The Upcoming Ethereum Merge (ETH 2.0): What will it mean for Ethereum?

Ethereum developers get harassed with this question. The Merge, often postponed but now seemingly really close, is expected to happen in the second half of 2022. The Ethereum network will switch from a proof-of-work security model to proof-of-stake. What will be the consequences for perception and price of Ethereum?

The Ethereum Merge refers to the merging of the current Ethereum blockchain and the chain that is now running in parallel and being tested: the Beacon chain. This Beacon chain, which is based on Proof-of-stake (PoS), will after the Merge become the main chain. It will, as it were, swallow the old chain, including its entire history. The miners can then switch off their equipment and Ethereum will use more than 99% less energy. Users won’t notice a thing – hopefully! But for the price, this might be a big thing.

Here are the key things to think about for Ethereum’s merge with the Beacon chain.

What is Proof-of-Stake

Proof-of-stake (PoS) is a way of securing the network by allowing (in this case) Ether (ETH) owners to stake a certain amount of their holdings as collateral to validate transactions. And get paid out for doing so. View it as a dividend for their trouble. Malicious validators who don’t play by the rules risk having their collateral “slashed”, or taken offline.

Compare it to Ethereum’s current consensus mechanism (proof-of-work), which incentivizes miners to stay honest by putting in computational work in exchange for their rewards in Ether. After the Ethereum Merge, participants can only be paid out in Ether for staking (locking up) their ETH as block proposers/validators. The amount of ETH at stake is what ensures a PoS network’s economic security.

Lower Gas Fees? Not Yet

The Merge will be a milestone on Ethereum’s roadmap. But because it’s an upgrade under the hood, it won’t matter for usability. For example, lower gas fees are not to be expected after the Merge. Only when the next step of Ethereum’s roadmap will be implemented (sharding), will the amount of block space/ network capacity improve dramatically and allow for lower fees.

Read Erik’s article on Ethereum’s Roadmap for the coming years here.

Staking Yields Going Up

So how high will the percentage for staking post-Merge be? This is a hotly contested debate (and fun passtime). Currently, stakers are only earning the Beacon chain validator rewards. However, once the Merge of Ethereum is complete, staking rewards are a sum of not just block rewards but also tips and Miner Extractable Value. Crucially, the staking rewards will depend on the amount of ETH being staked. The higher this is, the lower the yield. We can’t all get rich, after all!

Based on the current amount of ETH staked, ETH staking yields post-Merge are estimated to be around 10% – that’s at least a figure that pops up most often across analysts. BUT. It is likely that after a successful Ethereum Merge, more Ether holders will stake their coins, which will lead to lower staking rewards. In the long-run they are projected to settle around 4-5%. Still pretty sweet!

Interesting Read: How to Stake Ethereum | A Complete Guide on Staking ETH

Ether Will Become Deflationary: Number go up?

The reason why Ethereum proponents have begun referring to Ether as ‘ultra sound money’ is that the issuance of new ETH will not only diminish post-Merge – Ether will actually become deflationary. There is also the fundamental different nature of the issuance. Post-merge, Ethereum will move from a ‘mine-and-dump’ economy to a ‘stake-and-hodl economy’.

Until the Merge, the block reward for miners is about 13.000 Ether per day. After the Merge, not only will the miners cease being a source of sell pressure – also, the new amount of ETH issued will drop to only 1500 per day. This 90% or so reduction equates to roughly three Bitcoin halvings. Hence: this change is sometimes referred to as: the triple halving. Subtract from that the 8000 or so burned ETH per day, and your back-of-the-napkin will tell you the amount of ETH in existence will drop with roughly 1-2% per year.

So will this large ‘supply sink’ post-Merge lead to a price jump? It just might. A successful merge will add up to: more belief + less supply. That could set up for a nice reflexive loop of price appreciation. Having said that, we face some unpredictable market circumstances. If the Merge should occur during peak economic uncertainty, at the bottom of the crypto bear market, then it’s hard to imagine how even good news will really move the price. Plus, in markets it is a known phenomenon of reverse-psychology that anticipated good news – provided it was anticipated – marks the top. ‘Buy the rumor, sell the news’… Also, we know from Bitcoin halvings that they take time to have an effect on the price.

We’ll have to wait and see if it’s the case here.

Huge Sell Pressure? Probably Not

Another concern in terms of price is the great number of users who will be allowed to unstake and sell post-Merge. However, this won’t be possible until Ethereum’s next hard fork, scheduled for another 6-12 months after the Merge.

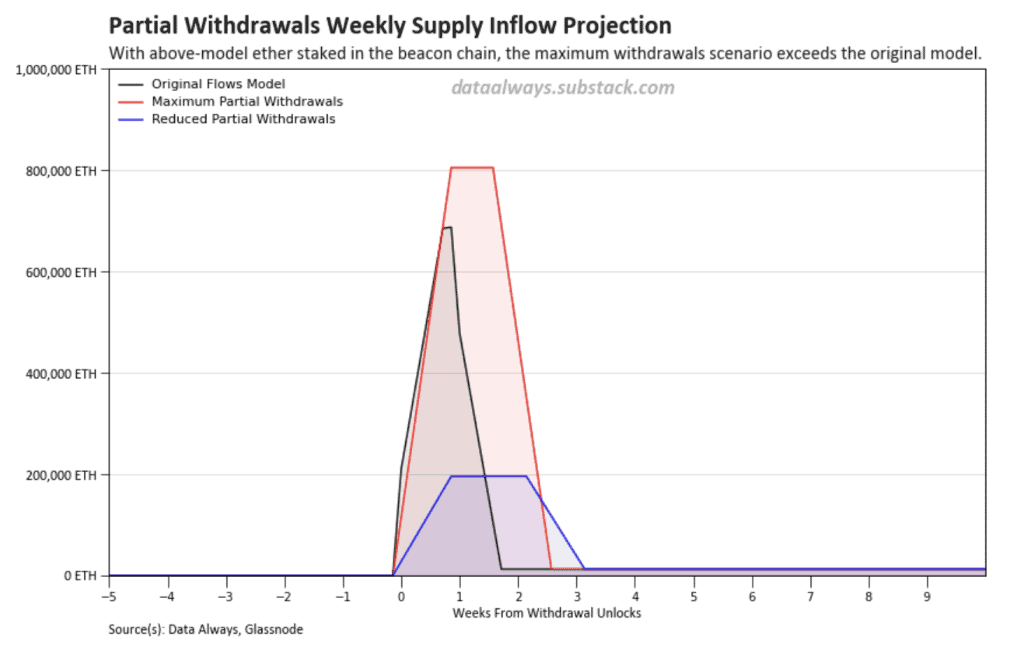

Even then, it won’t be an all at once event. Users who staked and locked their ETH to a Beacon chain validator will be allowed to partially withdraw (allowing them to ‘scalp’ profits from their validator so that their stake is exactly 32 ETH again) or fully withdraw. According to this analysis of post-Merge sell pressure, a rough estimate for the amount of ETH that will be sold by validators that use the partial withdrawal option will be in the ballpark of 28,000 ETH per day in the first days post-Merge. Compare that to the current sell pressure by miners of 14,000 ETH and the excess supply isn’t anything shocking.

Another, more unpredictable factor is the option to fully withdraw. Per protocol, validators can’t do this all at once, as it would cause instability. But still, a panicky exit would lead to exit queues and prolonged sell pressure. Although there is no reason to think this has a high probability of happening, it is a price risk.

Consensus Risks of Ethereum Merge

Risks with the transition to PoS are not just software risks and price risks, but also game-theoretic, ‘consensus’ type risks. Bitcoin maximalists are not shy pointing this out. They might have a case when they point to the risk of concentration of power into the hands of large ‘stakeholders’, for example large staking pools. Also, the next step in the roadmap (sharding) will make Ethereum node operation costlier and might reduce accessibility and individual (non-institutional) impact. Not good for decentralization.

Ethereum proponents might counter with the argument that the move to PoS increases the number of validators compared to the current number of miners. There are already 400,000 validators on the Beacon chain.

Liquid Staking

Liquid staking is another development the effects of which are yet to play out. After all, you know defi is gonna defi… so it’s no surprise that there are protocols that have tokenized staked ETH. These so-called Liquid Staking Pools run validators on their depositor’s behalf. They collect ETH, stake it and issue a token, such as stEth. This token offers yet another source of yield for depositors. This setup makes for a source of market turmoil in an already stressful time for defi. What if big holders want to sell their stEth (Celsius, anyone?) How much will stEth depeg in that case in a market that is not so liquid?

But besides the above, liquid staking creates another type of risk. Ethereum developer Danny Ryan points to the risk of centralization. “If pooled stake under one liquid staking protocol exceeds 50%, this pooled staked gains the ability to censor blocks.” In his view, Liquid Staking Pools, like Lido, should self-restrain and not attract too big a percentage of the staked ETH.

A Peek Into a Post-Merge World

The Merge of Ethereum is a massively complex project that hasn’t been undertaken before. It has taken six times longer than originally thought. Vitalik Buterin has pointed to the fact that the jump in the amount of software complexity between PoW en PoS is one or two orders of magnitude (10x – 100x). That’s wild.

So will they pull it off? Post Merge, all eyes will be on Ethereum. Sure, champagne bottles will be popped after the first few successful blocks. Deservedly so. But our scrutiny won’t be over just yet. There are some ‘unknown unknowns’ that we can’t immediately rule out. Consider the 7 block reorg (temporary fork) that occurred on the Beacon Chain in May 2022. It was the consequence of different clients running different updates. It wasn’t anything serious and it probably won’t happen again now that it is known what caused it. But the point is: it wasn’t anticipated – it came out of nowhere.

Now for the bull case. Suppose the Merge goes basically flawless and blocks will keep stacking in the months and years to come. What would this mean? Well, assuming that Ether will stay a dominant player in the Layer 1 world (there’s no reason to assume why not) then we would expect the price to rise in the long run. It’s a crucial step towards more scalability which equals more users. Add to that the deflationary pressure post-Merge, which is fuel to the fire. Miners being replaced by stakers is a good development for price. Miners are sellers, stakers are holders.

Interest from Institutional Investors?

Remember that, from an investor’s point of view, Ethereum will be a fundamentally different thing after the Merge. It’s not the miners any longer who get paid. Instead, Ethereum can become a source of passive income for everyone. Both retail investors and … possibly institutional investors? Let’s look at that possibility.

Are the institutions coming? There is a case to be made for staking Ether going on the radar of institutional investors. It’s an ‘internet bond’ but with higher yields than traditional bonds. Also, it fits better into the environmentally-friendly narrative than Bitcoin. As with traditional bonds, staking is basically an agreement between the bond issuer (the state or, in Ethereum, the protocol) and the bondholder (or, in Ethereum, the validator).

Just as a country has certain industries, Ethereum’s main industries right now are Decentralized Finance (DeFi) and NFT’s. Many more industries will likely follow. So an ‘Ethereum bond’ will be safe as long as there remains demand for the network, more precisely for block space. What institutional investor wouldn’t want to invest in that and draw yield from it? That is… if traditional investors are comfortable with smart contract risk – bugs in the software. Maybe, but maybe not. We’ll have to wait and see. In any case, we retail investors don’t need the nod of approval of the institutions. Oh no sir. We are happy to stake on our own account.

Responses