The Team from Dogechain, Bitcoin’s Stock-to-Flor Model & Cardano vs. Polygon

In This Issue

- The team from Dogechain talks about their new EVM-compatible, standalone blockchain.

- Erik has a report for you on the Bitcoin stock-to-flow model.

- David has a comparison article on Cardano vs. Polygon.

Premium members also get the following:

- My latest portfolio updates

- Rekt Capital has the latest technical analysis for you on the market.

- Rebecca has all of the latest news for you.

- Upcoming NFT drops

- Defi Dad has a tutorial for you on how to earn up to 17.4% APY with ATOM liquid staking.

- Jesse has a ton of hot new airdrops for you.

- Hot new token sales.

- Rebecca breaks down this week’s trending coins.

- Jesse has a deep dive for you on Biconomy.

And much more!

Dogechain Inverview

For anyone not familiar what is Dogechain?

Dogechain is a new EVM-compatible, standalone blockchain that uses the Polygon Edge framework to provide high transaction speeds and smart contract capability. Even though it’s a layer-1 protocol, the chain acts as a layer-2 for the original Dogecoin network.

In this regard, users are able to wrap their PoW DOGE in smart contracts and mint wDOGE on Dogechain. They can use these tokens to pay for gas on the chain and access advanced blockchain features such as DeFi apps, NFT marketplaces and GameFi protocols. This way, DOGE gains incredible utility as it can be finally used in advanced financial products, purchase and mint NFTs, or play blockchain games.

What does the DC token do?

The DC token is the governance and staking token of Dogechain. Users will be able to lock it using the veDC model to receive veDC tokens. These tokens can then be staked with validators to receive DC rewards or used as voting power in the governance model regarding future development or decisions on grants for projects building on the chain.

There was a big bug, what happened there?

A bug in the bridge contract was detected by the devs on Sep 11, which required a hard fork of the chain. The bug was quickly squashed and no user funds were compromised because of it.

How has the progress been so far? (transactions, wallets, etc?)

Dogechain has seen incredible growth in the 2 months since its launch. As of Sep 25, it has passed the threshold of 40,000,000 transactions and 240,000 unique wallets. It now averages around 1 million transactions per day, getting close to top protocols in DeFi. At one point it even surpassed Polygon and Ethereum (Sep 14 2022), where it reached 3.6 million transactions in 24 hours.

Is the Dogecoin community on board?

Some of the original developers of Dogecoin have been extremely supportive of the chain, such as current Dogira and Polygon developer Eoghan Hayes. Moreover, long-term DOGE holders have already started experimenting with dApps on the chain and accessing Defi and NFT marketplaces with their coins.

Otherwise, Dogechain doesn’t have any links with the Dogecoin foundation as of yet. The team hopes that the foundation will soon see the utility Dogechain brings to DOGE and embrace it as the meme chain that empowers the original memecoin.

What kind of dApps are being built on Dogechain?

There are already hundreds of projects running on the chain, including a dozen DEXes, NFT marketplaces & collections, yield optimizers, chain tools etc. The onboarding program of the chain has been a resounding success with more than 200 projects that have shown their interest in building on Dogechain and using wDOGE as gas. Many projects are implementing functions that help DOGE like using DOGE as native currency in a dapp, burns, and airdrops of fees to DOGE holders.

How can investors use Dogechain and get their hands on some sweet DC airdrop?

The snapshot for the initial airdrop for Early shibes is already taken and new participants cannot get a piece of this pie. However, the team is reworking another airdrop model called “Loyal Shibes” that will reward ongoing supporters of the chain.

The overhaul of this model has a goal to make it more inclusive for all participants in the chain and incentivize users to actually use the chain and participate in governance, instead of just holding tokens in their wallets. The date and mechanism for this airdrop program will be released in the near future.

What comes next for Dogechain?

Some incredible utility is coming to the chain, which includes the DC token. In the next few months, the team will release the aforementioned veDC model that will provide users with staking capabilities and governance power.

What’s more, the veDC model will also serve to constrict the circulating supply as users will be able to lock their tokens for extended periods of time, in a verifiable manner. It’s a crucial element of the tokenomics model and will allow for the long-term vision of the team to be achieved by promoting growth, sustainability, and inclusiveness.

Additionally, there are hundreds of projects already launching on the chain. Their developers are in close communication with the business development team of Dogechain and are working together towards smooth deployment of their dApps in various niches, supported by a grants program.

Finally, we should note that once the veDC governance model is live, users will be able to propose projects and vote on grants from the DAO fund. This participation from the user base will allow projects to come to fruition and allow users to be actively involved with the BD side of Dogechain.

Bitcoin’s Stock-to-Flow Model by Erik

The most controversial price prediction model of Bitcoin is the stock-to-flow model. The foundational ingredient of this model is the inflation rate of Bitcoin, which is continuously falling and supposed to correlate with higher and higher prices. What is the Bitcoin stock-to-flow model and why is there so much controversy surrounding this price model?

The Bitcoin stock-to-flow model (affectionately known as s2f model) was created in 2019 by pseudonymous Dutch financial analyst PlanB. It gained a lot of attention in the 2020/2021 bullrun. It seemed to have predicted the Bitcoin price reasonably well. When the bear market unfolded in earnest, the model didn’t look so good anymore: price has been deviating a lot from the projected price.

What is the Stock-to-Flow Ratio?

A crucial property of money that has historically been conclusive in determining which money got adopted widely, is scarcity. This term can be numerically pinpointed as the so-called stock-to-flow ratio. In the dynamics of supply and demand that determine the value of everything, it is the supply-side variable.

Stock-to-flow is the ratio of a good’s accumulated stock to the amount produced or taken out of the ground each year. The higher the stock-to-flow (inventory divided by production), the greater the scarcity and the harder it is for producers to influence price. A high stock-to-flow acts as a kind of insurance of value retention.

Gold, to name an important example, has a high stock-to-flow ratio. Roughly about 1.5 percent of the above-ground stock (in vaults and jewelry) is mined each year. That equates to a stock-to-flow of about 65 (100 divided by 1.5). That means that stock-to-flow is the opposite of inflation: gold has a high stock-to-flow and therefore a low inflation rate of 1.5 percent.

The Bitcoin Stock-to-Flow Ratio Over Time

When Satoshi started mining in 2009, Bitcoin’s stock-to-flow ratio was zero: there were no BTC in existence when the first block reward was 50 BTC. Currently, there have been more than 19 million Bitcoin mined and the issuance has dropped to 6.25 Bitcoin per block. This comes down to a stock-to-flow ratio of around 58, or a yearly inflation rate of around 1.7%. These numbers are constantly changing though, as the stock keeps growing relative to the number of BTC left to be mined. The stock-to-flow ratio especially bumps up after every Bitcoin halving, roughly every four years. The halvings are visible as vertical dotted lines in the graph.

What is the Stock-to-Flow Cross Asset model

A year after his 2019 article, PlanB came with an iteration of his model: the Stock-to-flow Cross Asset model. He removed the variable of time and plotted the price of Bitcoin and other scarce assets against their stock-to-flow ratio. The scale is a log scale, and the different small colored dots are the different stock-to-flow ratios of Bitcoin for all the months it has been in existence.

From the above graph, the linear regression is hard to miss. From the article:

“Fitting a linear regression to the data confirms what can be seen with the naked eye: a statistically significant relationship between SF and market value. […] The likelihood that the relationship between SF and market value is caused by chance is close to zero.”

As can be seen from the cleaned-up plot below (no colors, no gold and silver), the dots that represent monthly Bitcoin s2f scores cluster in three, possibly four groups.

This clustering is no surprise, as the Bitcoin halving makes Bitcoin’s stock-to-flow ratio suddenly jump up in value and thus to the right in the graph. PlanB came with a rather daring interpretation of these clusters, namely that they would overlap with different stages in Bitcoin’s evolution as a financial asset, ‘phase transitions’ even.

- BTC “Proof of concept” (S2F 1.3 and market value $1M)

- BTC “Payments” (S2F 3.3 and market value $58M)

- BTC “E-Gold” (S2F 10.2 and market value $5.6B)

- BTC “Financial asset” (S2F 25.1 and market value $114B)

The reason the hypothesis is daring is that it’s not needed to explain the clusters. Imagine gold would have a supply squeeze every four years, because of mining getting progressively harder. Would this require an explanation of ‘phase transitions’? Probably not. Gold is still gold.

Still, Bitcoin’s ‘phase transitions’ isn’t totally far-fetched. The theory draws our attention to the fact that how we view Bitcoin is subject to change. Bitcoin has become a different asset in our eyes since its inception (hence PlanB’s name ‘cross asset model’). And to be fair, there can be a feedback loop between perceived function and price. After all, if Bitcoin becomes taken seriously as a financial asset, this will likely draw in institutional investors that would have stayed on the sideline in earlier phases of BTC’s incarnation as an asset.

Criticisms of the Stock-to-Flow Model

A few different kinds of criticisms have been raised against the stock-to-flow model. Some are fairly obvious and accepted, one is more contentious.

Critique 1: Demand is not taken into account

The most important critique is that s2f only takes the supply side of the story into account. The entire model hinges on the assumption that demand is constant. As we experienced in 2022, when the Federal Reserve started tightening liquidity in the financial system, this is not the case. All asset prices dropped because of the demand destruction.

Critique 2: The model is not sustainable

Is it likely that the relation between price and stock-to-flow is so predictable and can it really endure? According to the model, Bitcoin would reach a price of 250 billion dollars in 2045. Rather unlikely, considering the amount of dollars in circulation.

Let’s approach this critique from a different angle. Take Ethereum post-Merge, which could reach an extremely low inflation rate of close to, let’s say as an example, 0.1%. Ether’s stock-to-flow would then be 1000. Would the price of Ether jump by an order of magnitude right after the Merge? Empirically, it hasn’t. What if ETH would become deflationary and s2f would go to infinity? The model has to break at some point.

Critique 3: The underlying math isn’t solid

This is an econometry/mathematics argument that your writer has to trust statisticians on. Some have discredited the stock-to-flow model on the grounds that a property known as cointegration exists between stock-to-flow and the price of bitcoin. Cointegration is supposed to hint at a causal relation between the two variables, which would make the correlation that the model finds trivial. However, this cointegration debate is still hotly contested and by no means settled.

Competing Models

The s2f model has spurred many analysts to delve into supply demand dynamics and come up with their own model. We discuss a few.

Incorporating Adoption Curves: Timmer’s model

Jurrien Timmer from Fidelity shares the common critique on s2f, namely that it doesn’t incorporate the demand side. How will the demand for Bitcoin develop in the coming years? No one knows, but Timmer took the past growth curve of mobile phone adoption and internet adoption as proxies.

See Timmer’s Twitter thread here.

Correlation with Global Money Supply

A different way to look at the supply side is the amount of dollars that are floating around to buy Bitcoin. The more the currency is debased (the more money is ‘printed’), the higher the incentive to buy Bitcoin/crypto. Macro investor Raoul Pal charted the global money (M2) supply growth / decline versus the size of the crypto market. The graph hints at a significant correlation. It’s the liquidity, stupid.

Conclusion

The most important thing to realize about the stock-to-flow model is that it’s just that: a model. It might sort of work or totally fail. Most models fail sooner or later, as reality is more complex than any model and always comes up with new variables that were not included in the model. This is especially the case for s2f, as the whole demand side of the equation isn’t factored in.

Still, the model reminds us of the powerful role that scarcity plays for assets that are deemed valuable. Even if the s2f model fails, this doesn’t take away from the fact that Bitcoin is and will be one of the scarcest monetary assets on the planet. Let’s just see if it keeps being in demand!

Cardano vs. Polygon by David

Cardano and Polygon are two of the most prominent cryptocurrency projects to date, and both are in competition for market share in the fast-developing blockchain economy. This article offers an in-depth conceptual and technical comparison of both projects, so that investors and stakeholders can make more informed decisions with regards to these networks.

An Associated History

Cardano and Polygon have a shared associated history because the latter is a Layer-2 (L2) solution for Ethereum.

Vitalik Buterin conceived of Ethereum in 2013. Charles Hoskinson and a few others joined Buterein to help develop the project. But the two disagreed over whether the project should have a non-profit or for-profit basis. By late 2014, Hoskinson left the Ethereum project to start a blockchain engineering and research company called IOHK. And Cardano soon became IOHK’s flagship project.

Launched in 2017, Cardano is a “third-generation” blockchain, developed to be cheaper, faster, and greener than Ethereum. In that same year, Polygon launched to help Ethereum achieve those same objectives. Fast-forward to today, Cardano and Polygon both stand in the top 13 crypto projects by market-cap.

What Are Cardano and Polygon

Both are open source, decentralized, proof-of-stake (POS) blockchain networks. Both have smart contract logic for the development of third-party decentralized applications. Both provide users with fast transactions and low fees. However, there are major conceptual and technical differences.

- Cardano is a decentralized, POS, L1 blockchain protocol. Cardano’s development has been slow and purposeful as its subject to extensive peer-reviewed research. Cardano is being rolled out in stages and is currently in stage three (Goguen: Smart Contracts) of five total. Cardano’s ambitions are to scale into the global economy and transform multiple industries. Cardano’s native token is ADA.

- Polygon is a decentralized, POS, L2 multi-blockchain network for Ethereum. Polygon has a POS main-chain, but it also has a software framework that allows third-party developers to create new L2 chains that work with its main-chain and Ethereum. Polygon’s mission is to bolster Ethereum by reducing the latter’s gas fees and increasing its transaction output. Polygon’s native token is MATIC.

How Do Cardano and Polygon Work

Cardano and Polygon deploy POS consensus mechanisms, but each use different POS sub-variants, as well as other differing technologies to create their unique blockchains.

Cardano Technicals

- Ouroboros POS: “Ouroboros” is the ancient symbol of the snake that eats its own tail. Ouroboros POS implements a Global Random Oracle (GRO), which is a randomness algorithm that itself randomly changes over time. GRO leverages previous block data in part to produce each new iteration of randomness – hence the parallel to the legendary symbol. Ultimately, GRO is used for the secure selection of Cardano’s block validators. The algorithm is believed to provide enhanced security due to the extreme difficulty in anyone being able to predict the next block validator.

- Epochs and Slots: The Cardano blockchain is divided into epochs (approx. 4 days) and slots (approx. 20 seconds). The latter occurs inside the former. Ouroboros randomly selects nodes (selection odds are based in proportion to how much is staked) to validate new blocks for each slot. These selected nodes are known as “slot leaders”. Given an epoch can contain 432,000 slots, Cardano is able to process approximately 250 transactions per second.

- Two-Layered Architecture: Cardano operates in two layers. The Cardano Settlement Layer processes and records all ADA transactions. The Cardano Computation Layer processes the smart contract logic for the operation of the network’s decentralized applications.

Polygon Technicals

- Proof of Stake: Polygon’s main-chain uses a decentralized network of 100 permissionless POS validators to secure the network. With a set of staking management contracts deployed on Ethereum, anyone can stake MATIC on these contracts and join as a validator. However, one must currently stake approximately $20K of MATIC in order to become a top 100 validator. So entry is difficult. Validators are subject to rewards and slashing.

- Layer-2: L2s are built “on top” of the underlying L1 for the purpose of improving the latter’s scalability and efficiency. Polygon achieves lower gas fees and increased TPS for Ethereum by processing transactions on the Polygon chain, and then batching over in bulk the synthesized transaction data onto the Ethereum chain.

- Multi-Blockchain Network: The core of Polygon is the Polygon software development kit (SDK). The SDK allows third-party developers to create Ethereum-compatible side-chains and dApps that connect to Polygon’s main-chain and the larger Ethereum chain behind it. The amount of innovation happening with Polygon side chains is staggering. Polygon Edge (a particular software development kit iteration) is live. And multiple zk-rollups, optimistic rollups, and other scaling solutions are under development.

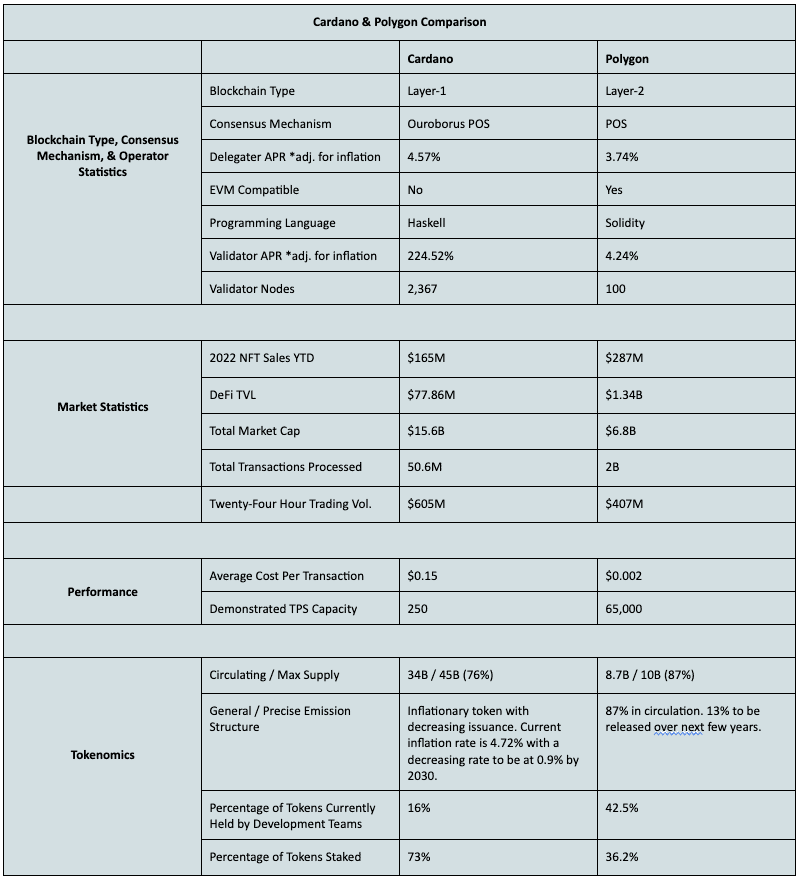

Cardano vs. Polygon: Product Statistics

Cardano and Polygon both support NFTs, DeFi marketplaces, decentralized exchanges, gaming, metaverse, and payment dApps.

Cardano Product Statistics

- NFT Marketplaces: Approximately $165M in USD transactions since the beginning of 2022. Current daily USD transactions averaging $260K. Cardano NFTs mainly hosted via jpg.store.

- DeFi, Lending, and DEXs: Market cap of $77.86M locked across 9 projects. Minswap, Wingriders, and Sundaeswap collectively represent 89% of Cardano’s DeFi market.

- Web3 Gaming: Cardano’s gaming ecosystem is in its infancy. According to the statistics available, it appears that there are multiple games launched, but user numbers currently remain low.

Polygon Product Statistics

- NFT Marketplaces: $287M in USD transactions since the beginning of 2022. Current daily USD transactions averaging at $200K. Polygon NFTs hosted on OpenSea.

- DeFi, Lending, and DEXs: Market cap of $1.57B locked across 302 DeFi projects. Polygon hosts the DeFi heavy-weights AAVE, Curve, Uniswap, Quickswap, and Sushiswap.

- Web3 Gaming: Well-developed gaming ecosystem with 100K+ users across multiple games.

- EVM Compatibility: Polygon has realized and potential access to Ethereum’s rich dApp ecosystem.

ADA and MATIC: Tokenomics

ADA and MATIC are the native tokens for Cardano and Polygon, respectively. Both are used for transactions, network fees, staking, and governance. Both have differing issuance schedules, and initial and current token distributions.

ADA Tokenomics

- Max supply of 45B tokens. 34B (76%) are currently in circulation. ADA is an inflationary token with decreasing issuance over time. The current inflation rate is approximately 4.72%. The rate is estimated to be 0.9% by 2030.

- Approximately 73% of ADA tokens are staked.

- Initial coin distribution occurred from 2015 to 2017. The vast majority of coins (25.9B out of 31.1B) were sold to investors through a public token sale.

- Currently, 79.7% of ADA is in the hands of investors, while 16% is in the hands of IOHK, Emurgo, and the Cardano Foundation (the three centralized entities in charge of Cardano’s development).

MATIC Tokenomics

- Max supply of 10B tokens, all of which have technically been issued. 8.7B are currently in circulation, while the remaining 1.3B will be unlocked over the next few years via staking rewards.

- 36.2% of MATIC tokens are currently locked up in staking contracts.

- Initial coin distribution occurred in 2019 with 41.9% going to the Polygon team, advisors, and Polygon Foundation (centralized entities responsible for Polygon’s development).

- Currently, the share of tokens held by Polygon’s centralized entities has increased to approximately 42.5% of total supply.

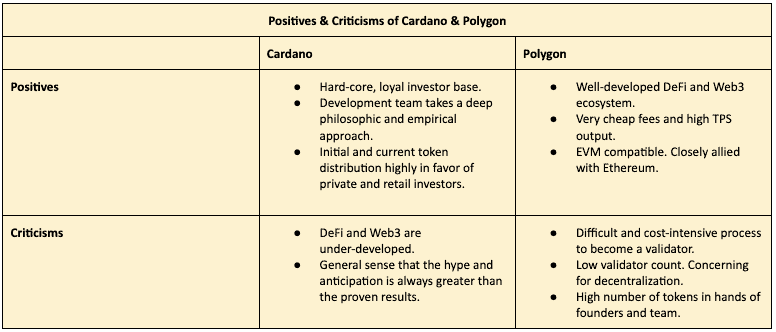

Cardano & Polygon Concluding Thoughts, Positives & Criticisms

Cardano and Polygon are both technically sophisticated projects, but each are fundamentally different: Cardano (L1) is a direct competitor to Ethereum while Polygon’s (L2) central purpose is to directly support Ethereum.

A comparison of both projects reveals the following high-level positives and criticisms of each:

One interesting observation between these two projects is the mismatch in total market cap to use-case market cap. Cardano’s total market cap is twice that of Polygon. And yet, Polygon has a larger NFT marketplace, and dramatically larger DeFi TVL, total transactions processed, and Web3 applications.

This mismatch is likely due to Cardano’s extremely loyal fan-base. Cardano users have patiently stuck by the project through its slow roll-out process. Meanwhile, Polygon hasn’t quite attracted such an enthusiastic following, but regardless has still found success in bringing in persons to use the network.

Final Notes

Thank you so much for your support, and I truly hope that today’s issue will give you insights needed to help you master your wealth.

If you are reading this it means you are on the free version of the Wealth Mastery Investor Report, which is great for news and tips on the crypto markets.

If you really want to take advantage of fastest growing asset class EVER, I highly recommend you join us in the Premium Investor Report.

You’ll immediately get access to:

- Deep dive Altcoin report & The Trending Coin Report

- Technical Analysis on the crypto large caps and overall market

- Token sales, Airdrops and DeFi Tutorials

- Updates on the NFT Ecosystem and new mints

- My Investment Portfolio Updates

- Monthly Crypto Alpha Report

See you next time!

Lark and the Wealth Mastery Team

Legal Disclaimer

TCL Publishing ltd (director Lark Davis, owner of Wealth Mastery) is not providing you individually tailored investment advice. Nor is TCL Publishing registered to provide investment advice, is not a financial adviser, and is not a broker-dealer. The material provided is for educational purposes only. TCL Publishing is not responsible for any gains or losses that result from your cryptocurrency investments. Investing in cryptocurrency involves a high degree of risk and should be considered only by persons who can afford to sustain a loss of their entire investment. Investors should consult their financial adviser before investing in cryptocurrency.