Layer 2 Summer… This or Next Summer?

TL;DR

For another bull market to occur, Layer 2 (L2) adoption on Ethereum is key: without it, gas fees on the base chain won’t allow mainstream adoption. The good news is that L2s are maturing, and adoption is already happening. Arbitrum, in particular, is showing high daily transaction volume, even comparable to Ethereum’s main net, despite a much smaller market cap.

You could argue that for another bull market to happen, Layer 2 adoption on Ethereum is a requirement. Without Layer 2’s to offload traffic, gas fees for a swap on the Ethereum base chain will exceed $100. The bull market will throttle itself as the Ethereum base chain will get overpopulated. This happened in the previous cycle.

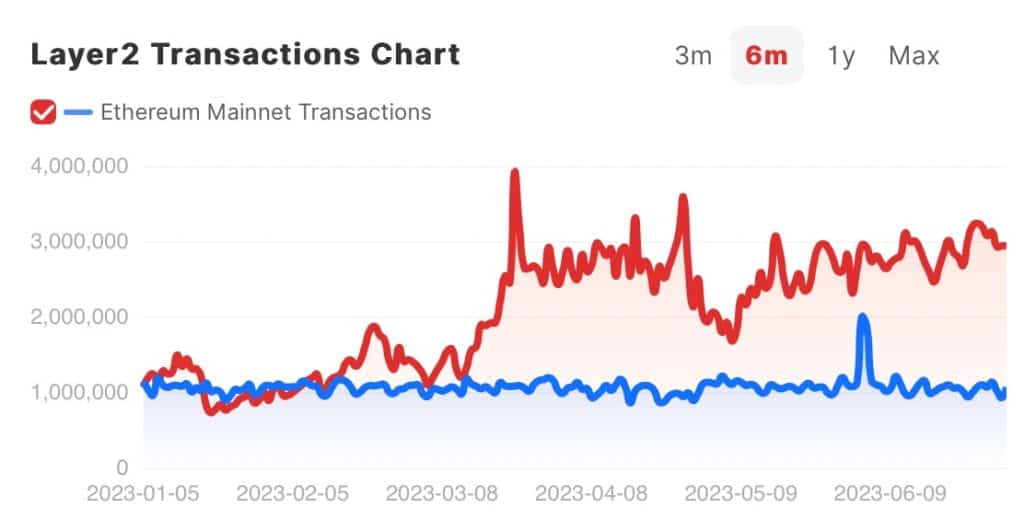

The good news: Layer 2 solutions are popping up left and right and people are finally using them. In fact, daily activity has been outpacing Ethereum main net through 2023. In the last two months, it’s been by nearly a 3:1 margin for the last two months. Here’s the chart. Red is added Layer 2 transactions, blue line is Ethereum.

Wen Layer 2 Summer?

Viewing the above chart, you could argue Layer 2 summer is already here. Still, markets don’t really feel frothy yet – far from it. It feels more like the ‘bear market is for building’ phase. Compare it to how the groundwork for DeFi summer of 2020 was laid during the bear market of 2018 and 2019.

And make no mistake, a lot of building still needs to be done for crypto as an industry to reach some serious degree of mainstream adoption. This is at least Vitalik Buterin’s point in a recent post. According to him, for Ethereum to move from an experimental technology to one that can onboard the masses, there are three major technical transitions that it needs to undergo. The Layer 2 scaling transition is one of them. The other ones are people moving to smart contract wallets (in which they don’t have to store a private key). And the third is privacy-preserving transactions.

If the builders keep building and can manage to achieve all the above within a year or two, and if historic market cycles rhyme with the current, the bear market of 2022/2023 will serve as the foundation for a potential Layer 2 summer in 2024.

What will definitely help L2s is that The Ethereum Improvement Proposal 4844 (EIP-4844), part of the Cancun upgrade, will go live roughly in autumn 2023. It will reduce transaction fees on Ethereum by at least a 10x. While this is of course good for Ethereum users, it also benefits layer 2’s who transact on Ethereum’s base chain. Especially for large-scale applications like gaming or social media, that 10x will matter.

The final ingredient that yet is missing, is a breakthrough application. Everyone is building the base layer technology on which the applications can ride. But we are still waiting for a ‘ChatGPT moment’ in crypto. What application will bring the masses in, if any? Or which ecosystem of applications? A metaverse, a game, a social media platform? The tokenization of real-world assets? Tokenized ticketing, music. If/when these applications will pop up, unlocking new possibilities and use cases, they will attract more users to the Layer 2 ecosystem.

Layer 2s: the Data

Now let’s have a look at some Layer 2s.

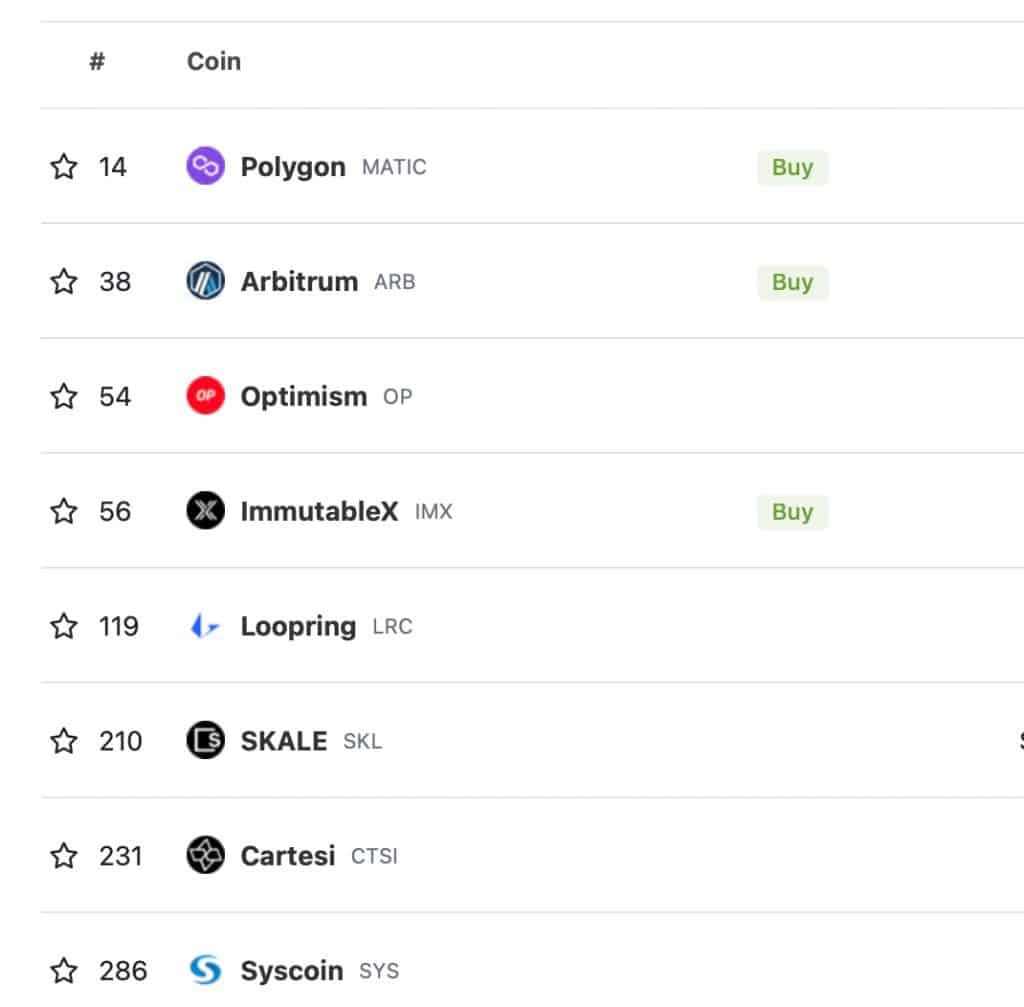

Here are the L2 coins in the top 300 (data from Coinmarketcap.com). There is a clear top 4: Polygon, Arbitrum, Optimism and Immutable X.

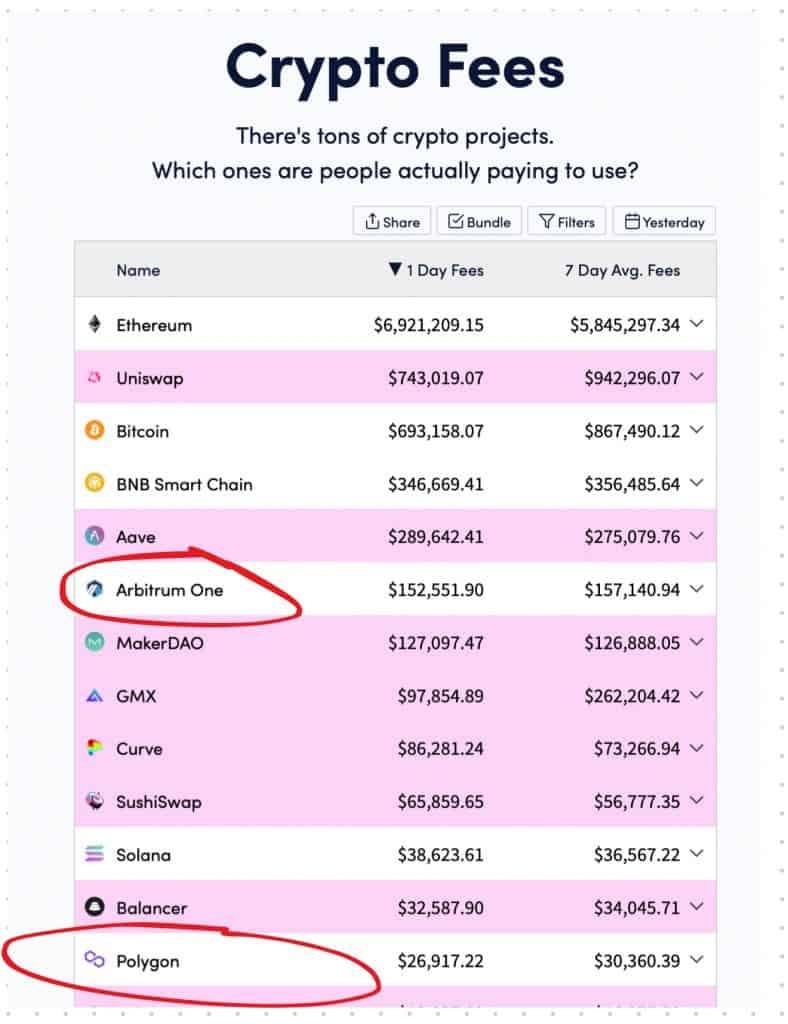

Now let’s look at transaction fees. Which L2s collect meaningful transaction fees?

Arbitrum and Polygon collect meaningful fees. It’s notable that Arbitrum is higher on the fees ladder than on the market cap ladder. You can draw your own conclusions…

Before we move on, it’s important to realize that not every Layer 2 has a token yet. Notably, a month after launch, ZkSync Era is already in third position counting Total Value Locked, partly because of the expected airdrop. ZkSync Era has bet on zero-knowledge (zk) technology as the key requirement for onboarding hundreds of millions of users to Web3 without compromising security.

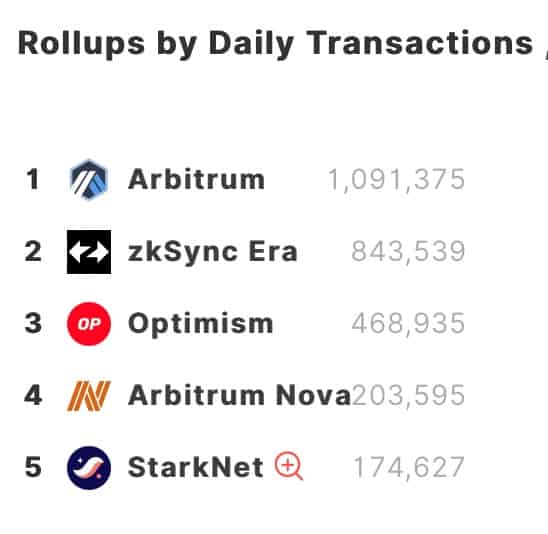

Here is a snapshot of the July 4 2023 daily transaction volumes for all Layer 2’s, including the ones that don’t have a token. Note that zkSync Era is doing great. Also, StarkNet is doing solid.

Delphi Digital has assessed which of the current top 3 L2s (Arbitrum, zkSync Era and Optimism) is the most profitable. They took the spread between the fee revenue generated by the L2 and the price the L2 pays to the L1 (L1 ‘call data security costs’), plus the verification costs for zk-rollups. It turns out that Arbitrum is the most profitable L2.

Being a clear winner on all fronts, let’s dive into friend of the show Arbitrum.

Arbitrum’s Impressive Numbers

It’s no secret: we like Arbitrum. Subscribers of The Wealth Mastery have gotten tons of hints in the pre airdrop phase that this could be a hot one. Arbitrum’s airdrop happened in the second half of March 2023 (almost to the date of ZkSync Era’s launch).

Arbitrum is an Ethereum layer 2 scaling solution, and it uses ETH for gas fees on the network. The stats behind Arbitrum are pretty hard to ignore. Native Arbitrum dapps have really taken off. For example, Radiant Capital is popping off. Many non-native apps have moved over to Arbitrum because it’s where users are going right now. For example, we’ve seen Trader Joe find big success by being an early mover to Arbitrum.

Circle has also teamed up to launch USDC natively on Arbitrum, which brings safer liquidity options and more liquidity directly on-chain.

As mentioned, in terms of fees gathered, Arbitrum is King of Layer 2’s. It makes on average 150 k per day in fees. It leaves most Layer 1’s in the dust.

Let’s look at some key statistics. Below are daily transactions (source: Artemis). Arbitrum is almost at par with the Ethereum main chain: pretty impressive. On some days, Arbitrum transactions exceed the number of transactions on the main chain by as much as a factor of two. Consider that Arbitrum is valued at less than a percent of the market cap of Ethereum.

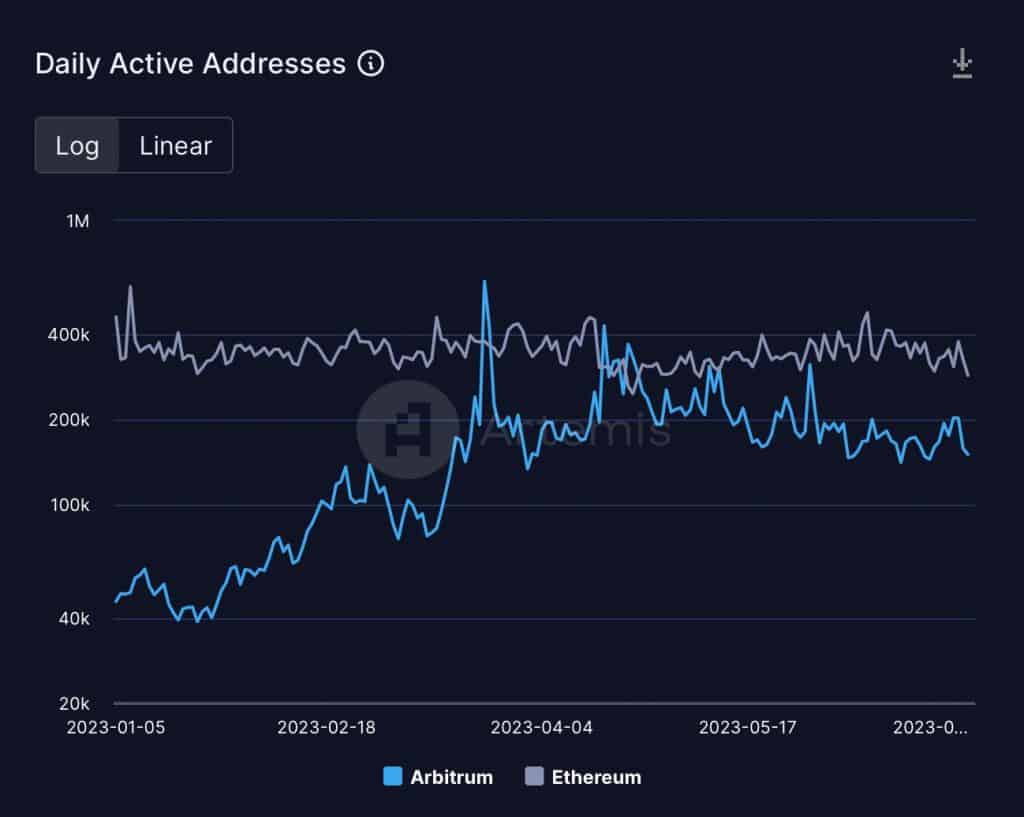

Daily active addresses are either at parity or slightly below Ethereum, which is quite crazy, once again showing that a massive number of users have flooded into the Arbitrum system.

So, why is the price not skyrocketing? Well, altcoins face many headwinds. The regulatory uncertainty in the United States is one. Also, the stage of the market cycle (late bear/early bull market) doesn’t favor altcoins in general.

Taking this into account, you can see ARB price has done quite ok. Measured in ETH (wrapped ETH on Uniswap, to be precise) it hasn’t lost ground hardly at all since launch. That can’t be said for other altcoins in the past few months. ARB price in ETH is slightly below what it was a quarter ago, but it has broken out of a descending wedge, a bullish sign.

Conclusion

The increased use of L2 solutions shows we are already in a Layer 2 Summer of sorts – even though prices don’t show it. Leading L2 solutions are Arbitrum, ZkSync Era and Optimism, with Arbitrum in particular being impressive. Keep an eye on ZkSync Era though, which might airdrop. Ethereum’s upcoming Cancun upgrade (including EIP-4844) will reduce transaction fees, benefiting both Ethereum and L2s. However, for true summer in the city to happen, the crypto market is still waiting for a breakthrough application on L2 that will ignite mainstream adoption.