Hype Makes Money In Crypto

In This Issue

- I share my thoughts on fear persisting in the markets, Pepe madness, Ethereum this week, Stripe’s massive news & Curve’s stablecoin.

- This week on chain

- Rebecca breaks down the latest news.

- David compares Ethereum, Solana, Cardano and Polkadot.

The News Now

Fear Persists In Markets

Banks are still in trouble.

Recession fears are still high.

Interest rate hikes are bound to break more things.

Inflation remains a sticky problem, especially in Europe.

Although, stock markets in the USA are actually doing ok due to a good first quarter of earnings.

Magic Internet Money though…

Bitcoin has been bouncing in a tight range between $30,000 and $26,500 for about two months now. Ethereum has also cooled off.

Many altcoins have been taking hits after a big run up last month. The only things really making money the last two weeks have been meme coins. More on that in a moment though.

One very interesting thing that did come out last week was the earnings report for Coinbase. It showed that it beat earnings expectations and most interestingly that it grew its user base by 14.3% in Q1. That’s actually crazy considering that many still consider this to be a bear market.

People still want to make money. People still want to ape into crypto coins. People are showing up and new users are entering the market.

In fact, the recent meme coin madness likely only increased their desire.

Pepe Proved One Thing

I know we are all probably getting a bit over talking about Pepe by now, unless you made shit tons of money, in which case enjoy your victory laps. But what is perhaps most striking about the Pepe meme coin madness that has taken place over the last few weeks has been that it has really exposed the grim reality of crypto.

👉 Hype Matters Most 👈

There are so many fundamentally “strong” coins with good tokenomics, strong devs, sweet staking rewards, big partnerships, etc. that are languishing in the purgatory of the market. Sure some can get enough critical mass to make it, but that still requires some kind of hype narrative to even get eyes on all that good stuff in the first place.

Almost all of these projects were just outperformed by a coin with a frog logo.

That is literally all Pepe is.

Look, at the end of the day everyone comes to crypto to make money. And for better or worse meme coins are a simple and relatable way for people to do that.

Also, a reminder here if you are reading all of the stories about the guys who turned $10 into a million then keep in mind that the people buying the Binance listing were exit liquidity for that guy and there will be a lot of bag holders.

Meme coins are often little more than a quick pump and done. Doge and Shib are the exceptions, not the rule. The vast majority of names you are seeing now will be worth zero in 6 months. Some big ones like Pepe may survive in some form. But already meme season is feeling very played out. Literally hundreds of meme coins have been launched in the last two weeks. The Binance Listing for Pepe probably marked the top for meme coins for a while. I could be wrong but that is what I am thinking right now.

While meme coins are fun and can make money the best investments in crypto are often the coins that can bring in strong tokenomics, have good teams and backers, build something useful that people want to use, and can create hype that builds a strong long term community of people who are committed to the success of that protocol.

There are literally dozens of coins like this such as WOO, INJ, ROSE, AVAX, JOE, etc.

Just remember, there are endless opportunities to make money in crypto.

Ethereum This Week

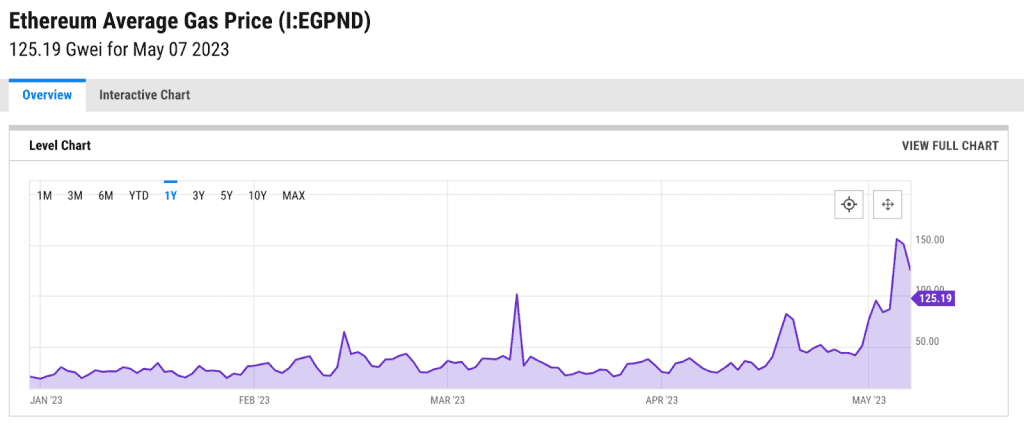

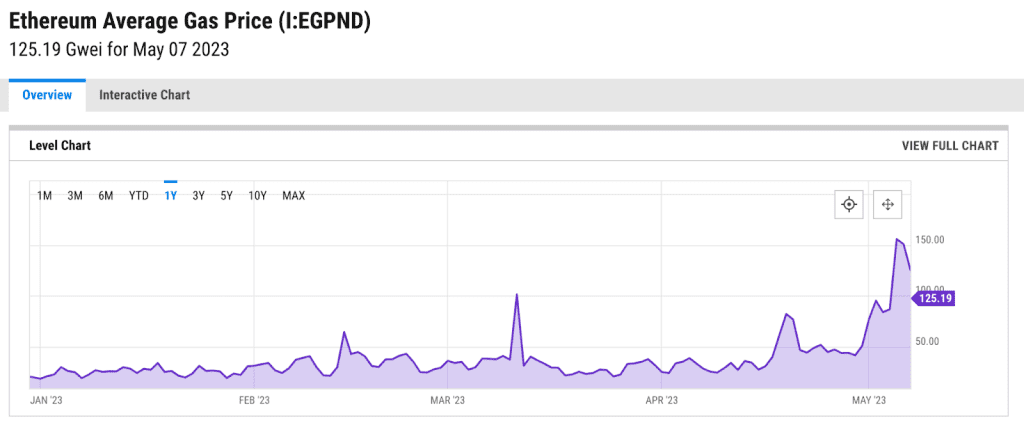

Three big things are happening in ETH this week… aside from the insane fee explosion, but more on that in a minute.

- The Ethereum Foundation sold 30,000 ETH. Often, not always, but often this has coincided with local market tops. Although I do question why they are even selling at all anymore? Why not just stake all the ETH Foundation coins and live off of the staking rewards?

- Ethereum is making very strong deflationary moves right now. Currently ETH is deflating at a rate of 2.5% a year when accounting for the last 7 days of burns. That’s insane! If that keeps up then ETH is on pace to burn millions of coins this year.

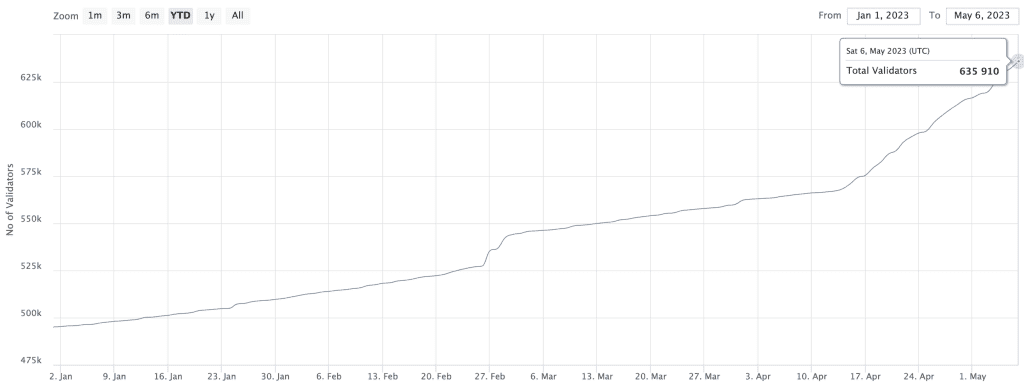

- Ethereum staking has reached a new all time high of 19.4 million ETH staked. The Shanghai upgrade has been wildly bullish for ETH from a fundamental perspective. Almost a million more ETH have been staked in the last month since it went live.

Stripe’s MASSIVE News

You might not know who Stripe is, but if you have ever bought anything online then you have probably used their services. Stripe is one of the world’s biggest payment processors. Stripe just launched a fiat to crypto on ramp! This will allow a huge range of companies a safe payment rail to onboard clients into their web3 products.

Currently it is a one way trip of fiat to crypto only, with no crypto to fiat round trip. But hopefully this is something we see in the future.

At a time when banks are shunning crypto companies it is nice to see such a big company taking the plunge into crypto.

Curve’s Stablecoin Is Finally Here!

We have been waiting a long time, but it seems that the crvUSD stablecoin is finally here. And, yes, I know what you are thinking “not another damn stablecoin”. Usually I would share that sentiment, however this is something different.

Curve Finance is the biggest stableswap protocol in crypto. Kind of a big deal for them to be launching their own stablecoin.

crvUSD is a collateral backed stablecoin similar to Maker’s DAI stablecoin. This could be a big step forward for CRV holders as it could open up new revenue streams.

Now all eyes will be on Aave to launch the GHO stablecoin.

This Week On Chain

Ethereum gas fees have gone insane. Again. The worst part is that there is no relief in sight for ETH. The next major upgrade is proto-dank sharding which will help Ethereum layer twos, but do little to reduce main chain congestion. Don’t expect the fee situation to be solved until 2024 sometime. Oh, and why are fees insane? Pepe and meme coins are driving insane user traffic. The promise of getting rich overnight always does this. Gas prices are up on average 50% since PEPE launched.

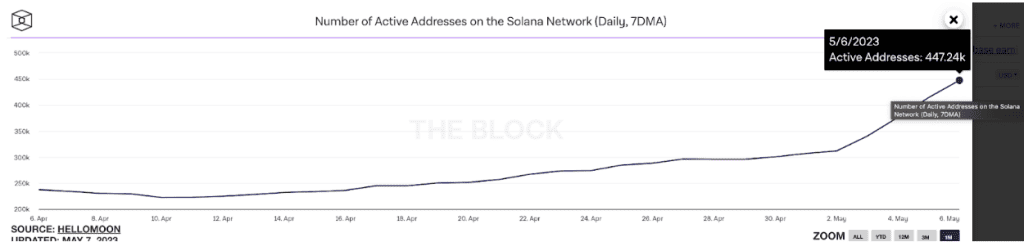

But, Ethereum’s pain can be another chain’s gain. This chart shows daily active addresses on the Solana blockchain. You can see they have nearly doubled in a month. While a decentralized exchange swap on Ethereum might cost $50-100 right now, the same swap on Solana is 1/10th of a cent at the moment.

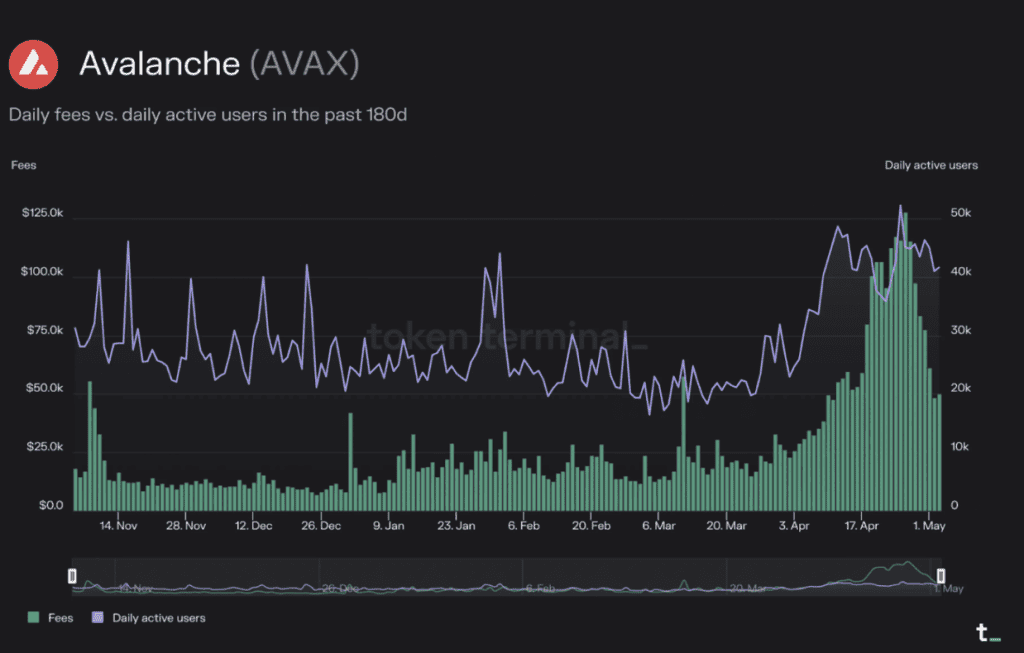

Over in Avalanche land the total number of daily active users is staying strong. Showing that indeed users are seeking and using alternatives. This behaviour will likely continue while Ethereum’s fee market remains so insane.

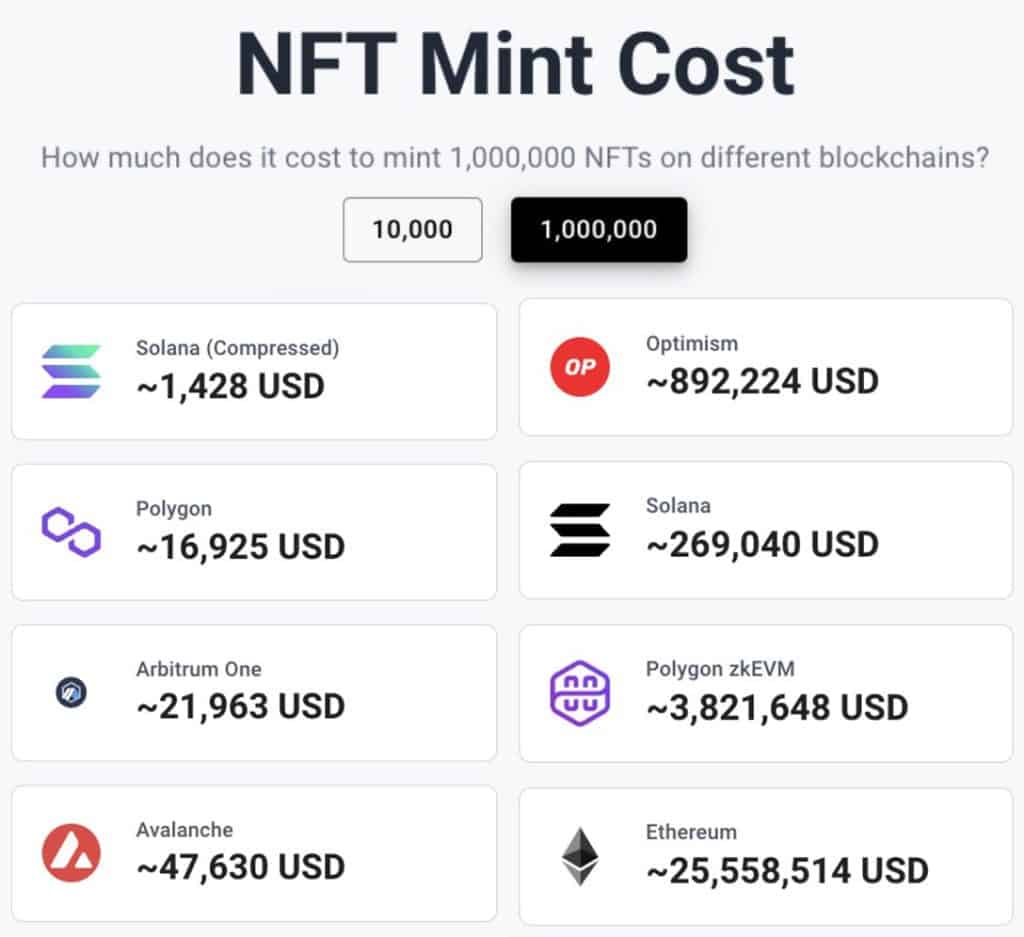

Also, check out this chart here. It shows how much it would cost to mint a million NFTs across various chains. This is an action that a game, for example, would feasibly do. The results are pretty shocking. Only 4 chains come in under $50,000. Compressed transactions on Solana being the clear winner.

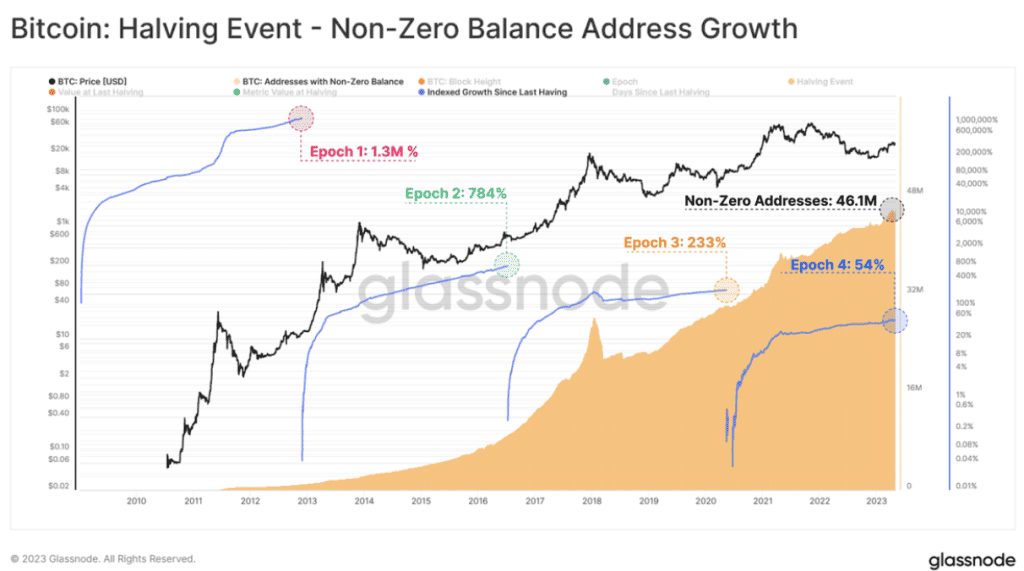

This Bitcoin chart here shows that adoption is continuing to soar despite the prevailing market conditions. Currently there are 46.1 million addresses with a non-zero balance. A number that has grown consistently throughout the bear market. This is nothing like the 2018 bear market where we saw a huge drop off as people sold and walked away. This time is different.

Although it should be pointed out that Bitcoin has also been suffering from a huge spike in fees recently, up 300% in 30 days, as Bitcoin tokens explode.

I wonder if this will spur on a new round of layer two innovation for Bitcoin? We already have a few big players like Stacks and Rootstock as well as coming players like Portal. Can they capitalise on the moment and offer people the defi experience they want on Bitcoin but for a fraction of the cost?

This Week’s Trending Coins by Rebecca

Here are my key takeaways from the trends this week and memecoin mania has gone mad!

- ChainGPT is an AI model launched by Seedify that’s running an airdrop campaign, teasing a partnership with an education platform, and has announced a strategic partnership and integration with Alvey Chain.

- Bitcoin transactions were halted twice on Binance due to a congestion issue. As a result, Binance has announced it’s working to enable Bitcoin Lightning payments. A bug has also been found in the Bitcoin Ordinals system which affects NFT numbering.

- Pepe is a memecoin on Ethereum that’s hit a market cap of $1 billion after being listed on Binance, CryptoCom and KuCoin. PEPE liquidity pools have also become the most active on Uniswap.

- FLOKI is a memecoin on Ethereum and Binance Smart Chain that’s been listed on Binance and Rollbit for trading.

- Ignore Fud is a memecoin that’s promised to burn 200M tokens if it gets 2M trending tweets.

- SnailBrook is a memecoin that’s burned 17.6 billion SNAIL tokens. SnailBrook is also hosting a giveaway on Twitter to the community.

- ZoidPay is a liquidity solutions provider that’s launched a trading competition on KuCoin.

- tomiNet is a Web3 infrastructure company on Ethereum that’s been listed on CryptoCom exchange. The tomi team has also donated 10 billion PEPE tokens to its DAO treasury.

- Popcorn is a non-custodial yield optimizer that’s pumped on Gateio after launching a new USDC Sweet Vault on Arbitrum.

- DinoLFG is a memecoin that’s been listed on Bitget on Gateio. Bitboy Crypto, Ben Armstrong, has tweeted that he’s rolled his memecoin profits into DINO.

- Arbitrum is an Ethereum Layer-2 scaling solution that’s seen Chronos exchange reach $217M in total-value-locked (TVL) a week after launching, and has become the eighth-largest DEX, according to data from DeFiLlama.

- Sui is a Layer-1 blockchain that’s successfully launched its mainnet with immediate listings on Binance, Huobi, KuCoin, ByBit, OKX, and Poloniex.

- Wojak is a memecoin on Ethereum that’s been featured in a thread gone viral by crypto trader, DimitriDotEth

- ArbDoge AI is a memecoin created by AI on Arbitrum that’s burned 7.5% of its supply in total.

- XEN Crypto is an ERC-20 token that’s reached the 5 trillion total burn mark which equates to 30% of its supply.

Follow Rebecca on Twitter and Instagram.

Ethereum vs. Cardano vs. Polkadot vs. Solana by David

As the cryptocurrency markets march forward, investors continually work to understand the underlying technologies and the protocols that might dominate the future. The winning narrative over the past three years has been the “multi-chain” future. The idea is that Bitcoin will be gold 2.0 and a basket of other layer-1 (L1) protocols will serve as Web3’s major economic hubs.

Currently, the four most prominent cryptos in that basket are Ethereum vs. Cardano vs. Polkadot vs. Solana. This article steps back to compare these four side-by-side in order to see where they’re at and where they might be going.

Development History

The history between these four protocols is like a nerd version of Game of Thrones.

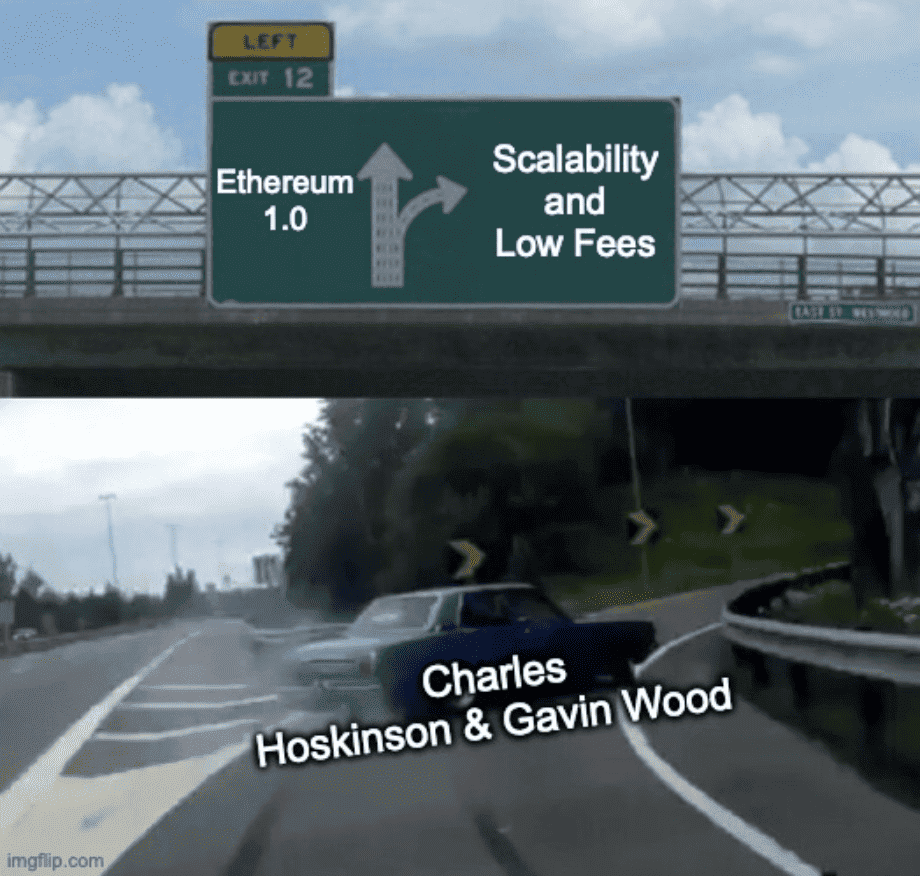

Vitalik Buterin proposed the Ethereum whitepaper in 2013. His big idea was dApps fueled by smart contracts. When Buterin assembled his team, both Charles Hoskinson and Gavin Wood were in the inner circle. Ethereum launched in 2015 and became extremely popular because of the usefulness of dApps.

At some point during all of this, both Hoskinson and Wood foresaw that Ethereum would run into scalability problems. So both men departed and went separate ways. Hoskinson launched Cardano in 2017, and Wood launched Polkadot in 2020. All the while, a developer named Anatoly Yakovenko kept tabs on all of this, and launched Solana in 2020.

The key takeaway here is that Hoskinson, Wood, and Yakovenko all believed Ethereum’s scalability issues would lead to its ultimate undoing. Thus, they saw an opportunity to build a better technical solution that might be able to handle true mass adoption. That’s the story.

With this broader context in mind, let’s delve into the protocols.

Macro Comparison

First, let’s knock out the similarities.

Ethereum, Cardano, Polkadot, and Solana are all open source, permission-less, decentralized, proof-of-stake (POS), L1 blockchain protocols. The only exception here is Polkadot, which is actually a layer-0 (L0) blockchain ecosystem. All four support the development of dApps via smart contracts. Generally, you can conceptualize these protocols as global computer blockchain networks that allow anyone to engage in commerce, entertainment, and self-expression.

Now, here’s the differences:

Ethereum

Ethereum initially launched as a proof-of-work protocol. As previously mentioned, the innovation behind dApps helped Ethereum become the second largest cryptocurrency by market cap with 20% market dominance. The protocol has over 3,600 dApps and is the run-away leader in terms of DeFi and NFT market numbers.

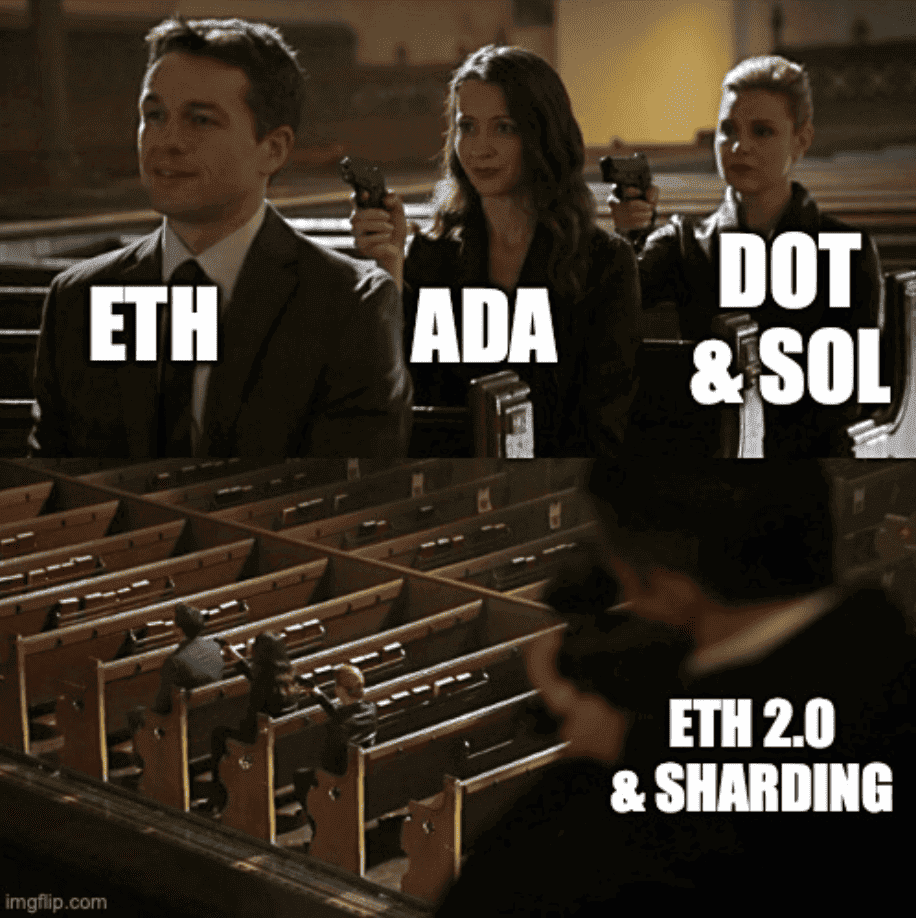

But high transaction fees, scalability and environmental issues forced the protocol to transition to a POS consensus mechanism in late 2020. That transition was successful. And during that time, a diverse ecosystem of layer-2s (L2s) was constructed to further increase scalability and lower fees. Ethereum’s next major upgrade is “sharding”, which is scheduled for late 2023 or early 2024. Sharding should boost Ethereum’s performance even further.

Cardano

Cardano launched looking to displace Ethereum through purposeful research, advanced tech, and better performance. Cardano’s development has been slow and steady, as the network is subject to extensive peer-reviewed research and testing. All this brain-time appears to have worked, because Cardano deploys a sophisticated technical setup that helps it achieve 250 transactions per second (TPS) with very low fees.

Cardano developers have extremely ambitious hopes for the protocol, hoping it will one day transform the global economy into a more financially inclusive and efficient system. But before that happens, Cardano first needs to complete its planned upgrades. The protocol is currently in Stage 3 (“Goguen” Smart Contracts) of 5 total. Stage 4 (“Basho” Scaling) and Stage 5 (“Voltaire” Governance) are TBD. The protocol has an extremely loyal fan-base and is a top 10 crypto asset.

Polkadot

Polkadot launched as a L0, multi-blockchain ecosystem. Polkadot’s core innovation is a platform that allows for the creation and deployment of interoperable, sovereign blockchains. Thus, Polkadot’s overarching goal is a multi-blockchain ecosystem that’s extremely scalable and efficient. And by extremely scalable, Polkadot’s stated goal is for the ecosystem to achieve 1 million TPS.

At the core of Polkadot is the “relay” blockchain. This is the central utility chain that provides security and interoperability for Polkadot’s “parachains” – sovereign, highly-customizable chains owned and operated by third-party developers. Currently, there are parachains 20 live and operating, with a total capacity of 100. It appears Polkadot has constructed a solid foundation for blockchain scalability and interoperability, but the network, at the time of this writing, is the smallest of the four being just outside the top 10.

Solana

Solana launched with hype that it was the real “Ethereum killer”, and it gained widespread recognition for its extremely low fees ($0.00025) and high TPS (4,760). In fact, Solana takes 1st place out of this list in these categories. And due to the low fees, the protocol has become a well-known hub for NFT minting and trading, and the network resides within the top 10 cryptos by market cap.

But not everything has been sunshine and rainbows. The protocol now has a reputation for instability as Solana has suffered more than seven major outages, some lasting longer than 24 hours. The most recent was on February 25th, when the blockchain had to be “restarted” due to software update issues. Solana is trying to repair this damage, both with technical fixes, and also with the release of the Solana phone, a Web3 phone set to debut at the time of this writing.

Micro Comparison

We got the big picture. Now let’s inspect the micros. We will keep this short and sweet.

Consensus Mechanism

All four use POS consensus mechanisms. But here’s the differences:

- Ethereum: Validators stake a minimum of 32 ETH on Ethereum and run special validation software. Security via slashing.

- Cardano: Uses the “Ouroboros” variant, a randomness algorithm that itself randomly changes over time to select Cardano’s next validator. No slashing. Validators are incentivized to behave though a game theory called the Nash Equilibrium.

- Polkadot: A “nominated” POS system. Nominators stake a minimum of 250 DOT to the validators (up to 16) they support. The validators with the most nominations validate and propose blocks on Polkadot’s relay chain. Security via slashing.

- Solana: POS + proof of history (POH). POH means all validators run “cryptographic clocks” that are synchronized with each other. This time alignment makes for faster ordering of transactions, and it’s why Solana achieves such high TPS. Security via slashing.

Transactions per Second (Scalability) and Fees

| TPS | Fees | |

| Ethereum | 29 | $1.68 |

| Cardano | 250 | $0.15 |

| Polkadot | 300 | $0.5 |

| Solana | 4,760 | $0.00025 |

Ethereum’s 29 TPS includes all L2s except for Polygon. And as mentioned previously, Ethereum “sharding” is scheduled for late 2023 or early 2024. And Cardano’s “Basho” upgrade (TBD) will introduce side-chains to its network as well. Meaning, if all goes well, both Ethereum and Cardano should see significant increases in their TPS after these upgrades are completed.

Decentralization and Security

It’s difficult to make hard conclusions as to which is the most decentralized and secure. But here’s what we know:

| Active Validators | % of Staked Tokens to Overall Supply | |

| Ethereum | 635,910 | 14.86% |

| Cardano | 3,176 | 63.63% |

| Polkadot | 297 | 40.47% |

| Solana | 1,768 | 71.65% |

Ethereum’s active validator count just keeps ripping. The protocol’s +600K validators is fantastic. However, Ethereum’s percentage of staked tokens to overall supply is very low compared to the other three protocols. But since the Shanghai upgrade, staked ETH is flowing away from centralized staking services to decentralized liquid staking protocols, which is positive for decentralization.

Cardano and Polkadot’s validator count seems low compared to Ethereum. But given they use different POS systems, one can’t really make an apples to apples comparison. Cardano and Solana have high staked tokens to overall supply, which is great.

Regarding Solana, it has two major black-eyes. First, the top 33 SOL validators collectively control 33% of all staked SOL. This means these 33 could halt the network if they colluded together. Second, the network uses just one validator “client.” Thus, the entire network is exposed to a single point of failure because all validators must connect through one software service. Not good for decentralization!

Economic Statistics

Here’s how the four protocols compare in terms of economics.

| Total Market Cap | Total dApps | DeFi TVL | NFT Trade Volume (All Time) | |

| Ethereum | $230B | +3,600 | $28B | $43B |

| Cardano | $13B | +2,000 | $151M | $580M |

| Polkadot | $6B | +550 | $290M | Unknown |

| Solana | $8B | +1800 | $270M | $4B |

The big takeaway here is just how dominate Ethereum has become! To put it plainly, Ethereum blows the other three completely out of the water in terms of economic numbers. It’s not even close. And this isn’t even factoring in Ethereum’s L2s and Polygon! Wow.

Another takeaway is how small Cardano’s DeFi and NFT numbers are to its competitors and its own market cap. The protocol is lagging in terms of real world usefulness. Its relative high market cap is likely due to Cardano’s loyal fan-base.

Strengths, Weaknesses & Final Thoughts

After comparing these four protocols, their respective strengths and weaknesses become more apparent.

| Strengths | Weaknesses | |

| Ethereum | – Largest economy by a mile- Ability to successfully upgrade and adapt as needed (e.g. ETH 2.0) | – Lowest TPS- Highest Fees |

| Cardano | – Advanced tech due to peer-review process- Solid TPS and low fees | – Lowest DeFi and NFT trade volumes |

| Polkadot | – Dynamic L0 ecosystem, with built-in interoperability and cross-chain communication- Potential for extremely high scalability | – Lowest Market Cap and dApps |

| Solana | – Lowest fees and highest TPS by a mile- Decent NFT trade volumes | – Recurring outages.- Concerns over decentralization and security |

No one knows the future, but allow me to put on my Nostradamus hat for a moment. OK that’s better.

Ethereum is the most promising project by a long-shot, for two reasons. First, because of the project’s first mover advantage in terms of dApps via smart contracts, the network has developed a very diverse and large economy. Keep in mind that Ethereum has 20% dominance of the entire crypto market. That’s huge. Second, Ethereum has proven that it can upgrade and adapt as necessary to changing user and market conditions. Case in point: Ethereum’s transition to POS.

When I add these two factors together, it’s difficult for me to believe that one of these other protocols will be able to overtake Ethereum. For me, this theory is solidified considering the innovation happening on Ethereum’s L2 networks and the upcoming sharding upgrade.

Now, that’s not to say that Cardano, Polkadot, and Solana will wither and die. The future is likely multi-chain, and there’s room for multiple projects. So I generally expect these networks to continue to grow and mature. But these “killers” just couldn’t pull the trigger.

Final Notes

Pepe has broken Bitcoin and Ethereum. Find out how in the video below 👇

Thank you so much for your support, and I truly hope that today’s issue will give you insights needed to help you master your wealth.

If you are reading this it means you are on the free version of the Wealth Mastery Investor Report, which is great for news and tips on the crypto markets.

If you really want to take advantage of fastest growing asset class EVER, I highly recommend you to check out my new Altcoin course: Mastering Altcoin Investing

In this course we’ll teach you all about how to spot, choose and acquire the winning altcoins of the next bull market.

Learn how to build your portfolio so that growth is ensured and risk is mitigated. Let me help you build a strategy that’ll change your life forever in the upcoming bull run.

Are you ready to make it?

See you next time!

Lark and the Wealth Mastery Team

Recommended Services

💰 BINANCE: BEST EXCHANGE FOR BUYING CRYPTO IN THE WORLD 👉 10% OFF FEES & $600 BONUS

🚀 BYBIT: #1 EXCHANGE FOR TRADING 👉 GET EXCLUSIVE FEE DISCOUNTS & BONUSES

🔒 BEST CRYPTO WALLET TO KEEP YOUR ASSETS SAFE 👉 BUY LEDGER WALLET HERE

Legal Disclaimer

Wealth Mastery (Lark Davis, and the Wealth Mastery writing team) are not providing you individually tailored investment advice. Nor is Wealth Mastery registered to provide investment advice, is not a financial adviser, and is not a broker-dealer. The material provided is for educational purposes only. Wealth Mastery is not responsible for any gains or losses that result from your cryptocurrency investments. Investing in cryptocurrency involves a high degree of risk and should be considered only by persons who can afford to sustain a loss of their entire investment. Investors should consult their financial adviser before investing in cryptocurrency.

You can find a full disclosure of all my crypto & venture investments here.