Ripple Victorious: The Times They Are A-Changin’

TL;DR

Altcoins pumped hard on the news that the SEC essentially lost its case against Ripple, the company behind XRP. The SEC can appeal and probably will, but the verdict from the New York Court is considered thorough and shifts the balance of power in the tug-of-war in favor of the US crypto industry. It is the boost of confidence that the industry needed and it proves that sticking to its guns pays off: the SEC will be held accountable by the courts if it sues without proper legal foundation. The verdict also marks a clear call for regulatory clarity, which will have to come from Congress. That too will be good for crypto in the US.

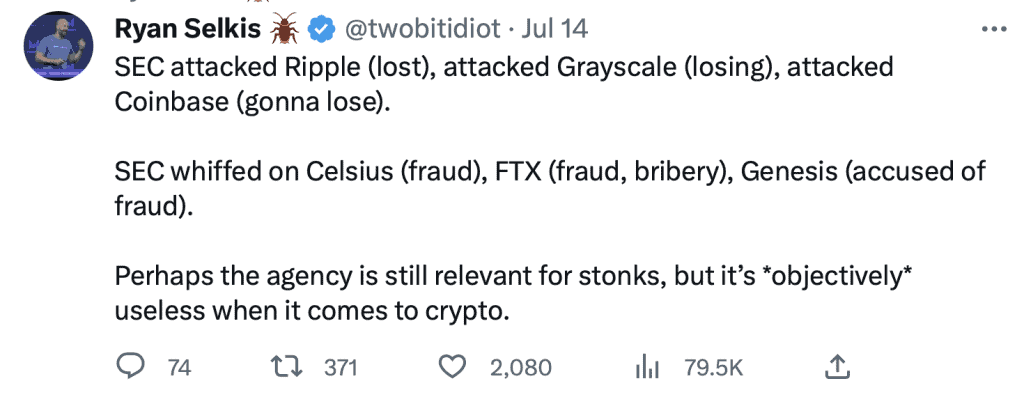

Ripple’s victory is considered a big deal and not just in the crypto community. Traditional media agree that last week’s ruling in favor of Ripple Labs and against the financial watchdog SEC is big. ‘A key legal victory’ says a CNN headline. ‘A landmark win’ says Reuters. Crypto Twitter is not just victorious but vindictive: ‘FY Gensler’. It is indeed a big win for Ripple, American crypto exchanges, and altcoins in general.

A key part of the ruling of the New York District Court’s Judge was that crypto exchanges that allowed trading of Ripple’s token XRP were NOT engaging in listing an unregistered security. Selling a security comes with strict requirements: disclosure requirements and all kinds of compliance that most crypto projects don’t adhere to. The securities laws, from the 1930s don’t seem to be fit for this new asset class.

Why is this News Big?

First of all, if Ripple’s XRP is not considered a security then it’s hard to imagine which altcoin will. After all, Ripple is one of the most company-like, and least decentralized crypto projects.

As Paul Grewal pointed out in an interview:

“Particularly the portion [of the verdict] dealing with trading on exchanges: look for all the references to XRP and just swap out the letters XRP and swap in MATIC, Cardano – I mean you could pick any number of assets including those that are at issue in our [Coinbases’] case. The logic holds. There’s nothing different about the tokens that would change any of the Judge’s analysis. That’s why this thing is such a blockbuster.”

So, US crypto investors no longer have to feel like they are potentially doing something against securities laws.

“For exchanges, for tokens that are listed on exchanges, for regular investors, this ruling strikes a blow to the idea that somehow securities are being traded when people go onto exchanges and trade the assets,” Paul Grewal, chief legal officer at Coinbase, said on CNBC.

What does this mean in practice? A few weeks ago, Robinhood delisted coins ADA, SOL and MATIC. XRP was already long ago delisted by American exchanges such as Coinbase and Kraken. After the verdict, these exchanges relisted XRP. And the current ruling makes it of course likely that Robinhood will make a similar move with respect to mentioned alts.

Background of the Case

In December 2020, the American Securities and Exchange Commission (SEC) started legal action against Ripple Labs. The heart of the matter was whether XRP is a so-called security or not. If so, then Ripple would have breached the securities laws. Issuing a security comes with all kinds of regulatory requirements.

The American SEC uses the so-called Howey Test to determine what qualifies as an “investment contract” and would therefore be subject to U.S. securities laws. An investment contract exists if there is an “investment of money in a common enterprise with a reasonable expectation of profits to be derived from the efforts of others.” BTC is not considered a security by the SEC, but instead a commodity.

XRP is an odd duck among crypto coins. For one thing, the XRP Ledger doesn’t use proof-of-work or proof-of-stake. Instead, it is maintained by independent participants that are approved first. In other words, it’s not permissionless like Bitcoin and Ethereum and it isn’t decentralized. Ripple Labs (which has issued shares) views its payment system as an alternative to SWIFT and wants to draw in clients like (Central) Banks. No wonder that most crypto fans are no fans of XRP, even though the project has its army of shillers.

The Verdict in Brief

- Ripple putting XRP on exchanges for trading is not an investment contract/security.

- Ripple paying people in XRP is not an investment contract/security.

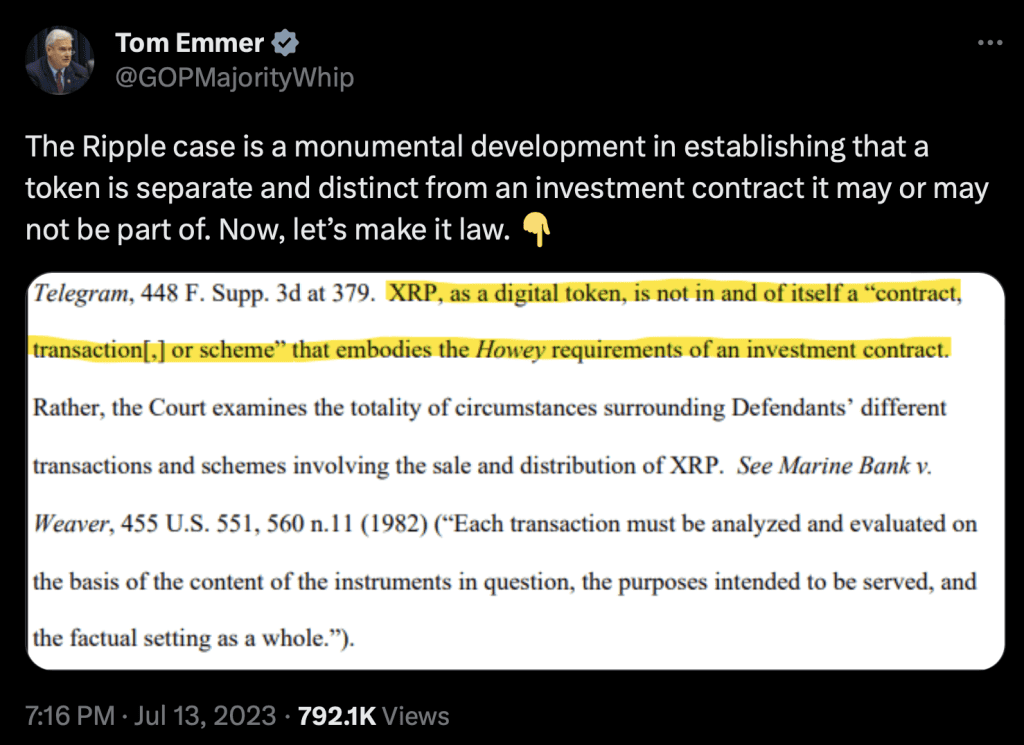

- XRP is not a security in and of itself even when offered through a securities transaction.

- However, Ripple selling XRP the investment contract to institutional investors in the early days, was an investment contract, and thus a security. This was illegal.

In brief: a crypto asset may initially be sold as part of an investment contract (ticking the boxes as a security) and then later be resold as a non-security. Any commodity (gold, art, whiskey, whatever) or coin may be sold under certain promises and commitments by the seller, which qualify it as a security. But if this commodity or coin is then later resold, these qualifications may no longer apply.

Implications for Crypto in the US

It is considered likely that the SEC will try to immediately appeal this decision to the Second Circuit. But even if the second circuit reverses some of the judge’s findings, it could take years until we get there.

In the meantime, the verdict is a big blow for forces in D.C. that want to ban crypto. It is likely that the anti-crypto armies will have to deal with a legislative agreement that is permissive to crypto assets. After all, that’s what you get if you play the high-stakes game of going to court and it backfires. Another more recent SEC court case revolves around Coinbase. The SEC recently sued and there are signs that things are not going great for the SEC. The SEC claimed Coinbase acted as a middleman trading crypto assets, such as Solana, Cardano and Polygon that should have been registered as securities. This case isn’t strengthened – to say the least – by the Ripple ruling. Not to mention the fact that the SEC had already approved Coinbase’s listing on the stock exchange in 2021 – so it contradicted its earlier approval.

In the words of John Rizzo, a former spokesperson for the U.S. Department of the Treasury:

Far from achieving the end of crypto in America, the SEC’s attempt to cripple crypto in America may lead to a bipartisan regulatory framework that engrains crypto more deeply into the economy than once thought possible – a bad day for those who banked on a strategy of killing crypto assets in America, indeed.

The timing of the ruling is nice, as American Congress feels the urge to put a regulatory framework around crypto assets just like the EU has already done.

This is also the objective of Congressman Tom Emmer, a fierce critic of SEC Chairman Gary Gensler. ‘Now let’s make it law’. Namely, the ruling that a coin is not in itself an investment contract.

Conclusion

The existing framework of financial regulators like SEC is to view the decision if something is a security or not as a binary thing. It either is or isn’t. This NY district court ruling has said – for the first time: it depends on the context. This is a big shift in perspective and is much needed for the future regulation of tokens/coins. After all, they are a new asset class that doesn’t fit in the century-old securities legal framework. Unlike equities and bonds, tokens on a blockchain can be more than a claim on a company’s earnings and assets.

Regulation will have to adapt to this new reality and this verdict is a first step, however the potential appeal of the SEC unfolds. There is bipartisan legislation underway, and this ruling can inform and speed up that process.

The anti-crypto army no longer has a realistic chance of winning in the US. The times, they are a-chaingin’.