Inscriptions on Other Chains than Bitcoin: Degeneracy Finds a Way

TL;DR

It hasn’t happened often in recent years that an innovation pioneered on Bitcoin spreads to different chains. This has been the case with inscriptions. Inscribing ’empty block space’ with new tokens has become a frenzy in recent months, clogging chains like Avalanche and Arbitrum, to name just a few. What to make of this?

Some quick background. Inscribing data on the Bitcoin blockchain, to a package of data attached to a single Satoshi, has been possible since early 2023. These data can be anything from a JPEG to a video game, or: new tokens according to the BRC-20 standard.

These BRC-20 tokens are not to be confused with Ordinal NFTs on Bitcoin, even though they are made possible by the same innovation. The foundation of both is the Ordinals protocol, allowing one to track each Satoshi and inscribe ‘metadata’ to it, and thus be tracked and transferred. The first application was NFTs.

In April 2023, developer Domo invented a way to create fungible tokens using the Ordinals protocol: these are the BRC-20s.

The consequence? It has become easy to create your own coin on Bitcoin: give it a name using four characters and a total supply, and then start minting.

It’s just a token. Like a meme coin, it doesn’t ‘do’ anything – there is no smart contract functionality. But that hasn’t kept the first and largest BRC-20, ORDI, from reaching a 1.7 billion market cap at the time of writing. A Binance listing in November 2023 helped…

Give a bunch of degenerates the tools to mint coins named after themselves or their favorite pet, and… you get the picture: degeneracy will find a way.

Increased Transaction Fees

The popularity of inscriptions has led to increased transaction fees on the Bitcoin network, which impacts the economic sustainability discussions within the community. All this has sparked new debates about the purpose and use of block space, leading to a vibrant and evolving Bitcoin building culture.

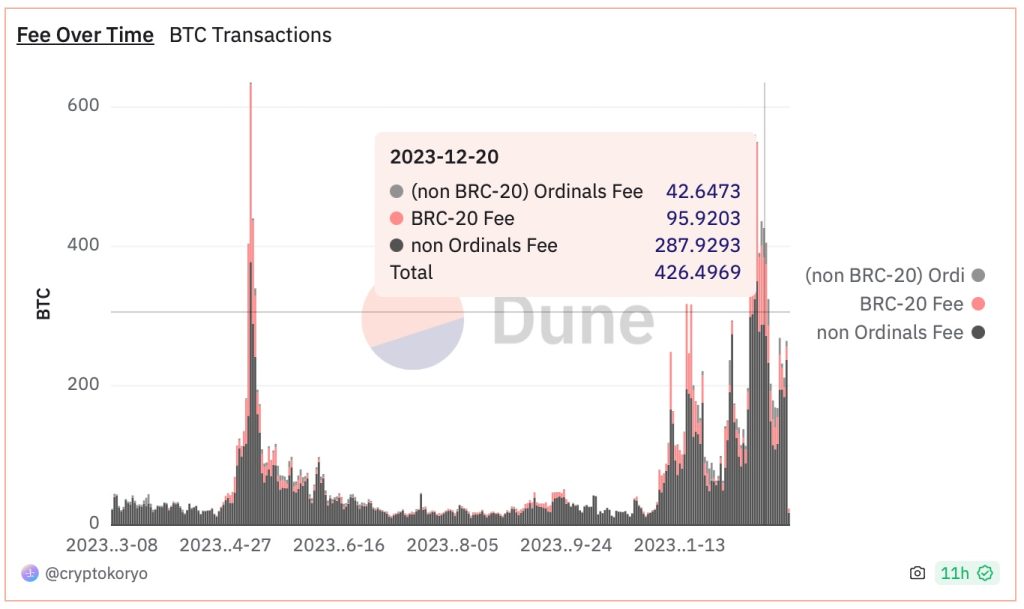

You can see that, after a summer lull, BRC20-activity is back. On December 20, 2023, for example, almost one-third of fees paid to Bitcoin miners were related to BRC-20 and/or other Ordinals-related fees.

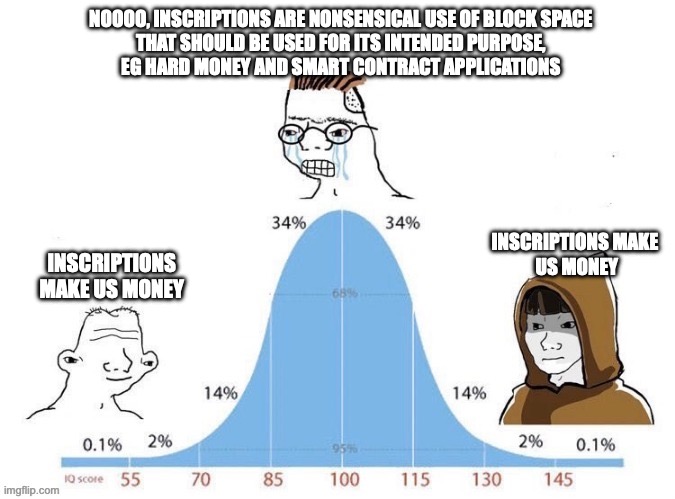

Bitcoin traditionalists don’t like this ‘nonsense’, of course. Bitcoin is supposed to be money, and not affiliated with an avalanche of fungible tokens and monkey jpegs.

Tensions are running high, with the two camps slinging insults at each other. There is speculation about whether the differing views within the Bitcoin community could lead to a fork, although at this point this doesn’t seem likely.

Inscriptions on Other Chains

Interestingly, the concept of Bitcoin inscriptions has spilled over to developer communities of other blockchains, notably Ethereum. This is notable as, in the past, innovations typically flowed from Ethereum to Bitcoin.

But why inscriptions on other chains? After all, inscriptions on Bitcoin were created as a workaround for Bitcoin’s lack of native support for tokens. But on any for example Ethereum compatible chain (Ethereum, Binance Smart Chain, Avalanche, for example) you can already create ERC20-tokens. So why the inscription-based tokens?

Well, creating ERC-20’s will cost you a few thousand dollars for the developer to show up, as it were. Smart contract development and testing, plus ensuring the security and functionality of the token is a process.

On the other hand, inscribing involves embedding data within a transaction. This process is less complex and costly than creating an ERC20 token. It doesn’t require the same level of smart contract development.

They’ve recently spread to many other blockchains for various reasons, mostly that they can be cheaper to move around than native tokens.

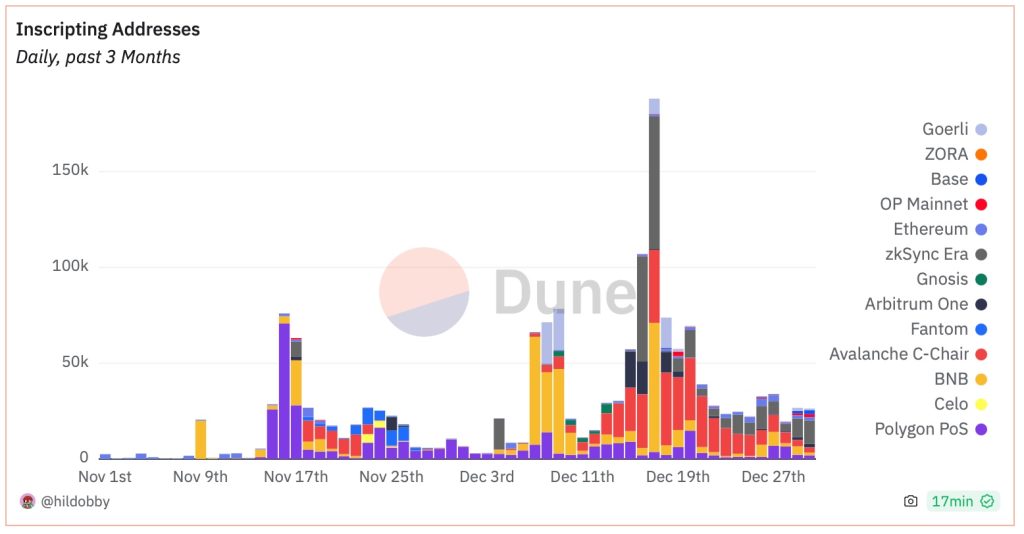

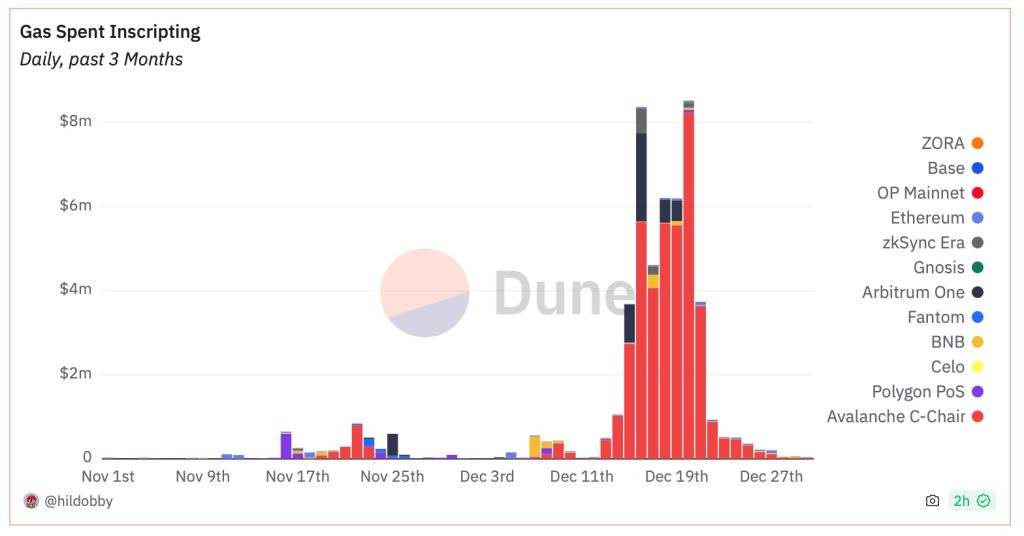

As can be seen from the Dune chart for inscription addresses on all Ethereum-related (EVM) chains (see Dune dashboard), Avalanche (red) zkSync Era and BNB chain have all been busy in recent weeks.

In the case of Avalanche, they are called ASC-20 tokens. The Tron tokens are called PSC-20.

Some records:

- The number of inscription transactions per hour record was set by BNB: 5 million per hour.

- Runners up in chains with inscription transaction density were Arbitrum, Polygon and Celo, all approaching the 1 million per hour mark.

- Avalanche users paid over 13 million dollars in fees over a five-day period in the third week of December 2023.

Chains Under Stress

The inscriptions frenzy has been a stress test for EVM chains. How much data can be handled by these chains?

On the day when transactions peaked, Arbitrum had a three-hour outage: its first downtime since June. The incident highlighted concerns about Arbitrum’s ability to handle surges in network usage. (The current design has a chokepoint when posting transactions to L1, causing the sequener to stall. Upgrades like Arbitrum Nova and Ethereum’s upcoming Proto-danksharding might alleviate these issues).

What to Make of Inscriptions?

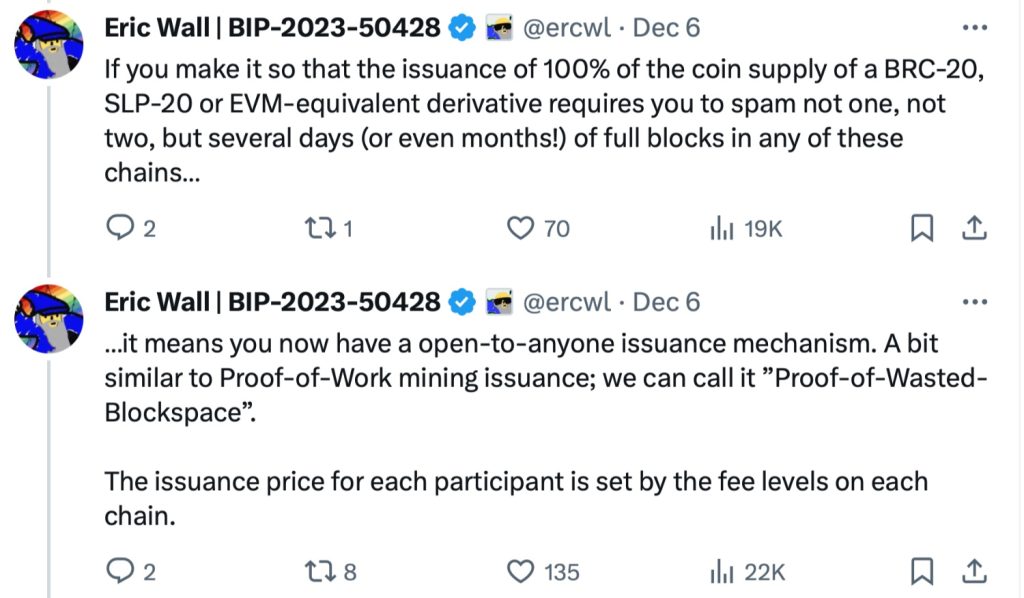

As Eric Wall, one of the founding fathers (wizards) of Bitcoin Ordinals has noted, inscriptions are a way for the plebs (retail investors) to get access to new, low-cap coins. There is no other realistic way to invest early in a let’s say sub-1-million-dollar market cap coin unless you want to go degenerate on meme coins and risk getting dumped on by the issuer. Initial Coin Offerings like in the 2017 bull market used to be the way for retail to get in early on new projects. But these are illegal now. Only accredited investors can buy.

With inscriptions, literally, anyone can participate in the issuance of a new token. The costs? You’ll have to pay the transaction fees for as many blocks as you want to keep on issuing your new token.

Eric Wall:

As such, inscriptions are ‘one of the few last bastions where retail can get in at the ground floor in a not-yet-clearly-illegal fashion’.

Just hype, just a flash in the pan? Maybe. But. You can’t blame people for creating their own money when given the chance. Sure, it can be degeneracy, lunacy. It’s not what Satoshi would have done. Or would it? Satoshi was (one of) the first to create his own money. Why couldn’t other people do the same? And that’s the whole point. Don’t mid-curve it. People make inscriptions and inscriptions make people money, as simple as that.

Conclusion

Degeneracy finds a way. When thinking about the use case for crypto, decentralizing this and that – all true! – we also must remember that the primary use case of crypto is making money. Not just figuratively, in the sense of increasing your wealth. But also in the literal sense: creating a form of money that didn’t exist before. Creating new coins. Inscriptions show you that, indeed, crypto is just that. It’s making money.