scenario. The less healthy version is that degen stakers will restake their ETH in all kinds of dubious protocols until something breaks somewhere…