What the Dollar Milkshake Theory Implies For Gold and Bitcoin

TL;DR

The dollar milkshake theory states that the dollar will gain strength in the short to medium term. The inventor of the term, Brent Johnson, believes that the current fiat money system will inevitably fail, but that the dollar will gain strength until that time, and will collapse last. At that point, hard assets like gold (and Bitcoin?) could rise sharply. But until that time, the dollar isn’t going away, despite what you might hear about de-dollarization.

Let’s start with a meme that Johnson also invokes. In the 80s cult classic Highlander, an ancient clan of immortal warriors battling to the death. Only beheading will kill an immortal for good. Kurgan is the villain under these immortals, while MacLeod (the lead is played by Christopher Lambert) is the hero.

(Before the extravagant name of the theory and the memes in this piece throw you off, let’s first establish that Brent Johnson runs a hedge fund and has over twenty years of experience in the capital markets.)

The Highlander meme, where MacLeod is the last man standing, often pops up in crypto and in currency discussions in general. Why? Here’s the parallel. All immortals share the belief that “In the end, there can be only one” and the prize is the power of all the immortals through time. This rings true to the world of currency, where a dominant currency tends to dominate and suck out the energy from the others.

Just see what’s happening now to weaker currencies like the Argentine peso and the Turkish Lira. The dollar sucks them dry. According to Brent Johnson, in the coming years the dollar will do this to all currencies. Just like the villain warrior Kurgan, the dollar will first kill all other currencies. Only then the final showdown will happen, between gold and the dollar. Gold will win. Johnson is not a Bitcoiner, but as crypto enthusiasts, we can insert Bitcoin in the place of gold in this narrative. It shares many of the same properties.

Signs of De-Dollarization: Not So Fast

But why would the dollar suck up money from the worldwide capital market? Isn’t that idea absolute? Aren’t we in a trend of de-dollarization? Let’s first have a look at a theme that has been popping up a lot in recent months: the trend of de-dollarization. Are countries saying goodbye to the dollar?

It is true that some shifts are happening. Talks between India and China about abandoning the dollar for their trade are advanced and BRICS countries are developing a joint currency.

Some concrete examples of de-dollarization:

- Brazil has agreed with China to settle their mutual trade in their own currencies.

- Kenya will settle the purchase of oil from Saudi Arabia in its own shilling.

- Russia will use the Chinese yuan for trade with Asia, Africa, and Latin America.

- France purchased gas from China with the yuan instead of the dollar for the first time.

This is leading to alarmist messages about the dollar. But is the dollar’s hegemony ‘crumbling’, as some would have it?

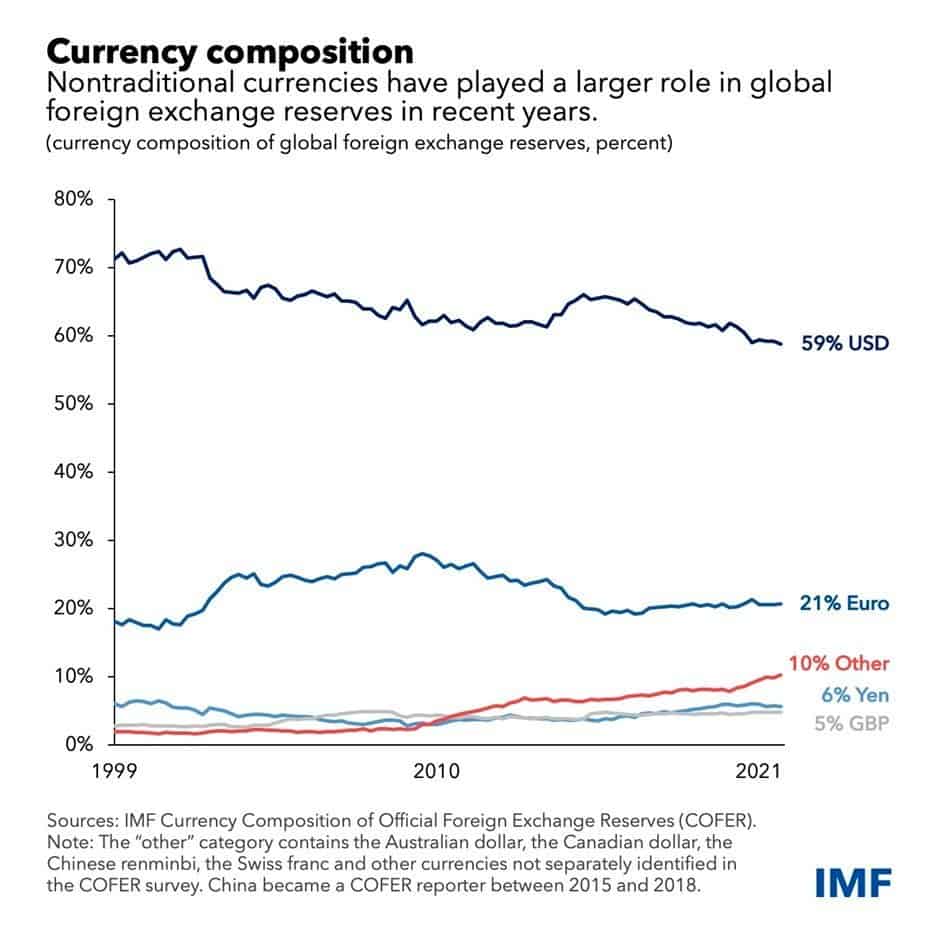

Not so fast. Sure, various countries would like to see a different balance. But just take a look at the IMF, which monitors the composition of international reserves. These consist mainly of dollars. The share is declining, but not dramatically.

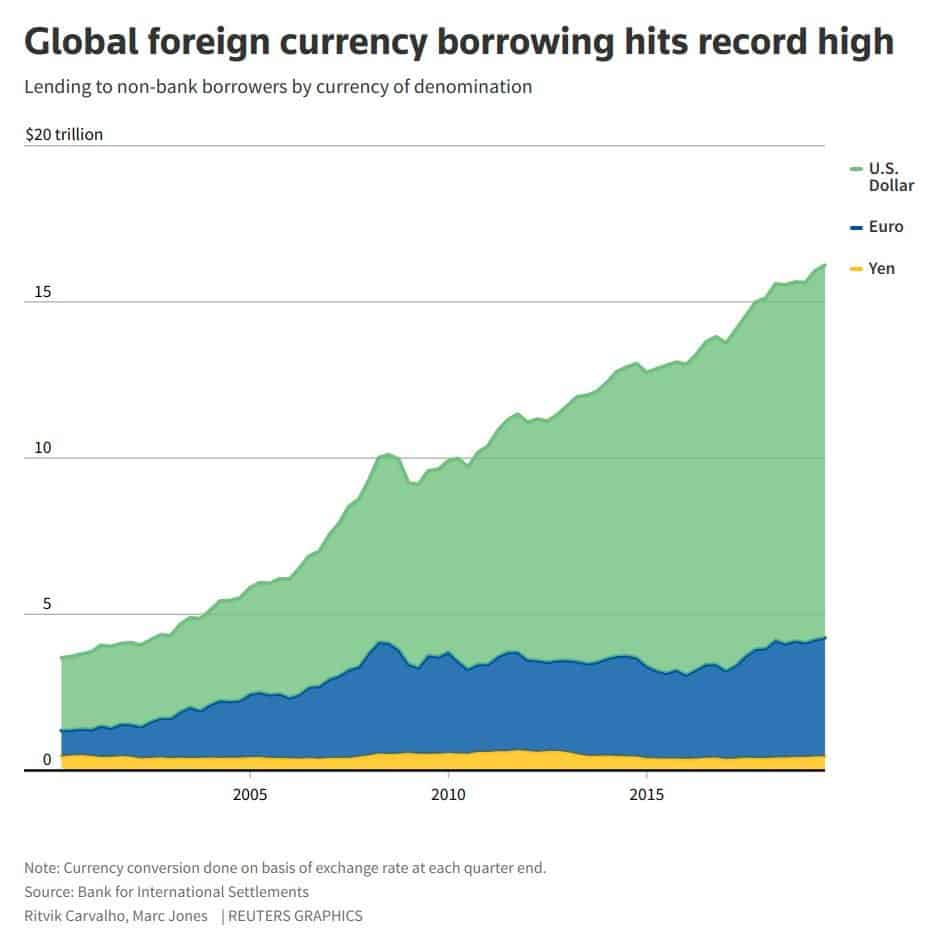

We also see this sluggishness in other data. Many debts are still denominated in dollars.

Every year, this dollar debt burden increases at a faster rate than the debt in other currencies.

The “Milkshake” in The Dollar Milkshake Theory

The Dollar Milkshake Theory uses a milkshake comparison to illustrate that the dollar (and US bond and stock market) tends to suck up investors’ funds globally during crises.

Part of the reason is that, as we saw, the world is addicted to dollars – even if it might want to detox. The other reason is the flight to safety that the dollar represents.

But what about the money printer in the US, won’t that devalue the dollar? Indeed, the US government keeps over time printing more dollars. But so do other countries. So, printing of dollars won’t weaken the dollar: it’s all relative.

The core problem with dollar addiction is that the world needs dollars to pay off debts in dollars. Other countries can’t print dollars so this creates extra demand for the remaining dollars that are still swimming around. And this is where the image of the milkshake comes in. The Fed has created a big “milkshake” of liquidity with their unprecedented monetary easing since the global financial crisis and the corona crisis in particular.

The Endgame: A Sovereign Debt Crisis

What happens to this milkshake of liquidity as the American Federal Reserve raises interest rates? It is as if they were sucking dollars through their straw, people need dollars to get some yield (interest rates are higher in the US than elsewhere) AND they have to pay their debt. So they need dollars on both ends.

That effect is self-reinforcing when economies outside the U.S. end up in recession and thus have less purchasing power in dollars. But their dollar debt burden gets bigger and bigger. Again, a doom loop. They need dollars to pay off their debt and the dollar rises in value.

The dollar milkshake theory suggests that the dollar won’t be replaced because of weakness, but because of too much strength. The strength of the dollar will make the world economy suffer so much that it won’t be sustainable any longer. A sovereign debt crisis might unfold if the loans can’t be repaid. And it’s in everybody’s interest – also that of the US – to change it for a new system. But what system will that be?

The Endgame and the Road There

The endgame, after the dollar has slaughtered all other currencies? The dollar will be the final one to inflate away. This is when the authorities might step in and anchor fiat currencies to hard money like gold… or Bitcoin.

Johnson warns us that too many investors jump to the endgame where the dollar falls and gold wins. He reminds us that the Federal Reserve has many tricks up its sleeve before it is forced to print to infinity. That’s why it’s maybe not wise to hold all your wealth in gold (or Bitcoin), because the endgame might be a decade or so away.

‘But, but, only gold (or Bitcoin) is real money! The dollar is just a piece of paper printed by a government.’

Sure, Johnson agrees. He owns gold, he thinks gold will go higher. But in the meantime, we’re in ‘fiat prison’. The party that monopolizes the money calls the shots. Compare it to an actual prison. If the gang that is in charge between those prison walls enforces that cigarettes are money, we can argue as long as we want that only gold is money – we will have to pay in cigarettes and gold isn’t worth much in that prison.

In fact, Johnson points out that the US government and others have tried their best to demonetize gold. On the Treasury’s balance sheet, gold is still valued at a measly 40 dollars per ounce. Many governments have acted like gold is a silly pet rock – Great Britain even sold its gold reserves two decades ago. They don’t want to go back to a gold standard if they aren’t absolutely forced to. But the current system seems to be spiraling out of control.

Conclusion

In Johnson’s vision, gold or Bitcoin are nice to add to your portfolio and forget about, owning it for the endgame scenario that might be a while in the future. On the road there, sure, it’s likely that Bitcoin and gold will rise, together with the dollar and US equities. But there can also be sharp drawdowns. We don’t need a reminder of that!