Fed Breaks Banks As Bitcoin Makes New ATH

In This Issue

- Rebecca shares her thoughts on what could be the Fed’s final rate hike, Bitcoin breaks new ATH, Biden’s Bitcoin climate change tax, the crypto exchange exodus & the SUI launch.

- Altcoin Alpha by David.

- Airdrop of the week by Jesse.

- Sam has an NFT report on 5 top Gaming NFT projects.

Premium Subscription highlights this week:

- Jesse’s Altcoin Report: Is Sui Network a good investment… or a massive scam?

- Portfolio Updates: I finally cleaned house. See what I got rid of and what I’m looking to pick up more of.

- New NFT Mints: As always, Sam has 3 new exciting NFT mints to watch out for.

The News Now

Fed’s Final Rate Hike? Potential Pivot Incoming! 🏦

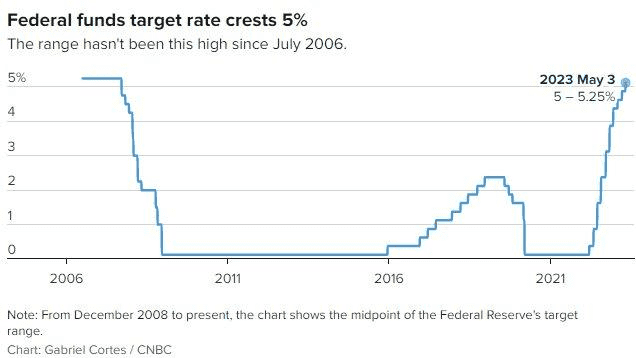

The Federal Reserve is giving sequel vibes like The Fast and Furious franchise—round 10 and another 25 basis points. This hike puts interest rates at the highest levels since 2007, and we all know what happened next. Recession. With a benchmark rate now between 5% to 5.25%, interest rates are above the latest CPI reading of 5%. The 2% inflation mandate remains priority number one for the Fed—for now. Even at the risk of more banks going under.

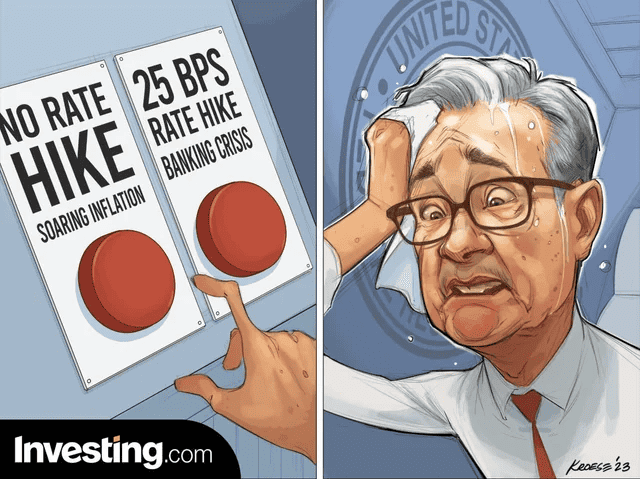

It’s been the most aggressive rate hike cycle in the US since the 1980s. But it looks like the saga might be coming to an end soon. The banking sector could sure use a breather right now! Fed Chair Jerome Powell’s statement was slightly more dovish than the last. Whilst he couldn’t commit to a pause in rates on the record right now, he certainly gave us a hint both in what he said and didn’t say. He said the Fed is “close or maybe even there” to a pause. But here’s the unspoken signal: the Fed removed all prior language signaling more hikes ahead. The Fed is back to being data-dependent, but the market is already expecting a Fed pause in June.

And as for the banks, Powell went full on Jim Cramer. Powell said that banking sector conditions have “broadly improved since March” and the US banking system is “sound and resilient.” But just hours later, PacWest Bancorp’s stock plummeted over 50% in after-hours trading and is considering a sale. Is PacWest Bancorp the next banking domino to fall? If PacWest fails, it will become the fifth-largest bank failure in US history. That’s not all, Western Alliance Bank has nosedived 45% since the Fed’s interest rate hike. Buckle up!

Important dates to watch:

- May 5: US unemployment data

- May 10: April CPI announcement

Banks Are Breaking But Bitcoin Breaks New ATH 📈

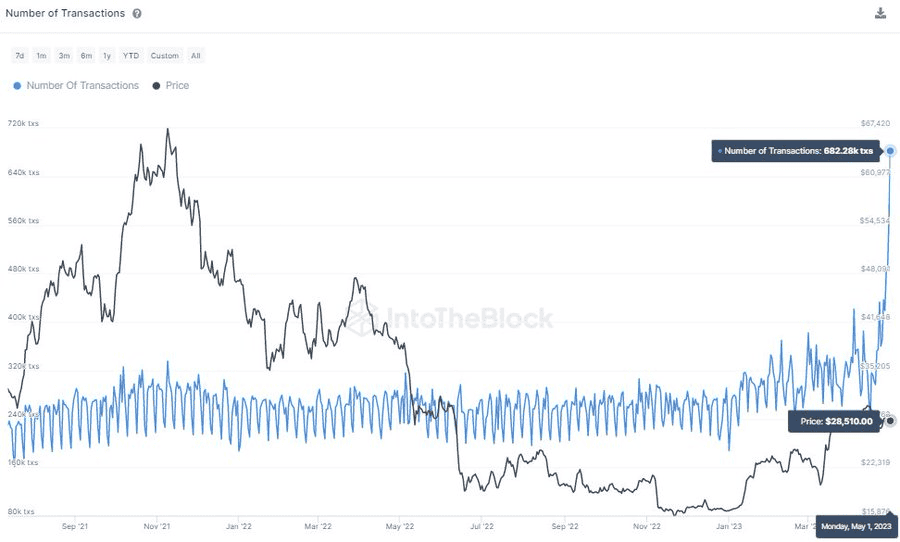

Unlike the banks, Bitcoin doesn’t skip a beat and is in fact, putting in a new ATH. Okay maybe not in USD terms yet, but Bitcoin is mooning right now regardless. Bitcoin’s daily transactions hit a new ATH and get this, on the exact same day as First Republic collapsed. Talk about a rapid response, you can’t make this stuff up. It’s all down to one thing, Ordinals.

Love them or hate them, the Ordinals craze continues. Out of the record-breaking 682,281 daily transactions on May 1, around 54% of those were Ordinal NFTs. If you’re not familiar with Bitcoin Ordinals, let’s rewind for a moment.

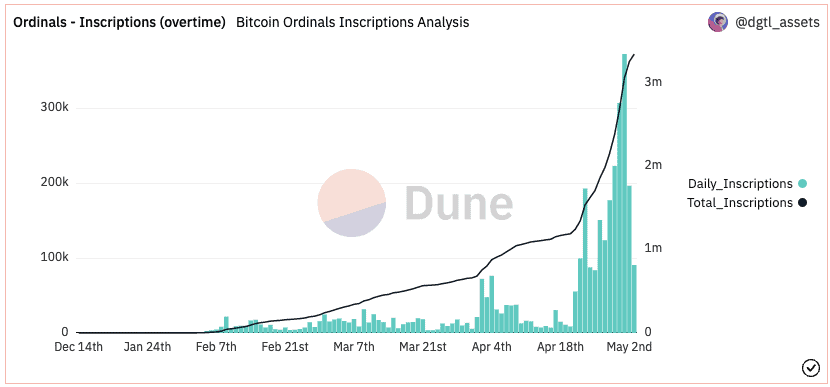

What do you get when you mix Bitcoin’s Segwit (2017) and Taproot (2021) upgrades with a bad case of NFT FOMO? Boom! Bitcoin Ordinals are born. Launched on the Bitcoin network back in December 2022, Ordinal NFTs can store data like text, images, and video. But most NFTs being minted, or inscriptions as it’s called on Bitcoin, were just like your typical ERC-721 on Ethereum—jpegs! But the community had bigger ambitions for Bitcoin. Enter the BRC-20 token standard.

It’s goodbye to boring BRC-20 text files and hello to the era of BRC-20 smart contracts. Ordinal NFTs are now programmable and unstoppable. Users can issue smart contracts, mint tokens, and transfer tokens on the Bitcoin network. And with that, Bitcoin demand has skyrocketed way ahead of the 2024 halving. Ordinals have surpassed 3M inscriptions and Bitcoin miners are laughing all the way to their Bitcoin bank accounts.

More transactions mean more transaction fees. The miners are making so much bank right now, that their revenue hit an 11-month high. Ordinals just hit an ATH for fees paid to miners in a single day after topping out at 28.4 BTC ($810,277). We gotta be careful here and hope that transaction fees don’t pull an Ethereum on us. But let’s also remember that every NFT and BRC-20 mint is making Bitcoin more secure. A ton of new miners have come online, pushing Bitcoin’s hash rate also to a new ATH. It’s proof that Bitcoin can indeed go parabolic in a banking crisis.

Biden’s Bitcoin Climate Change Tax 🔌

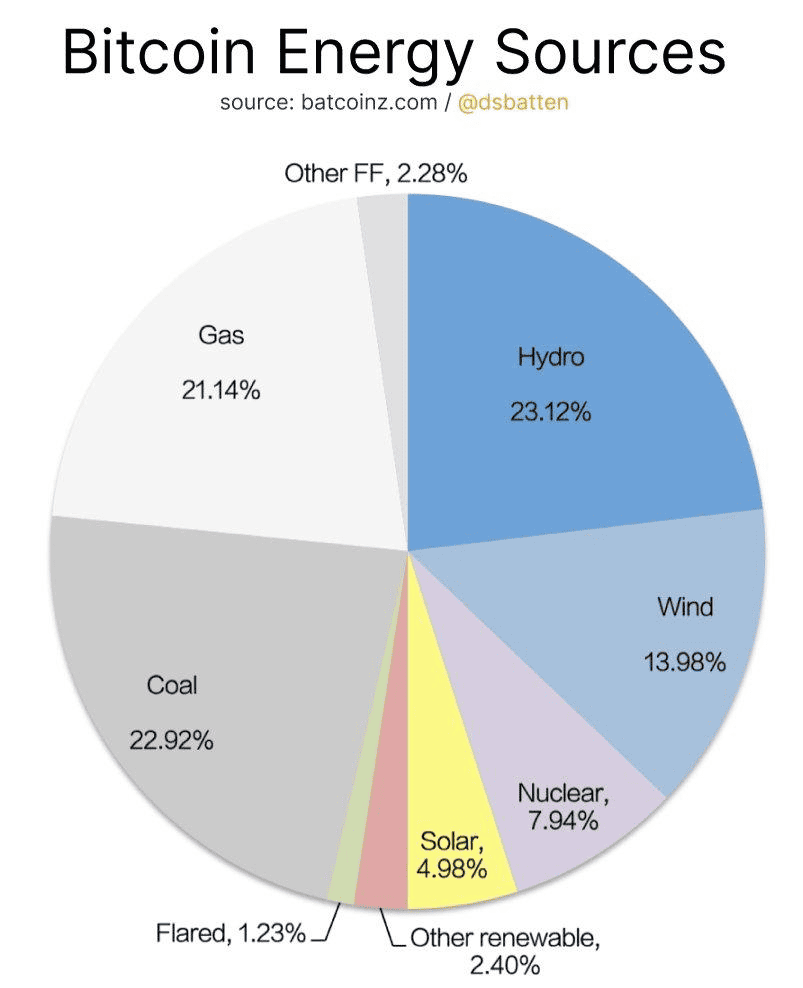

It’s Banks vs. Bitcoin and Biden just pulled out the climate card again. The Biden Administration is proposing to pull the plug on Bitcoin with a 30% tax slapped on Bitcoin miners. Someone feels threatened! It’s all in the name of climate change, but we know that it’s more a game of crisis control. The establishment can’t let the so-called enemy win. After China’s Bitcoin mining ban, the US became the biggest mining country with around 35% of the total hash rate in 2022.

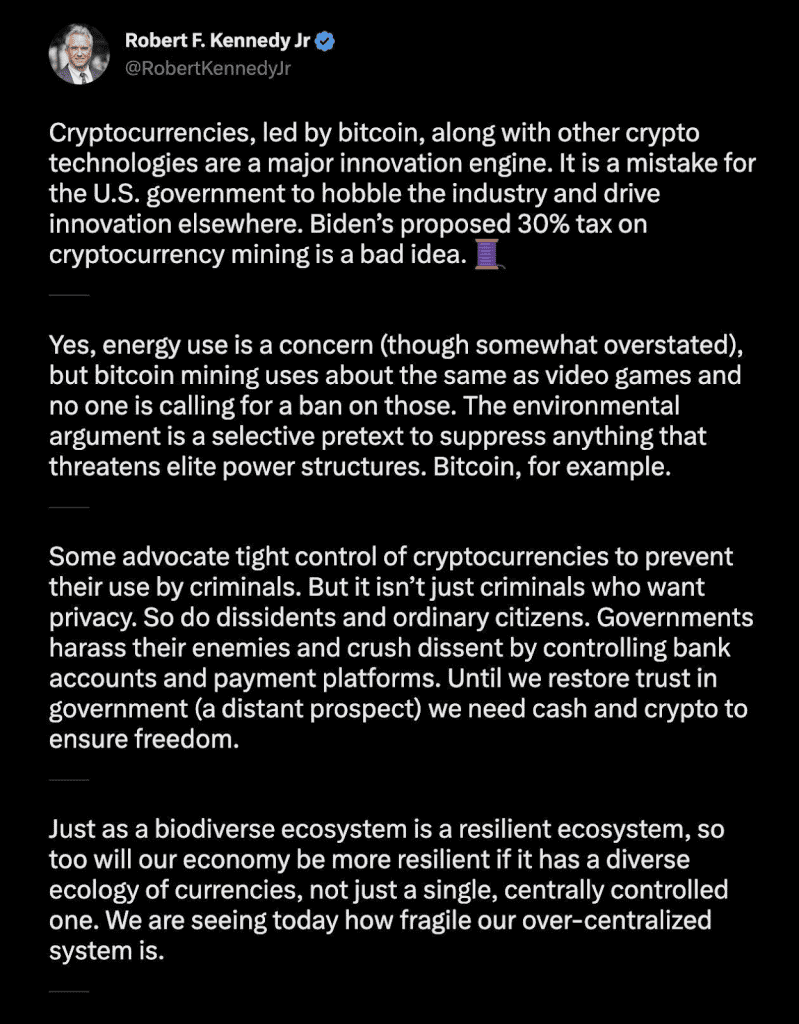

Biden is forgetting that more than 50% of Bitcoin mining uses renewable energy and incentivizes green energy. Not the opposite. If this proposal gets passed, the Digital Asset Mining Energy Tax could be the death of Bitcoin mining in the US. Someone who gets it is Democratic Presidential candidate Robert Kennedy Jr. He shared this incredible statement opposing the tax. This is the difference between a politician embracing innovation rather than coming from a place of fear.

Crypto Exchange Exodus To Offshore Operations 🏝

The exchange exodus is already underway in the US. Coinbase and Gemini have launched offshore derivatives exchanges. After growing tired of the US regulators, crypto exchanges are starting to say “screw it, we’ll just pack up and move then.” Whilst Coinbase and Gemini haven’t shut up shop in the US just yet, they’re certainly hedging their bets and preparing for if/when that day comes.

Coinbase landed a license in Bermuda and just a few weeks later launched its new derivatives exchange. Coinbase International Exchange supports non-US institutional traders. Institutions will have access to futures trading for Bitcoin and Ethereum. Then there’s Gemini Foundation, a non-US trading platform for Bitcoin futures governed by Singapore law. It’s specifically not available to users in the US, UK, and EU. The West will look back on this in years to come and realize they made a big mistake.

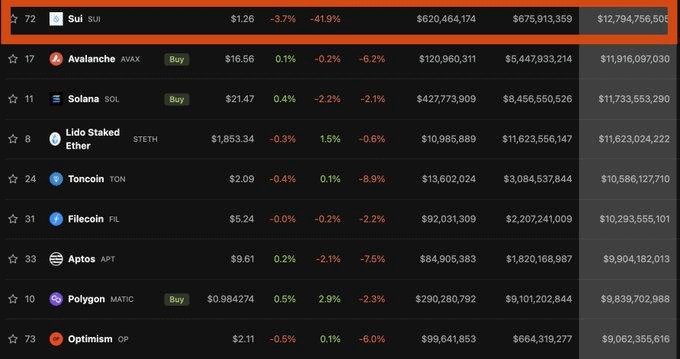

Speedy Sui Launches Long-Awaited Mainnet 🚀

Move over Aptos, Sui has arrived in town. Sui is the super speedy Layer-1 blockchain that successfully launched its mainnet this week. The blockchain is super-fast and in speedy fashion, it even arrived 30 minutes before its scheduled launch. Based on the testnet’s performance, the blockchain can already achieve between 10,871 transactions per second to 297,000 TPS. That’s way faster than the likes of Solana, which has a TPS of roughly 4,000. The mechanics of the Sui launch were slightly different, but it still entered the market with a larger fully diluted valuation than Avalanche, Solana, Aptos, Matic, and Optimism.

Sui was developed by former Meta engineers who had previously worked on the now-defunct digital wallet project, Novi. The new Layer-1 has seen an immediate response from some of the big-name exchanges with token listings on Binance, Huobi, KuCoin, ByBit, OKX, and Poloniex. SUI is the native token and rose to a high of $2.16 upon the launch before settling down to around $1.33. Layer-1s are a crowded space, so only time will tell here.

Altcoin Alpha by David

Existing Projects / Tokens

- Astar [ASTR] has been integrated into Injective [INJ]. Astar is a parachain that functions as a smart contract / dApp hub for Polkadot. With this integration, Astar assets can now be accessed on Injective and the larger Cosmos ecosystem.

- Astroport [ASTRO], the highly anticipated DeFi protocol that jumped from Terra to Cosmos, has launched a new testnet on the Sei blockchain, in preparation for a mainnet launch. Sei is a new blockchain under development that’s built specifically for traders, with transaction finality in the hundreds of milliseconds.

- Cosmos [ATOM] is now connected to all EVM blockchains. In collaboration with Axelar’s General Message Passing (GMP), Cosmos dApps can now become “interchain” by connecting and operating between Cosmos and all other EVM chains.

- Curve [CRV] has deployed smart contracts onto the Ethereum mainnet for its new stablecoin, crvUSD. The user interface for these smart contracts is still under development. Like DAI, crvUSD is a decentralized stablecoin, pegged to USD, backed by an over-collateralized basket of other cryptos. Users can mint crvUSD on the Curve protocol.

- Hashflow (HFT) has 🤝 with Moonpay. Hashflow is a Ethereum DEX. With Moonpay, Hashflow users can now use their debit / credit cards across 160 countries to purchase and trade crypto on directly on the exchange. Hot damn!

- Sommelier Finance [SOMM] is one of Cosmos’ first dApps to use GMP to connect with with Arbitrum [ARB]. Sommelier Finance is an automated yield DeFi protocol. The team says they are gearing up to connect to other EVM chains via GMP.

New Projects / Tokens

- SWELL, a new ETH liquid staking protocol, is about to drop their new token any time now.

- TENET, a new Cosmos blockchain (currently under testnet), will use liquid staking tokens (LSDs) from other blockchains as security for its protocol. Users will be able to stake LSDs to TENET for LLSDs (derivative of a derivative) for various DeFi activities. Team Tenet says this effectively allows the protocol to “leverage” the security from other blockchains for itself. Doing this write-up makes me feel like I’m watching the movie Tenet.

Airdrop by Jesse

SyncSwap Airdrop

SyncSwap is a powerful automated decentralized exchange built on zkSync Version 2. It provides low gas fees and fast transactions without compromising security. SyncSwap recently confirmed the launch of it’s SYNC token and is expecting to airdrop users that have performed onchain activities with free tokens through the SyncSwap Loyalty Program. To get started using SyncSwap you’ll need to bridge some tokens to the zkSync Era Mainnet using the official zkSync Era Bridge.

Once you have some tokens transferred from Ethereum to zkSync you can begin completing actions on the network. Users can perform Swaps and add to the current Liquidity Pools to earn rewards in the loyalty program. You’ll need to also verify your wallet in the SyncSwap Discord through the #wallet channel. To verify you’ve completed all available actions to earn a SYNC token reward. Connect your wallet to the SyncSwap Guild Dashboard and complete the list of tasks provided by the project.

5 Top NFT Gaming Projects to Watch by Sam

NFTs may have been going through a rough time lately, but one area with plenty of activity, along with real utility, is NFT gaming. You might also see this referred to as Web3 gaming or blockchain gaming, but it’s the same thing: games development that makes use of NFTs and crypto.

There are various ways to use NFTs in games, and they could represent characters, or in-game items and collectibles. In these cases, the NFTs are part of a game’s mechanics, but they can also be held, transferred and traded outside of the game.

Another common trend is for projects to offer NFT passes which function as limited supply membership tokens, and provide benefits to holders such as access to future NFT drops, and early access to games. Sometimes, initial NFT drops will combine these functions, acting, for example, as a membership pass, an in-game character, and maybe as a PFP too.

Passes that guarantee access to future mints can be particularly worth getting hold of, since they mean you’ll be in line to receive an ongoing supply of potentially valuable new assets.

Oh Baby Games

Image credit: Oh Baby Games

This Web3 gaming platform has generated growing interest, and attracted a burst of attention back in January when it was announced that it had raised $6 million in funding from investors including Kevin Lin, the co-founder of Twitch, and Synergis Capital. Marking out Oh Baby Games as deeply immersed in crypto/NFT culture, investors also included Inversebrah and CL207 of eGirl Capital, who are well known figures in the world of crypto Twitter.

Oh Baby Games is currently working on four games, with a Mario Kart-style product called What The Kart creating hype. There are plans to allow assets to be used across titles on the platform, and there will be wallet-to-wallet social connectivity. No NFTs have been released as yet, but you can sign up on the website to get involved in Alpha Testing.

MapleStory Universe

Image credit: MapleStory Universe

An interesting point about MapleStory Universe is that if you watch the introductory video on their website, you’ll find Daehyun Kang, the COO of Nexon (the company behind MapleStory) directly addressing the negative perceptions of crypto held by many gamers. He’s critical about P2E, observes that online and mobile gaming were both viewed negatively in their early days, and he lays out Nexon’s intentions to use blockchain as a way of enabling open ecosystems and exchangeable value, and not just as a P2E mechanism.

MapleStory Universe is creating an ecosystem in which NFT assets will be usable across various games and products. There will also be tools and resources for developers to make use of, with the aim of facilitating an expanding platform with multiple contributors and its own free market economy, and all powered by its own native token.

The platform has an initial advantage as it makes use of the IP around MapleStory, a game franchise that has been around for about twenty years and has over 180 million registered users. And by the way, MapleStory is operating on Polygon, which is growing fast as an attractive network for NFT gaming and other Web3 projects.

Pluto

Image credit: Pluto

As the first project from Magic Batch, also building on Polygon and with strong backing from Polygon’s investment arm, Polygon Ventures, Pluto is one to keep a close eye on. Just to remind you, Magic Batch is an influential launchpad/incubator that itself launched this year and is focused on supporting new Web3 platforms and protocols.

As for Pluto, this is not solely a gaming project, but aims to overlap across art, gaming and fashion, creating interlinked brands and an active community along the way. The project has plans to drop a Genesis Collection of NFTs which could bring valuable utility to holders, although details have yet to be clarified, and it appears that a mini-game called Sunbeam will launch soon, although again, details are not out in the open yet.

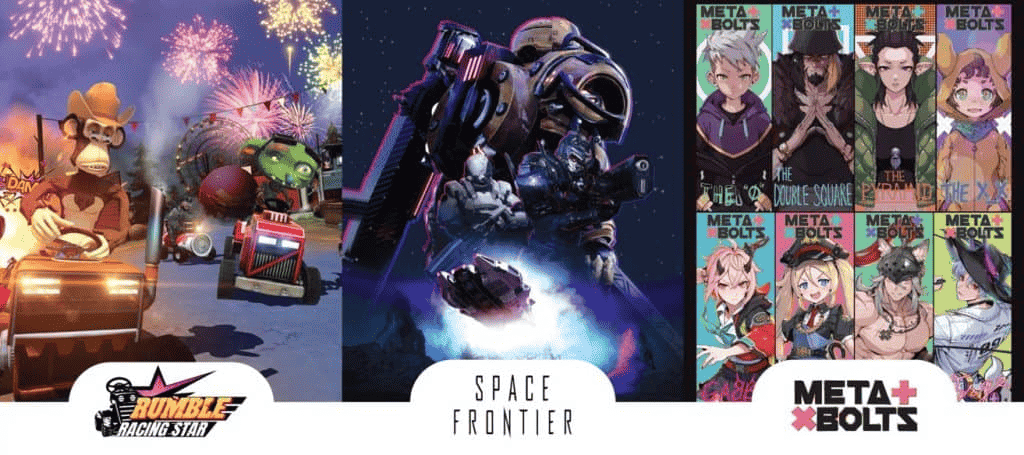

Delabs Games

Image credit: Delabs Games

You remember Nexon, the company behind MapleStory Universe? Well, web3 is an interconnected world in which everyone knows each other, and the former CEO of Nexon, Joonmo Kwon, is now the CEO of a new platform called Delabs Games, which is executing a plan that puts it in competition with MapleStory.

Delabs is stylish and cleanly put-together, and is proceeding along a similar path to Nexon, developing a Web3 gaming system in which NFTs are transportable and tradable. There are three impressive-looking games in development including, as at Oh Baby Games, a title reminiscent of Mario Kart, called Rumble Racing Star. Another similarity with Oh Baby Games is the feeling of being simpatico with NFT culture, as Rumble Racing Star ties in PFPs from big NFT collections including Bored Ape Yacht Club and A Kid Called Beast.

You can currently buy a DeLabs Adventure Pass for under 0.1 ETH on secondary, with these items promising future NFT airdrops along with other benefits, and with a staking system coming soon. And in case you were wondering, yes, this one is on Polygon too.

Symbiogenesis

Image credit: Square Enix

Not a platform this time, but an individual, impressive-looking game, this one is worth paying attention to since it’s made by Japanese gaming industry giant Square Enix. Symbiogenesis aims to combine artistic collectibles and gaming, looks like an epic production, and is also building on–you guessed it–Polygon.

It has a science-fiction setting, features narrative-driven gameplay, and plans to release 10,000 NFTs that will function as artworks, PFPs, and usable, in-game characters. In-game items, which are discovered through completing quests, will also be represented as NFTs which can then be traded on secondary markets. There are also Member Card NFTs, which allow holders to gain rewards, and are awarded to community participants.

Go Premium To See This Weeks Top 3 NFT Mints

Subscribe to the Wealth Mastery Premium Investor Report to get this weeks top 3 NFT mints AND gain full access to the premium archives.

Final Notes

Bitcoin price in May 2023, sell or buy? Watch the video below to find out. 👇

Thank you so much for your support, and I truly hope that today’s issue will give you insights needed to help you master your wealth.

If you are reading this it means you are on the free version of the Wealth Mastery Investor Report, which is great for news and tips on the crypto markets.

If you really want to take advantage of fastest growing asset class EVER, I highly recommend you to check out my new Altcoin course: Mastering Altcoin Investing

In this course we’ll teach you all about how to spot, choose and acquire the winning altcoins of the next bull market.

Learn how to build your portfolio so that growth is ensured and risk is mitigated. Let me help you build a strategy that’ll change your life forever in the upcoming bull run.

Are you ready to make it?

See you next time!

Lark and the Wealth Mastery Team

Recommended Services

💰 BINANCE: BEST EXCHANGE FOR BUYING CRYPTO IN THE WORLD 👉 10% OFF FEES & $600 BONUS

🚀 BYBIT: #1 EXCHANGE FOR TRADING 👉 GET EXCLUSIVE FEE DISCOUNTS & BONUSES

🔒 BEST CRYPTO WALLET TO KEEP YOUR ASSETS SAFE 👉 BUY LEDGER WALLET HERE

Legal Disclaimer

Wealth Mastery (Lark Davis, and the Wealth Mastery writing team) are not providing you individually tailored investment advice. Nor is Wealth Mastery registered to provide investment advice, is not a financial adviser, and is not a broker-dealer. The material provided is for educational purposes only. Wealth Mastery is not responsible for any gains or losses that result from your cryptocurrency investments. Investing in cryptocurrency involves a high degree of risk and should be considered only by persons who can afford to sustain a loss of their entire investment. Investors should consult their financial adviser before investing in cryptocurrency.

You can find a full disclosure of all my crypto & venture investments here.