The ApeX Pro Exchange: Definitive How-To Guide

If you’re looking for an action packed crypto how-to guide for using the ApeX Pro exchange, then you’ve come to the right place. In this article, we will give you:

- An overview of what exactly is ApeX;

- How to connect to the exchange;

- How to deposit and withdraw funds; and,

- How to execute a trade.

In the trading How-To, I execute a BTC-USDC 20x leverage long trade. Good times! So, this article should give you a good feel and sense of how this exchange works in practice. Furthermore – and even more so due to the recent FTX cluster – ApeX is a genuinely exciting innovation when it comes to the decentralized exchange (DEX) space. I’ll explain why below.

Ok, let’s get it.

What is the ApeX Pro Exchange

Before diving into the platform, take a minute to understand what ApeX actually is and how it works.

ApeX Pro is a non-custodial, private, decentralized crypto-currency derivatives trading platform. The exchange offers traders access to USDC-denominated, cross-margin, perpetual contracts via an order book trading model. ApeX Pro operates on Arbitrum, a Layer 2 scaling solution for Ethereum. It utilizes the StarkEx Scalability Engine and Validium, both of which allow for secure, fast, and low-gas fee trades on the platform.

That was a mouth-full. Let’s break it down.

- Non-Custodial: ApeX Pro doesn’t custody your funds. Instead, funds are held on Arbitrum Layer 2 in StarkEx’s smart contracts. Users retain full control over their funds. No FTX nightmares with ApeX Pro.

- Private: ApeX Pro is a permissionless DEX. Meaning there is no KYC. It’s 100% private. Simply connect your Web3 wallet to the platform and start trading with total anonymity.

- DEX + Order Book = ApeX Pro. ApeX Pro is innovative because it combines the benefits of a DEX and an order book model into one platform. DEXs offer traders enhanced security and transparency, while order book models provide enhanced trading insight and trading optionalities.

- USDC-Denominated, Cross-Margin, Perpetual Contracts: For trading, ApeX currently offers BTC, ETH, XRP, ATOM, and DOGE, cross-margin, perpetual contracts. All are denominated in USDC. Trades are available with up to 20x leverage. See the Glossary of Terms at end of the article if unfamiliar with cross-margin, perpetual contracts, or leverage.

- Secure: The StarkEx scalability engine, developed by Starkware, utilizes ZK rollup technology to securely process ApeX Pro trades on the Arbitrum Layer 2 network. The transactions are then sent over to the Ethereum network for verification.

- Multi-Chain Access and Support: Currently, ApeX Pro is compatible with Arbitrum, Ethereum (ETH), Binance Chain (BNB), and Polygon (MATIC) for deposits and withdrawals. Because the platform is compatible with all EVM chains, more networks might be added in the future.

How to Use the ApeX Pro Exchange

Now that you understand the high level ideas behind ApeX, let’s see how to get connected, deposit and withdraw funds, and execute trades.

Getting Connected

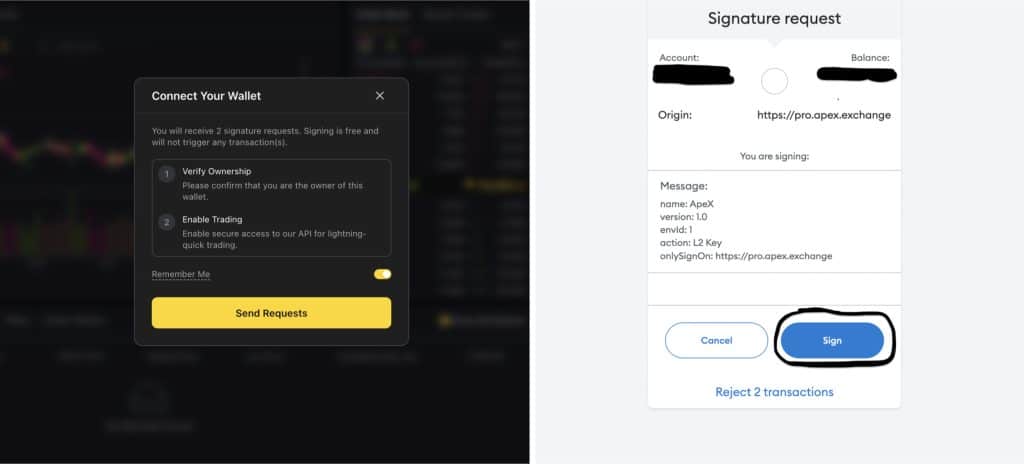

Is ApeX Pro the World’s easiest exchange to connect to? Probably. Here’s how you connect to ApeX Pro in four easy steps. With your Web3 wallet already open:

- Open the ApeX Exchange.

- Press “Connect Wallet”.

- Choose your network and wallet.

- Click “Send [Signature] Requests” from ApeX to your wallet. Sign the two requests in your wallet. You’re done!

Depositing Funds

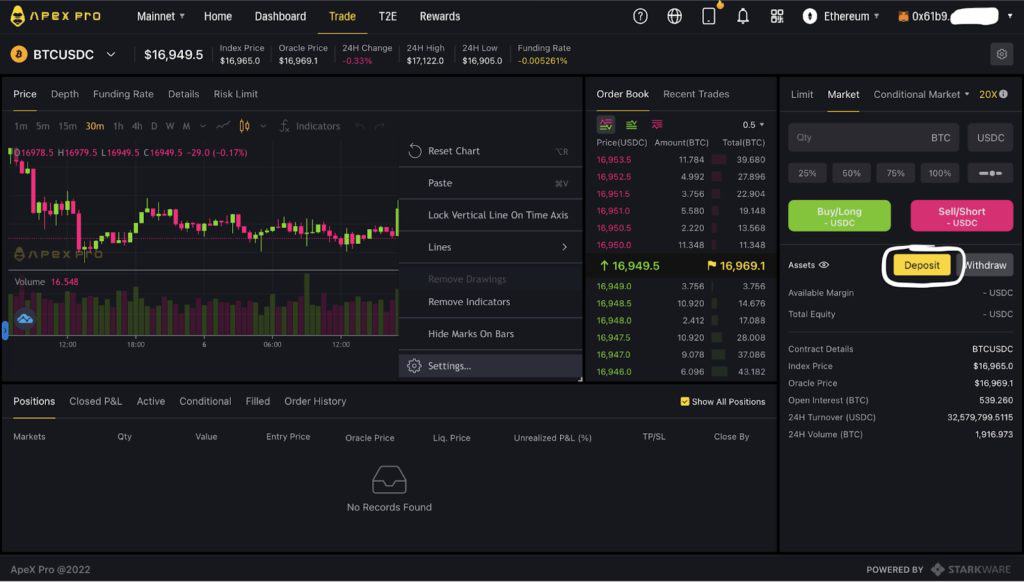

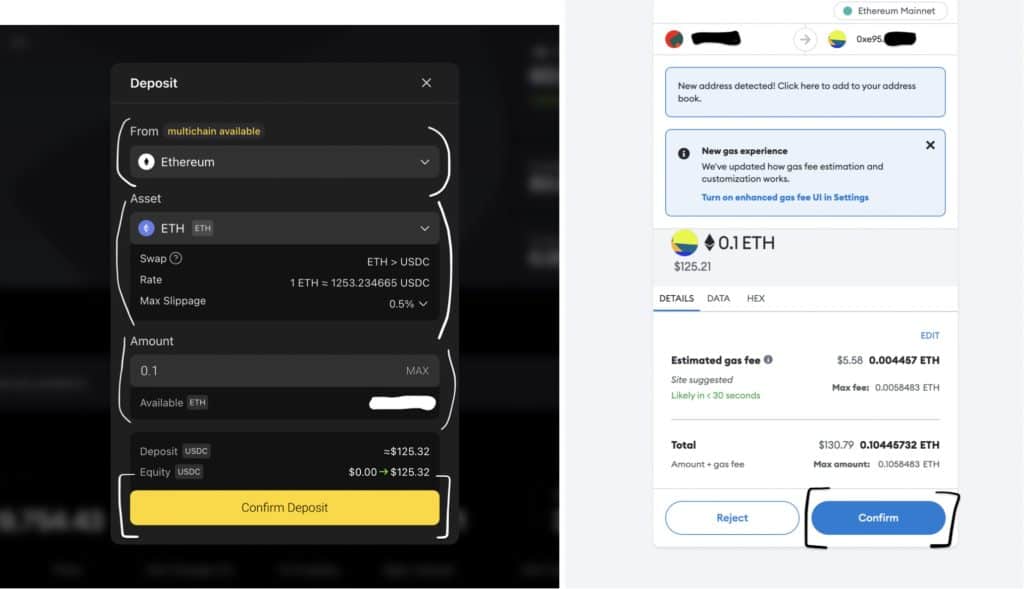

Depositing funds is a breeze. Click “Deposit” on your exchange interface, select your desired chain, asset, and deposit amount, and click the confirm icons on ApeX and your wallet. Done.

Because all contracts are denominated in USDC, ApeX automatically converts all deposited cryptos in USDC for your trading. Crypto typically takes about 5 minutes to appear and be available for trading.

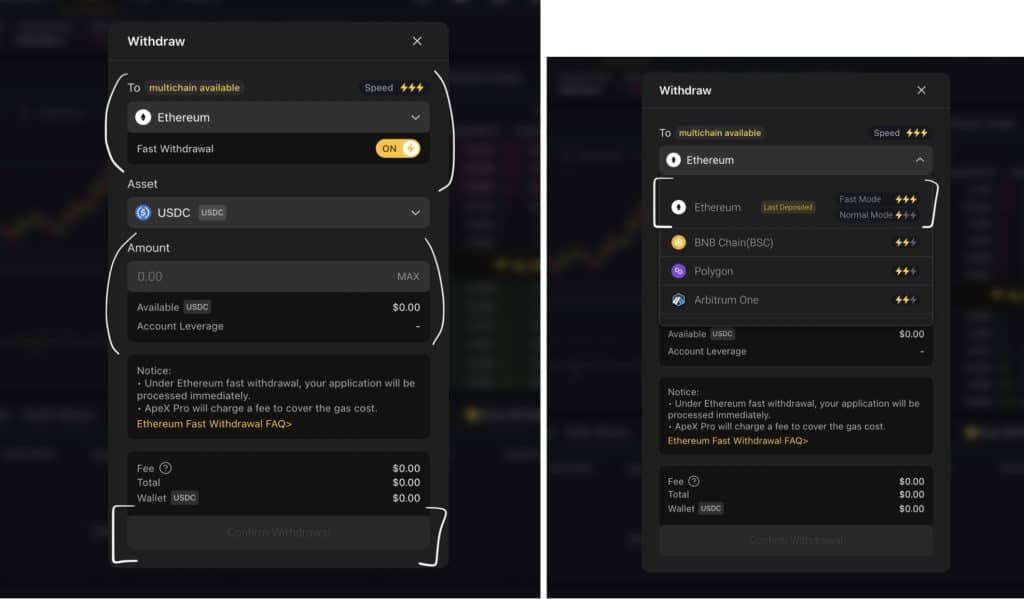

Withdrawing Funds

To withdraw funds, click the “Withdrawal” icon, select your chain, and the desired withdrawal amount. Since all exchange funds are denominated in USDC, only USDC can be withdrawn. Confirm the withdrawal on both the exchange and your wallet.

For Ethereum Network withdrawals, users have the option to make “Fast” or “Normal” withdrawals. These two methods utilize different Layer 2 mechanisms under the hood, but here’s what you need to know:

- Fast Withdrawals: Funds are immediately sent to the Ethereum blockchain via a Layer 2 liquidity provider, and users will receive their funds once verified on-chain. This process should take approximately five minutes. As a fee for the expedited withdrawal, users must pay a bit higher gas fee and 0.1% of the total withdrawal amount. Users can send up to $50,000 in a fast withdrawal.

- Normal Withdrawals: This withdrawal process follows the normal Layer 2 and Layer 1 processing and verification order. Users pay lower gas fees and should expect their funds in approximately 4 hours.

Trading

Here’s how to easily execute trades with ApeX Pro in three easy steps. See the glossary if unfamiliar with any of the terms used.

- Select your desired trading contract. That’s found in the drop-down menu at the upper left of your screen. For this example, we will use BTC-USDC.

- Fill out your trade order. Choose either a long or short trade. Select either a Limit, Market, or Conditional Market order. Select how much USDC you want to use. Click submit.

Your trade is now open!

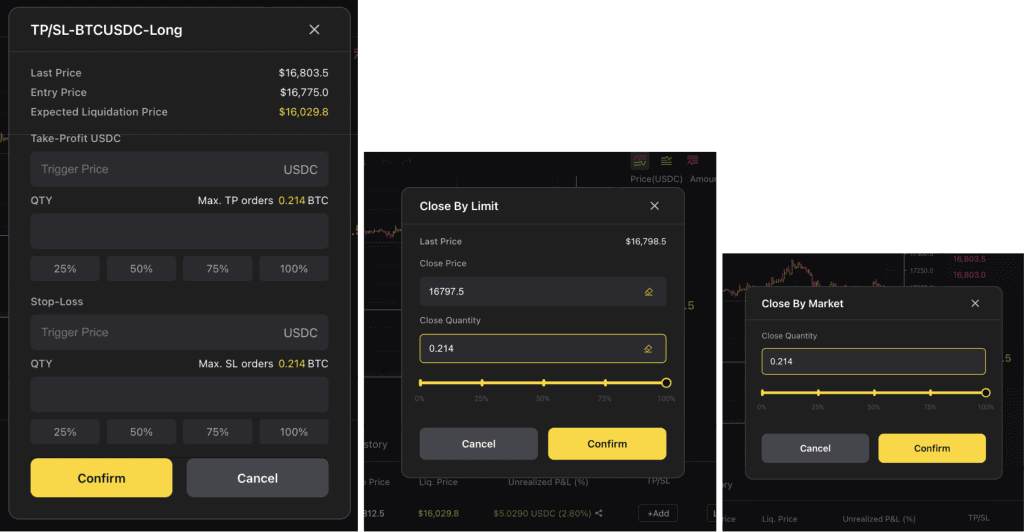

For this trade, I longed BTC with approximately 180 USDC at 20x leverage. Notice the position status window at the bottom of the screen shot. ApeX Pro shows your leverage order details, liquidation price, and updated unrealized P&L. The position status window is also how you close out your trade.

- To close out your trade, set your take profit and stop loss limit, or set your sell limit. If for some reason you need to immediately close out your position, click “Market” and close it.

These are the trading essentials for ApeX! No BS, their trading system and user-interface is incredibly simple, clean, and straightforward. I love it.

Trade to Earn

By now, you understand the core components for how to use ApeX. Let’s quickly look at how to use one other ApeX ancillary product.

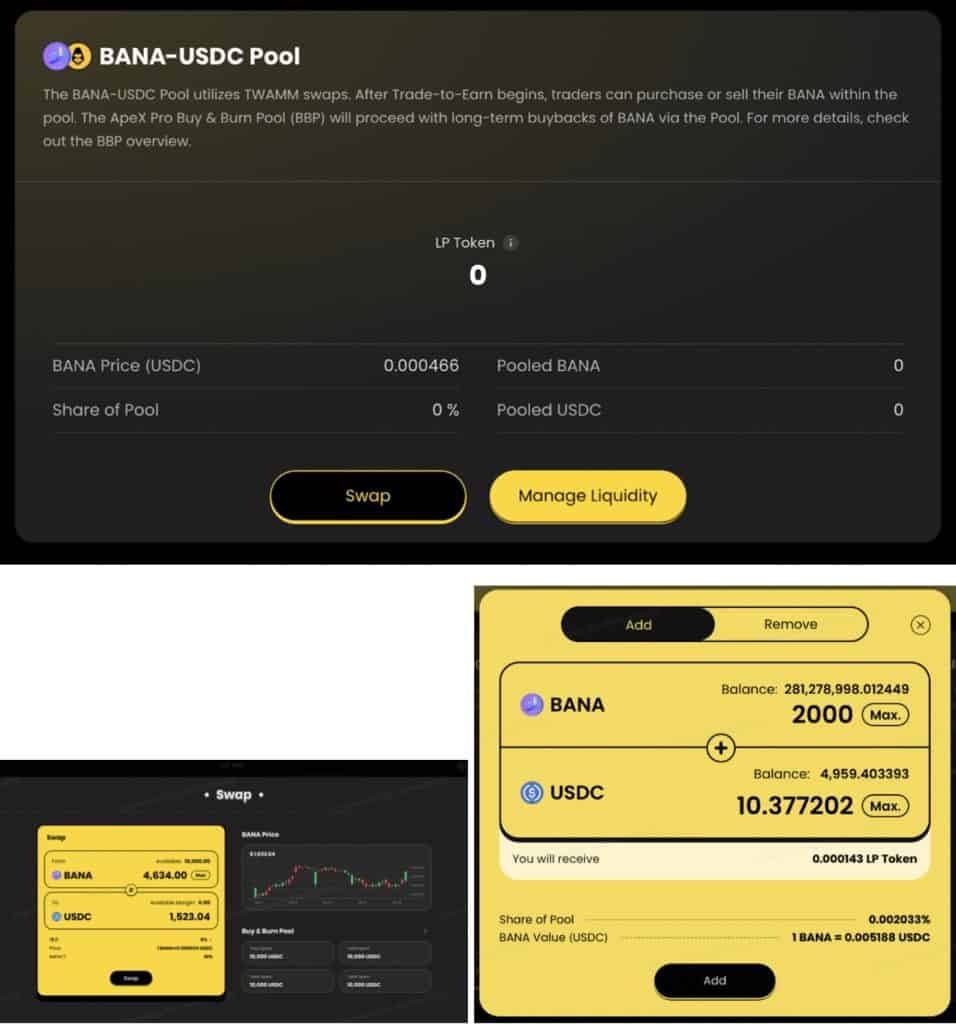

Trade to Earn is a simple method for traders to easily earn BANA, ApeX’s reward token. Traders automatically receive BANA just by making trades. In the screen-shot, you can see my estimated rewards automatically calculated for my trades thus far.

The program works within a 52 week epoch system. Your BANA is unlocked at the end of each week and available for sale into USDC. Alternatively, you can elect to hold your BANA for a full year, at which point you can swap for ApeX’s governance token, APEX.

If you want to sell your BANA, or use it for passive income in the BANA-USDC liquidity pool, at the bottom of the Trade to Earn sub-page, simply either use the swap or manage liquidity icons to do either. Both of the swap and LP options provide traders a way to make a bit of passive income off their trades.

Conclusion

This How-To guide should show just how easy and simple ApeX is to use.

Getting connected and depositing funds was the easiest experience I’ve had out of any exchange. The streamlined and simple trading interface was refreshing. I feel like it gives me enough optionality to make a sophisticated trade (and protect myself), but not so much that I feel overwhelmed.

This will be elaborated further in another article, but I think ApeX’s decentralized + order book format is a real, needed innovation. The decentralization can’t be understated, especially given the recent FTX debacle. And for multiple reasons, the order book format is ideal for hard-core traders. This really is an innovative combination.

Glossary of Terms

- Cross Margin: Margin is your collateral. Cross-margin means the entire available balance under your account will be used to meet margin requirements. Thus, your entire account is at risk for liquidation if your trade goes the wrong way. Stop Loss Army Unite!!!

- Leverage: Financial tool allowing traders to increase their market exposure beyond their initial investment. For example, 20X leverage means a trader can enter a position for $20,000 worth of BTC with only $1,000 of collateral. Remember, the odds of gains, losses, and liquidation exponentially increase as leverage increases.

- Market Order: An order to buy or sell an asset at the current market price.

- Limit Order: This is an order to buy or sell at a specific price. The asset will not be bought or sold until it is triggered by that price.

- Conditional Order: Either a conditional limit or conditional market order to buy or sell an asset that only takes effect only once a certain trigger price condition has been met.

- Perpetual Contracts: A perpetual contract is an agreement with another party to buy or sell an underlying asset at a predetermined price. The contract follows the price action of the asset, but the actual asset is never owned or traded. Perpetual contracts have no expiry date.

- Take Profit: A profit exit strategy which ensures that the trade is automatically closed once the asset hits a certain profitable price.

- Stop Loss: A risk management tool that automatically closes the trader’s position at a loss in case the trade goes the wrong way. Stop losses are used to avoid substantial losses or liquidation. It’s better to trim a bit off the top than be scalped. Use them.