No Tourists at Bitcoin Amsterdam 2023

TL;DR

In the second week of October, several thousand people gathered in Amsterdam to talk about Bitcoin. This year no ‘tourists’ at Bitcoin Amsterdam 2023, only people that are in it for the … technology. Let’s look at a cross-section of speakers, including some Dutch ones.

Yours truly (green arrow in the image below) has photographic evidence that he was in the crowd of a Bitcoin conference in the depression stage of the market cycle. It was interesting to see that the levels of attendance were lower than the first time the event was organized, in 2022. Even though the Bitcoin price is higher than a year ago (it was mostly below 20k in October 2022), public sentiment and interest are currently lower.

This is to be expected if you look at the market cycle cheat sheet. It’s darkest before dawn.

If that’s true, then the crowd and speakers of Bitcoin Amsterdam 2023 can be called early risers. There was great breadth and depth in the topics. The hall of the main stage, which can hold around 3000 seats, was never full. But the smaller conference rooms were often bulging.

Two Blondes and a Cowboy

Hugh Hendry is the quirky and well-spoken ‘acid capitalist’: a former hedge fund manager. With an ever-present grin, he has a charming way of voicing inconvenient truths to traditional media outlets. In his view, the current financial system is untenable in the way everyone is on the leash of the American Central Bank. He talked to the audience about different economic depressions of the past 200 years and reminded them that innovation ended those depressions. In this case, the innovation could be a new model of trust.

Self-described as someone who ‘doesn’t have the Bitcoin bug’, Hendry reminded the audience teasingly that the market cap of Bitcoin is smaller than Facebook’s. And that’s precisely why he’s invested in BTC, as there’s so much room to the upside. Hendry has bought shares of the Grayscale Bitcoin Trust. It seems to have been a good bet, as the discount has been getting smaller (meaning GBTC has risen faster than Bitcoin itself). Why? Because the expectation is that GBTC will be allowed to convert to a Bitcoin spot ETF, in which case the discount will disappear.

Host Jimmy Song, an OG Bitcoiner, must have bitten his tongue when he heard Hendry’s statement that there is a ‘centralized bogeyman’ in crypto too, referring to Sam Bankman-Fried and Tether. Not realizing he was preaching to the choir – Bitcoiners are no fan of custodial exchanges in general and don’t like Tether precisely because they know they pose centralization risk – was probably forgiven, as he is such a charismatic speaker. And his general point about Bitcoin as an innovative way out of an economic depression, was well taken.

He shared the stage with Eva Vlaardingerbroek, a young Dutch right-wing politician who has been very critical of the Dutch government when it comes to covid policy and, more recently, the intention to curtail the Dutch agrarian sector. She has also been very critical of central bank digital currencies, and thus was a perfect candidate to be orange-pilled by the community. In fact, no other than Saifedean Ammous sent her a copy of The Bitcoin Standard. Eva repeated the danger of centralized monetary systems, where governments can seize assets, as the Canadian government, of all governments, did during the Truckers’ protests against Covid.

The Dutch Crypto Exchange Landscape

The most prominent Dutch crypto podcast team Satoshi Radio interviewed the CEO of the leading Dutch crypto exchange Bitvavo. It might be surprising to foreigners that a local Dutch exchange, founded in 2017 by a few college students, has carved out a niche amidst established US players like Coinbase.

But it did: Bitvavo has 1 million customers: roughly 60% of Dutch crypto investors have an account there. It has traded over 100 B euros in volume since its inception. Nothing to scoff at!

A few points that Nuvelstijn made:

- Dutch crypto exchanges collectively won a case against the Dutch National Bank last year. For the sake of common interests and solid competition, Nuvelstijn hopes the current five or so Dutch crypto exchanges won’t all be acquired by either Bitvavo or international players. Kraken acquired Dutch Coin Meester (BCM), as an example. Bitvavo acquired LiteBit this past summer.

- Upcoming EU crypto law Markets-in-Crypto-Assets (MiCA) will make it easier to onboard clients from different EU countries, making the EU market more competitive. Mergers will happen, comparison sites will pop up, fees will probably go down.

- Also because of MiCA, banks and crypto exchanges in the EU will find common ground. Banks will provide more and crypto services, crypto exchanges more tradfi financial services, such as loans and interest accounts.

Aaron van Wirdum: Author of The Genesis Book

Did you know that eCash, the precursor to Bitcoin launched by David Chaum, was invented in Amsterdam? This is just one of the surprising facts from The Genesis Book. Aaron van Wirdum, Dutch tech journalist and technical editor for Bitcoin Magazine, said the book has been five years in the works.

The book, which can be pre-ordered on bitcoinmagazine.com, will also be available on Amazon. It lays out the ‘prehistory’ of Bitcoin. The book ends where BTC begins, or rather at the point in 2011 when Satoshi called it quits and disappeared.

In his book, he lays out the other forms of e-cash prior to Bitcoin that formed pieces of the puzzle. The book talks also about the emergency of hacker culture in the nineties: the extropians. It was Max Moore, the founder of these extropians who tied together the emergent crypto technology to economic principles from ‘Austrian economist’ Hayak. Then, it was Nick Szabo who ran with the idea. Can’t wait to read this book… so sad I missed the limited edition which was for sale at the conference.

(Here’s the interview with Aaron, but the Talk is in Dutch, just so you know).

Frank Holmes About What You Can Control

American investor Frank Holmes, who had a gold fund in the past, had an interesting talk about macro trends.

Without summarizing his entire talk, here are a few points that will stay with me:

- The Triangle of Conflict: Holmes introduces a “triangle of conflict,” involving heroes, villains, and victims. He points out that the media view themselves as heroes and often cast Bitcoin and crypto miners as the villains, stirring societal conflict (Holmes is also the founder of Bitcoin mining company Hive Blockchain).

- So, what to do about dealing with this conflict? Some people in the Bitcoin community can get very emotional about things like these, outside of their control. Instead, Holmes suggests, they might simply focus on… holding Bitcoin! After all, that is the entire purpose of the invention: it’s something that is under your control!

Holmes’ overarching message is that Bitcoin is an extension of the freedom afforded by private property rights. Bitcoin serves as a check against imbalances in government policies. Indeed, thank God for Bitcoin!

Conclusion: Visit a Crypto Conference

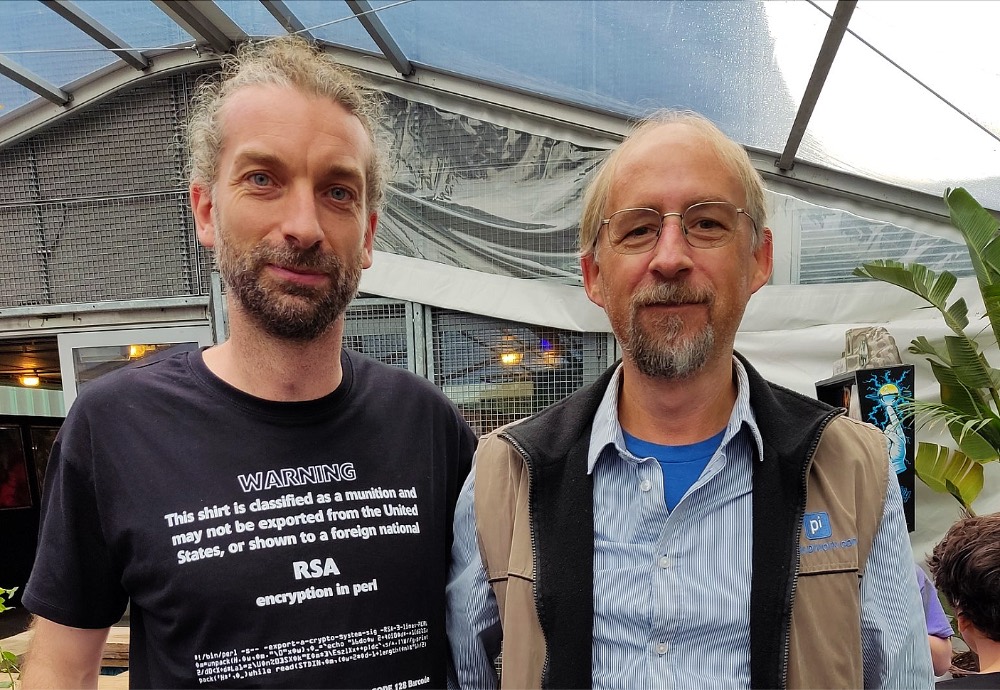

If you haven’t, I would really recommend you go to a Bitcoin conference or crypto conference. Meet a nice blend of international and local crypto enthusiasts. Walk the art gallery, pay for a beer with your Lightning wallet. Shake hands with your favorite podcasters from your own country. Stare in awe, from a distance, at Adam Back, the inventor of proof of work. Ask approachable Bitcoin thinkers like Knut Svanholm or Tuur DeMeester to clarify a quote that you remembered from their books. Visiting a conference is for sure the most fun way to ‘do your own research’.